Global Market News

Global equities falter

Global equities were lower on the week, ending a four-week winning streak. The S&P 500 and Dow Jones declined 1.21% and 0.16% respectively, while the Nasdaq dropped 2.62%. The yield on the US 10-year Treasury rose several basis points to 2.97%, while the price of a barrel of West Texas Intermediate crude oil decreased to $90.77. Volatility, as measured by the CBOE Volatility Index, ended the week at 20.6.

China cuts rates and injects stimulus as growth slows

While most of the world’s central banks are raising rates to fight inflation, the People’s Bank of China is lowering rates and pumping its economy with stimulus as growth slows. Last week, China’s central bank unexpectedly lowered two key lending rates and injected 2 billion yuan through seven-day reverse repos. The actions demonstrate the concern of China’s strict Covid-19 policies which have hampered economic growth, as well as the country’s ongoing weaknesses in its housing sector. China’s most recent economic data shows that industrial production and retail growth rates are lower than expected, and the jobless rate for 16-to-24-year-olds is at an all-time high.

International Developments

Russia and China to hold joint military exercises

The People’s Liberation Army of China said it would join military exercises led by Russia in its Far East region near the border with China. The military exercises are scheduled for August 30th to September 5th and will be the two nations’ second display of joint force in the region this year. Earlier this year, the two countries held a 13-hour drill close to Japan and South Korea as US President Joe Biden was visiting Tokyo. The upcoming exercises are the latest demonstration of Russia and China’s partnership which has strengthened over the last year and is reinforced by the countries’ shared rivalry with the US. The announcement comes amid heightened tensions between the US and China surrounding Taiwan, as well as ongoing tensions with the US and Russia over Ukraine.

North Korea rejects South Korea’s aid-for-denuclearization offer

North Korea rejected an offer from South Korea which included a large-scale economic aid package in exchange for denuclearization. The sister of North Korean leader Kim Jong-un, Kim Yo-jong, rebuffed the proposal, calling it “the height of absurdity” and claiming the plan was a copy of an approach that failed more than 10 years ago. Seoul said the offer included food, health, and infrastructure assistance. North Korea’s rejection comes just days before South Korea and the US are set to hold their largest joint military exercises in decades. Also this week, Pyongyang fired two missiles toward the Yellow Sea which lies to the west of the Korean Peninsula.

US Social & Political Developments

White House announces new vaccination plan for monkeypox

Earlier this month, the US declared the ongoing monkeypox virus outbreak a public health emergency. The declaration triggered grant funding and the availability of resources for treatments, vaccines, and other necessary medical equipment. This week, the White House laid out a new vaccination plan which will make an additional 1.8 million doses of a vaccine available to cities that use a new protocol that involves stretching one vial of the vaccine to administer five doses. The Biden administration has not yet acquired additional doses of the vaccine, so it hopes this method will allow public health officials to control the current outbreak in population areas they deem most at risk. More than 14,000 monkeypox cases have been reported in the US.

US to begin trade talks with Taiwan this fall

The Biden administration has announced that it will begin formal trade negotiations with Taiwan this fall. Negotiators will cover nearly a dozen different topics including agriculture, small business, and the environment, with the goal of reaching a trade agreement that will deepen economic and technological ties between the US and Taiwan. The US is moving forward with the plans for trade talks despite many warnings from Beijing that such steps would challenge China’s sovereignty and interfere with their One-China policy. Tensions between the US and China spiked last week when Speaker Nancy Pelosi visited Taiwan and China subsequently ramped up military drills in the waters surrounding the island nation.

Corporate/Sector News

China forces Apple and Toyota suppliers to shut down production due to heat wave

Authorities in China’s Sichuan province ordered most factories in the region, which included Toyota and Apple suppliers, to shut down production amid a heat wave. Chinese authorities are scrambling to secure sufficient electricity for daily use as demand has risen due to hot summer weather. Power restrictions have been imposed on other provinces as well, sparking concerns about the effects climate change is having on global supply chains. Approximately 16,500 companies operating in the Sichuan province are affected by the suspension. It is an additional blow to China’s industry and global supply chains which have already been restrained this year due to supply shortages and Covid-19 lockdowns.

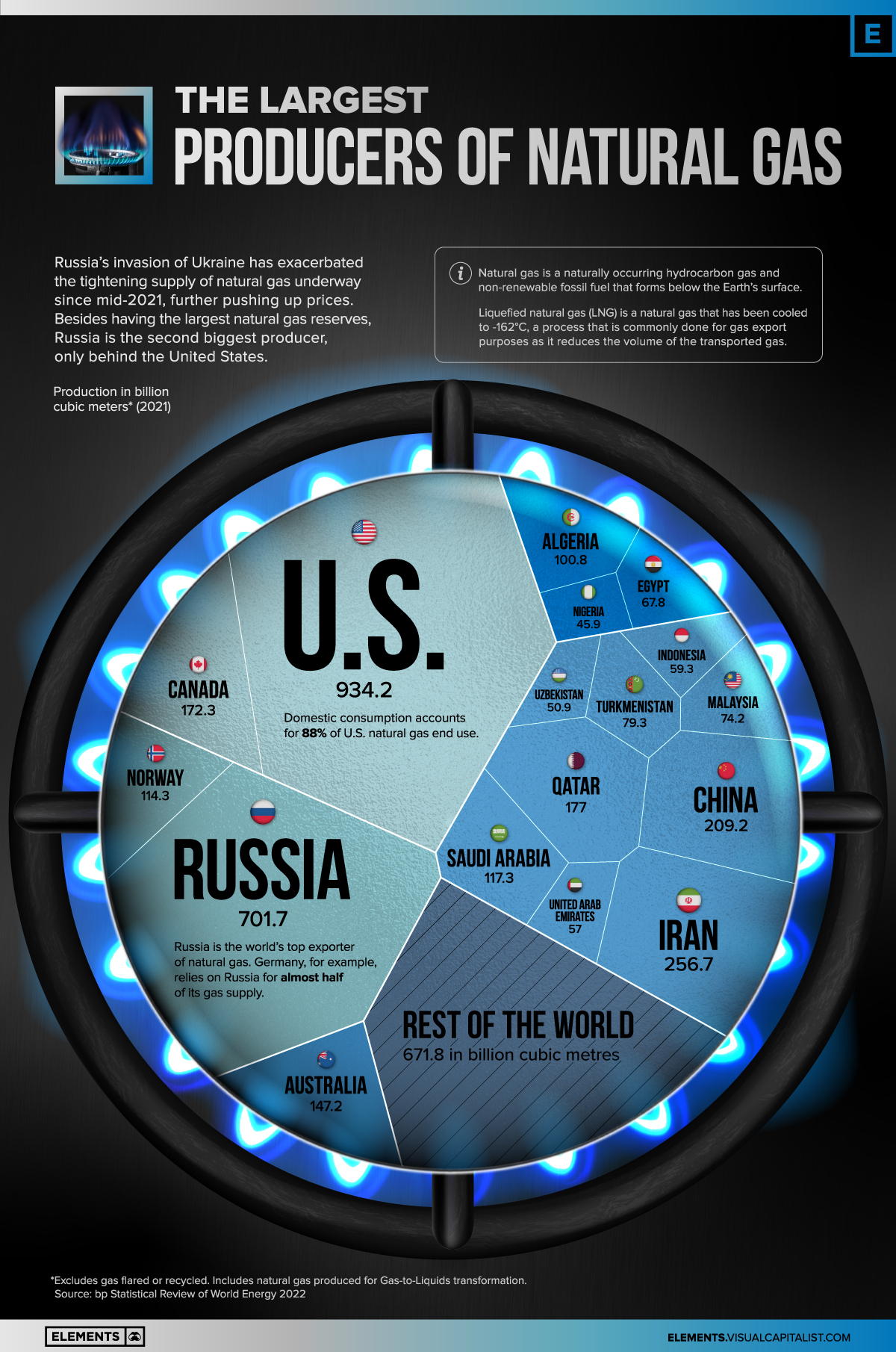

US natural gas prices at 14-year highs

US natural gas prices reached 14-year highs on Wednesday as Europe’s prices climb to their highest levels since Russia’s invasion of Ukraine. US natural gas futures surged 7% on Tuesday, closing at $9.33 per million British thermal unit (BTU), the highest closing price since August 1, 2008. A heat wave in California, higher than expected air conditioner demand, and forecasts for hotter weather are also contributing to the rise.

Rough road ahead for major retailers

Morgan Stanley is predicting a rough road ahead for major retailers in the second half of 2022. Though consumer discretionary stocks have underperformed this year, the sector has seen a recent rebound, with the Consumer Discretionary Select Sector SPDR (XLY) rising 20% in the last month. While retailers have benefited from improving consumer and investor sentiment, about half of major retailers have already cut revenue expectations for this year and more negative revisions are expected especially as the US economy heads towards a recession.

Recommended Reads

Germany is Bracing for a Winter of Discontent

How to help with energy bills

The Russia-Ukraine Grain Deal Is Skating on Thin Ice

What would push the West and Russia to nuclear war?

The World Is Seeing How the Dollar Really WorksMeasuring business uncertainty in developing and emerging economies

This week from BlackSummit

Crossroads – Rachel Poole Mustor

Geopolitical Challenges & Statecraft – The BlackSummit Team

Image of the Week

Video of the Week

German farm harvests green electricity and organic apples

Source: World Economic Forum