Below is a summary of last month’s commentaries from BlackSummit’s sister company, Fundamental Analytics. The following describes the factors affecting the energy and agricultural commodities that power and feed the world.

Crude Oil Takes the Spotlight in September

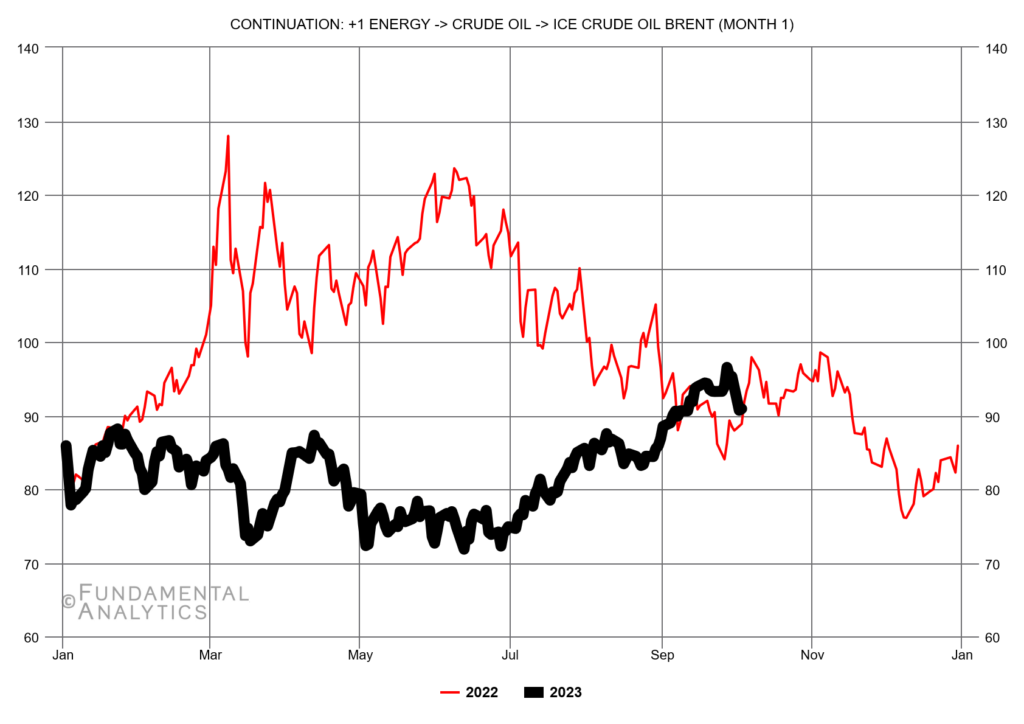

US firms had cut back on drilling operations last month, seeing as WTI crude prices were much lower than in the same period of last year. They have since jumped back up, reaching over $90 per barrel in early September with some fearing it would hit $100. Several reasons have pushed the price up: first, the West’s $60 price cap for Russian oil disallowed G-7 and EU nations from buying from Russia once prices overtook the cap; second, global demand has increased for power generation, air travel, and expectations for increased Chinese petrochemical activity; third, the Saudis and Russia both extended their voluntary output reduction, further tightening supply.

The price of crude naturally affects the price of its derivatives, the ones of interest being gasoline and diesel. Gasoline prices rose after a steep drop at the tail end of August and demand has remained strong, causing inventories to fall to their largest decline in four months. Unplanned refinery outages have pushed prices even higher, with prices hitting $3.81 per gallon at the beginning of September. Diesel has had a similar rise in price, with the EIA projecting diesel rising even faster than gasoline in the near term. While the elevated price of crude contributes to diesel’s climb, it is also due to lowered demand, which counterintuitively incentivizes refineries to make less diesel in exchange for gasoline, ultimately raising the price of diesel. This is certainly bad news for US consumers, as almost everything in stores is shipped by trucks or trains, many of which are fueled by diesel.

Natural gas has been outshone by oil this past month, but still had an interesting ride. The price of natural gas has been volatile as a number of forces push and pull on the commodity. For example, the sustained strength of the US dollar has made American natural gas more expensive, and because the US is the foremost producer and a top exporter, this has pulled gas prices up globally. Coupled with this pressure were the strikes at Chevron’s LNG facilities in Australia (that ended in the latter half of the month), which largely affected the price of gas in Europe. Pulling the price down, however, is the seasonally cooler weather, reduced LNG operations in the States that has kept more gas in the domestic market, and rising stockpiles.

Energy Commentaries on Fundamental Analytics’ website:

Dropping US Oil Rig Count Hinders Crude Oil Production

Natural Gas Prices On a Rollercoaster

Diesel Fuel Prices Climb Higher

Droughts Threaten U.S. Agriculture Exports

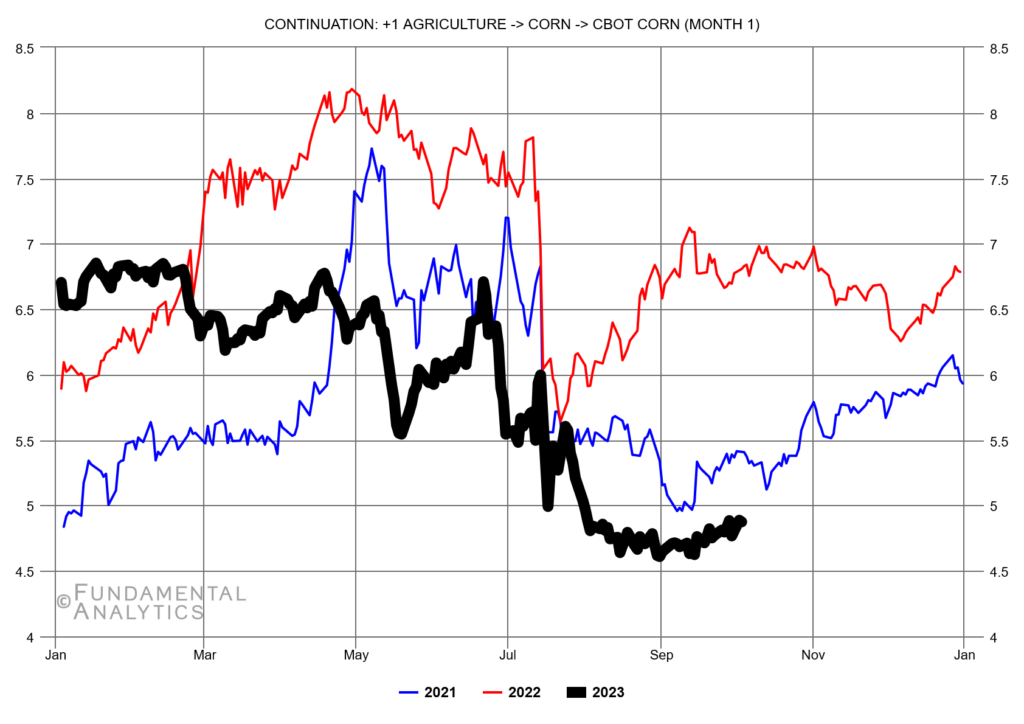

Changing weather patterns can affect not only the yields of crops, but the transportation of them, too. For example, barges on the Mississippi carry 60% of US grains for export. The price of hauling grain downriver is largely dependent on the rivers codition, as they require a minimal river depth to operate. When there is a drought and the river level falls to a certain point, it becomes much more difficult to operate. The Mississippi has fallen to 2022’s lows, which had previously skyrocketed the price of shipping by barge to $105.85 per ton from a normal $10-$12 last October. Luckily, we haven’t seen those prices yet; but they reached $30 per ton on September 5th. Fortunately, farmers have seen this before. They’ve moved grain to silos to wait for better conditions, which has kept prices relatively stable. However, shipments have been delayed and surplus inventories are drawing down. If the dry spell continues for an extended period of time, both farmers and the countries expecting their grains will be in trouble.

Agriculture Commentaries on Fundamental Analytics’ website:

Oversupply in Agriculture Products