Global Market News

Global equities slightly down on the week

Global equities were down again this week. The S&P 500 and Dow Jones closed the week down about 0.30% and 0.88%, respectively, while the Nasdaq dropped 0.28% on the week. The yield on the US 10-year Treasury note did not move much, closing at 1.78%, while the price of a barrel of West Texas Intermediate crude oil continued its climb, ending the week at $83.82. Volatility, as measured by the CBOE Volatility Index, ticked up to 19.2.

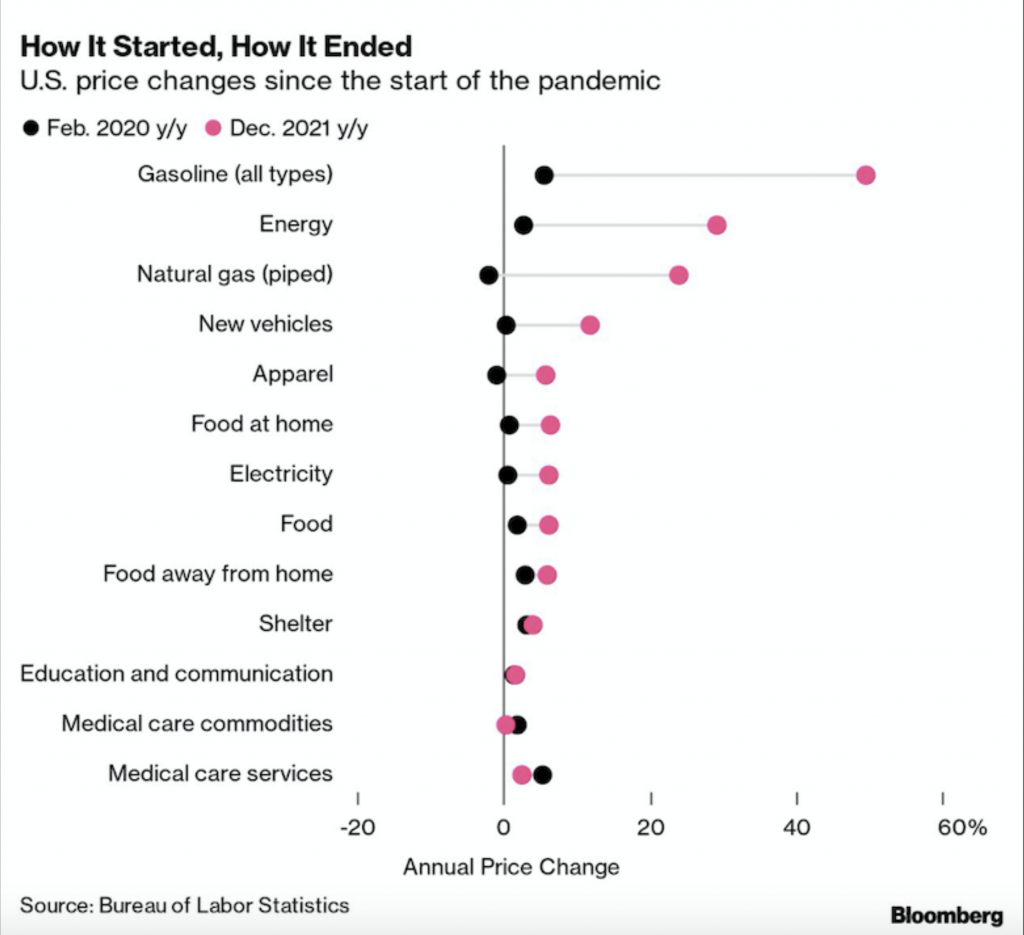

US inflation hits 40-year high

The US Consumer Price Index hit 7% year over year last month, marking a 40-year high for inflation rates, and the third month in a row that inflation was above 6%. In his confirmation hearing before the Senate Banking Committee this week, Federal Reserve Chairman Jerome Powell stated prices will likely peak in mid-2022 and said it would take multiple FOMC meetings for policymakers to take measures to reduce the size of the Fed’s balance sheet, abating market fears that quantitative easing could happen early this year.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 324,600,000Global Covid-19 deaths: 5,540,000

US Confirmed Covid-19 cases: 64,280,000US Covid-19 deaths: 844,000 *As of Friday evening

Covid-19 nearing endemic status

While the Covid-19 Omicron variant continues to rapidly spread in the US and Europe, it appears to have peaked in New York and London and cases have begun to decline sharply in recent days. While hospitalizations have risen due to the Omicron’s massive spread in absolute numbers, research from Kaiser Permanente in Southern California indicates Omicron patients are 74% less likely to end up in ICUs and are 91% less likely to die than Delta patients. As more and more studies reveal Omicron is less severe than other variants, health experts are suggesting we may be entering a new era of the virus becoming an endemic illness. The governments of Spain and the United Kingdom have been two of the first of European countries to suggest this while leaders in the US share similar sentiments, suggesting we may need to reassess how we are approaching the pandemic.

International Developments

Talks with Russia fail to reach breakthrough

Talks between the US, the North Atlantic Treaty Organization (NATO), and Russia this week have failed to deliver any type of breakthrough. Russian Foreign Minister Sergei Lavrov has called for a written response to Russia’s demands from the US and NATO by next week, saying Moscow has “run out of patience”. Washington and its allies have rejected Moscow’s demands for security guarantees, including that NATO will not expand or deploy forces to Ukraine and other former Soviet states. Meanwhile, several Ukrainian government websites were brought down by a cyberattack Thursday night. While the source of the cyberattack is not immediately clear, the message displayed on the websites by the hackers was that Ukrainians should “be afraid and expect the worst”.

US pushes for more sanctions on North Korea

Following a series of missile launches out of North Korea in the last four months, the US is urging the United Nations Security Council to impose more sanctions on North Korea. On Wednesday, the US imposed its own unilateral sanctions over the missile launches, blacklisting six North Koreans in addition to a Russian individual and a Russian firm that has been accused of procuring goods for the missile program. In a suspected response to the sanctions, South Korea has reported that North Korea launched two short-range ballistic missiles on Friday. The alleged action takes place shortly after North Korea warned the US it would take a “stronger and certain reaction”.

US Social & Political Developments

Supreme Court blocks Biden’s vaccine mandate

In a 6-3 vote, the Supreme Court blocked the Biden administration’s mandate to require businesses with more than 100 employees to have all workers vaccinated or tested weekly. While Congress has given the Occupational Safety and Health Administration (OSHA) the power to regulate occupational hazards, the Supreme Court’s decision rests on the fact that OSHA has not been given the agency to “regulate public health more broadly”. In a separate ruling, the Supreme Court let stand the mandate to require vaccinations for more than 10 million healthcare workers whose facilities participate in Medicare and Medicaid.

Department of Justice charges 11 for January 6th Capitol attack

This week, the Department of Justice (DOJ) charged 11 people with seditious conspiracy in connection with the January 6th, 2021 attack on the Capitol. The DOJ claims they conspired “to overthrow, put down, or destroy by force” the US government. The individuals charged include the leader of the far-right military group Oath Keepers, as well as several of the group’s members and associates. If found guilty, the defendants could face up to 20 years in prison.

Corporate/Sector News

Commodity markets rally

A broad rally is sweeping across commodity markets. WTI crude oil rose several dollars over the week, closing Friday at $83.82. Copper traded above $10,000 per ton for the first time since October while nickel and lithium stocks are surging thanks to increased demand for electric vehicles and dwindling stockpiles. Nickel is one of the most widely used minerals for EV batteries, but supply is not keeping up with demand. As EV makers struggle to secure precious minerals, Tesla has just signed its first US supply deal with Talon Metals to buy 75,000 tons of nickel from its Tamarack mine project in Minnesota.

Take-Two Interactive to acquire Zynga in big gaming deal

Take-Two Interactive has said it will acquire Zynga in a cash and stock deal valued at $12.7 billion. With the purchase, Take-Two, which is most known for its console franchises, is looking to expand its mobile and free-play, the fastest-growing segments of the gaming industry. If the deal goes through, it will be one of the largest acquisitions in the videogame industry.

IEA blames Russia for European energy crunch

The head of the International Energy Agency (IEA) is blaming Russia for the energy crunch hurting European economies. Despite soaring gas prices, Russia has not increased its gas deliveries to the continent. It has kept spot sales capped even though it could potentially boost gas deliveries by at least a third from current levels. Gas and power prices have broken multiple records over the past few months as gas inventories are at their lowest level in more than a decade. Gas storage facilities are 51% filled, compared with normal levels of around 70%. According to the IEA, Gazprom is responsible for half of the continent’s inventory deficit.

Recommended Reads

The flaws in the Fed’s approach to inflation

2021 Ended as Fifth-Hottest Year With Push From Spiking Methane

Russia, at an Impasse With the West, Warns It Is Ready to Abandon Diplomacy

Mortgage Rates Jump to Highest Level Since March 2020

This week from BlackSummit

Investment Landscape 2022: Market Epicureans vs. Market Stoics – John E. Charalambakis

Crossroads: At the Intersection of Geopolitics and Geoeconomics – Rachel Poole

The Day After & the Era of Transformation – Rachel Poole and Tyler Thompson

Image of the Week

Video of the Week

420 million hectares lost – Firms do too little against deforestation

Source: DW News