Global Market News

Global equities continue to drop

Global equities continued their fall, closing out a down week, month, and quarter. The S&P 500 and Dow Jones declined 2.92% and 2.91% respectively, while the Nasdaq dropped 2.69%. The yield on the US 10-year Treasury rose 14 basis points, ending the week at 3.83%. The price of a barrel of West Texas Intermediate crude oil increased to $79.49. Volatility, as measured by the CBOE Volatility Index, ticked up to 31.6.

Bank of England intervenes in bond market

The Bank of England (BOE) intervened in the UK’s bond market this week after a sharp decline in prices and a swift rise in yields occurred following British Prime Minister Liz Truss’ announcement that she would cut taxes and regulations. The prime minister’s plans for fiscal expansion at a time of high inflation have been widely criticized, including by the International Monetary Fund. Following the announcement, the pound fell to a record-low exchange rate of $1.0350 on Monday but bounced back to $1.11 on Friday, however investors fear the BOE’s intervention is a short-term fix. While the BOE had been preparing to shrink its balance sheet, it is now delaying quantitative easing and setting up a program to buy £65 billion in long-term bonds until mid-October.

International Developments

Putin to annex four Ukrainian regions

In a major escalation, Russian President Vladimir Putin signed a decree to annex the four Ukrainian regions of Donetsk, Luhansk, Kherson, and Zaporizhzhia following a referendum orchestrated by Moscow. Putin claims the locals of these four Russian-controlled regions voted by margins of up to 99% to join Russia. According to the Financial Times, Russia’s annexation of these territories will be the largest forceful takeover of European territory since World War II. In response to Russia’s actions which are widely viewed as a pretense for further escalation – including the possibility that Putin utilizes nuclear weapons – the US and the European Union (EU) plan to launch new sanctions and increase long-term military support to Ukraine.

Meloni’s right-wing alliance wins Italian elections

Giorgia Meloni’s party – the Brothers of Italy – and its right-wing allies swept Italy’s parliamentary elections over the weekend, earning 44% of the votes. The Brothers of Italy party garnered more than a quarter of the votes, putting Meloni on track to become Italy’s first female prime minister and its first far-right leader since World War II. Unlike some of her anti-EU coalition allies, Meloni is a supporter of Ukraine in its war with Russia and she has indicated her government will work with the EU.

US Social & Political Developments

Hurricane Ian tears through Florida and the Carolinas

Hurricane Ian made landfall in Florida as a category 4 storm, devastating Ft. Myers and the surrounding areas. The hurricane continued through Florida and went up the coast of Georiga and the Carolinas, leaving a path of destruction in its wake. Currently, the death toll could be as high as 23 in Florida but rescue efforts are still underway and officials fear that number could rise. According to a projection by Enki Research, the storm caused $65 billion in damages.

US hosts summit with Pacific Island leaders in Washington

The US invited more than a dozen Pacific Island leaders to Washington this week to discuss enhanced economic and security cooperation and demonstrate the US’ commitment to the region. To kick off the event, Secretary of State Antony Blinken and climate envoy John Kerry met with representatives to specifically discuss increasing US climate assistance to the region. The summit comes amid increasing rivalry between the US and China in the Indo-Pacific region, especially over the diplomatic allegiance of Pacific Island countries.

Corporate/Sector News

Apple shifts iPhone production to India

Apple has begun shifting its production of the iPhone 14 models to India as it slowly cuts its reliance on China. Analysts predict Apple’s decision will turn India into a global iPhone manufacturing hub by 2025, as it seeks to expand its manufacturing capacity in the country to produce 25% of all iPhones by this time. For more than a decade, China has been the primary location to produce Apple devices, but extensive supply chain issues and increasing political tensions have led Apple to reconsider. Samsung and Google are making similar moves.

Car retailer stocks plummet as used cars become unaffordable

On Thursday, CarMax, the largest used car dealer in the US, reported a 54% drop in earnings and a 6.4% decrease in the number of cars sold this quarter compared to a year ago. Following the earnings report, CarMax’s stock plummeted more than 25% and the stock price of its main competitor, Carvana, declined 23%. Low consumer confidence, rising interest rates, inflationary pressures, and rising prices due to computer chip and car part shortages are all reasons car retailers are reporting such weak earnings. Used car prices stand 48% higher than August prices three years ago, and prices of new vehicles are up by almost a third in the same time period.

Tesla announces new AI technologies

Tesla held its highly anticipated AI-day yesterday where it unveiled several new technologies and artificial intelligence initiatives. The highlights of the even included the demonstration of Tesla’s humanoid bipedal robot called Optimus, as well as discussion around robo-taxis and the company’s full self-driving software system (FSD).

Recommended Reads

The Promise and Perils of Big Tech

Putin Is Willing to Take Russia Down With Him

UK pension funds sell assets and tap employers in rush for cash

NATO formally blames sabotage for Nord Stream pipeline damage

China’s offshore currency hits record low against dollar

This week from BlackSummit

Market Turmoil, Plato’s Cave, and Lord Acton: Searching for the “Madonna of the Future”

John E. Charalambakis

The BlackSummit Team

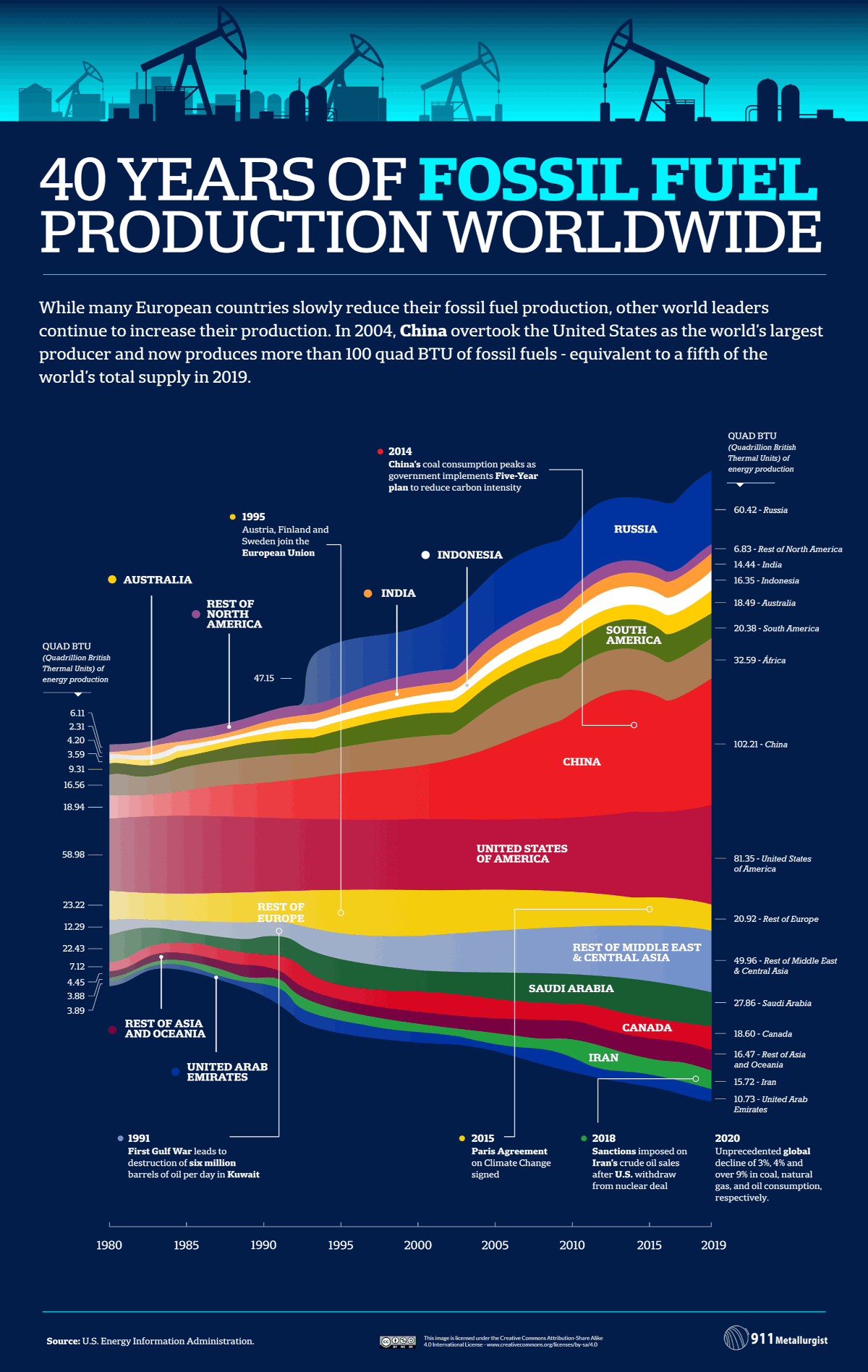

Image of the Week

Video of the Week

The race is on for green tech resources | FT Energy Source

Source: Financial Times