Global Market News

Global equities fall short

Global equities fell short this week, ending a 5-week winning streak. The S&P 500 and Dow Jones fell 0.31% and 0.63%, respectively, while the Nasdaq closed the week down 0.69%. The yield on the US 10-year Treasury note ticked up to 1.56%, and the price of a barrel of West Texas Intermediate crude oil decreased to $80.79. Volatility, as measured by the CBOE Volatility Index, ended the week roughly unchanged at 16.3.

CPI hits highest level since 1990

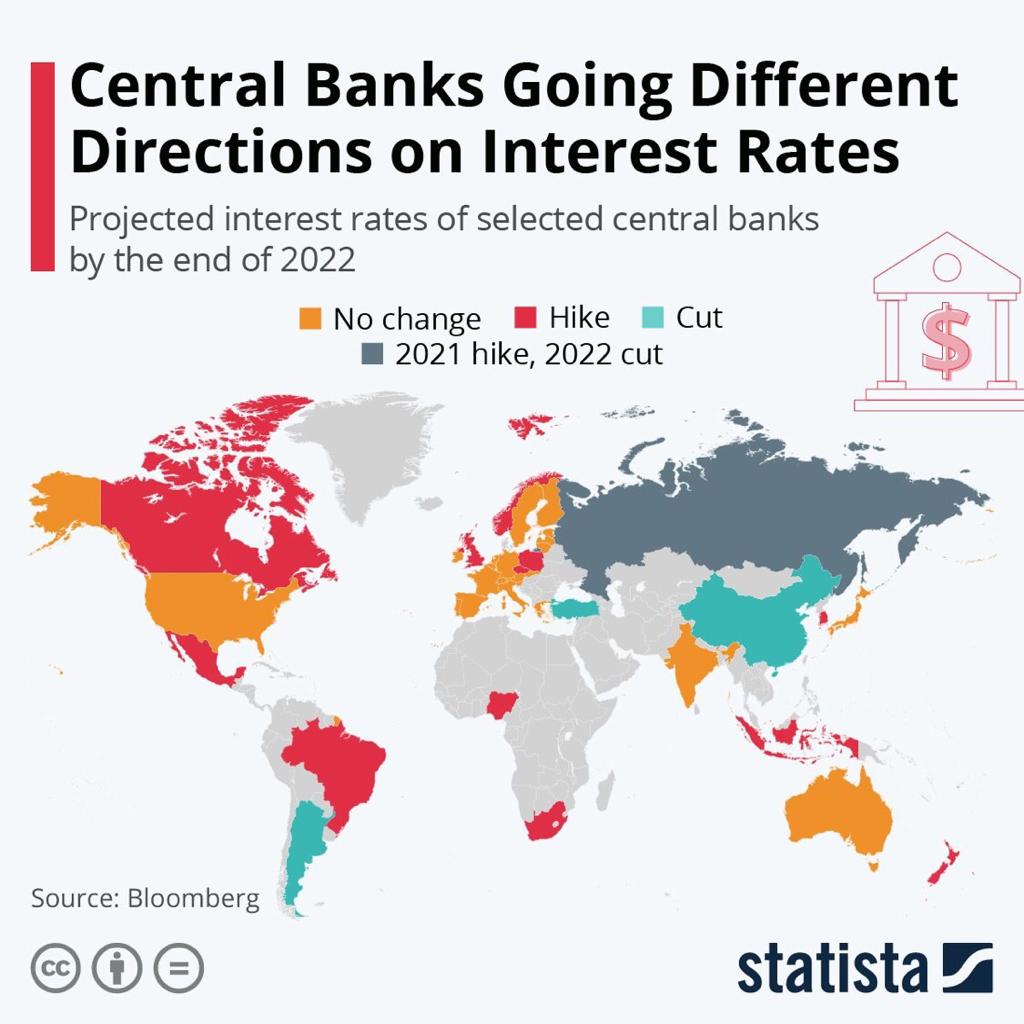

The US Consumer Price Index (CPI) rose to 30-year highs, suggesting inflation might not be transitory as price hikes spread beyond sectors impacted by supply chain disruptions or short-term reopening disruptions. The CPI rose 6.2% year over year in October while the core measure, which excludes food and energy prices, increased 4.6%. In reaction to the CPI release, futures traders appeared to price in an interest rate hike from the Federal Reserve as early as next July and the yield on the US 10-year Treasury climbed 14 basis points on Wednesday.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 252,000,000 Global Covid-19 deaths: 5,080,000

US Confirmed Covid-19 cases: 46,800,000 US Covid-19 deaths: 759,000

*As of Friday evening

10 states file lawsuit against Biden administration for vaccine mandates

A group of 10 states – Missouri, Nebraska, Arkansas, Kansas, Iowa, Wyoming, Alaska, South Dakota, North Dakota, and New Hampshire – has filed a lawsuit against the Biden administration for its vaccine mandate for health care workers, calling it “unconstitutional and unlawful.” The group argues the nationwide mandate will lead to shortages of health care workers. More than two dozen states, businesses, and religious organizations have also sued the Biden administration for its “vaccine-or-test” rule which dictates that organizations with more than 100 employees must require workers to be vaccinated against Covid-19 or test weekly.

International Developments

Delegates negotiate agreement in the final days of COP26

Delegates at the United Nations Climate Summit in Glasgow, the 26th Conference of the Parties (COP26), are entering the final stretch of negotiations. The draft agreement being negotiated includes a call for wealthy nations to double climate funding by 2025 to aid poor nations in addressing climate impacts. It also urges governments to present new emissions-reduction goals by 2022 and mentions phasing out coal and fossil fuel subsidies. There are still several issues that are being discussed that are not part of the draft because delegates disagree on them, such as international carbon markets. In the coming days, delegates will finalize the statement. Environmental NGOs and activists have criticized the draft for being too general and for not doing enough.

Belarus accused of inciting mass migration into Poland

Poland has accused Belarus of “exploiting migrants” at their shared border and urging the “mass entry” of migrants into Poland to incite tensions with the European Union (EU). Poland and the EU see Belarus’ actions as a play of revenge for the EU sanctions that were imposed on Belarus last year to punish Belarusian President Alexander Lukashenko’s government for cracking down on political opponents. European Commission President Ursula von der Leyen called out Lukashenko’s government for “instrumentalizing migrants” and has urged EU members to approve further sanctions against Minsk. Belarus has denied the allegations and has instead accused Polish authorities of being inhumane towards migrants.

US Social & Political Developments

US and China pledge climate action in joint declaration

In a surprise to many, the US and China issued a joint pledge to boost climate action while at the COP26 conference in Glasgow. As part of the agreement, the US and China plan to cooperate on reducing methane emissions, protecting forests, improving climate technology, and increasing the use of renewable energy. The declaration comes just a week before a planned virtual summit between President Biden and Chinese President Xi Jinping.

Congress passes $1.2 trillion infrastructure bill

After months of negotiations, the US House of Representatives passed the Infrastructure Investment and Jobs Act (IIJA) in a 228-206 vote. The $1.2 trillion bill seeks to improve transportation, broadband, and other “hard” infrastructure in America and has been hailed by President Biden as a “once-in-a-generation investment.” The IIJA, which will create thousands of jobs and increase American competitiveness, represents a long-term approach to rebuilding the country and is not just another stimulus package to address the pandemic.

Corporate/Sector News

Toshiba and General Electric announce plans to split into 3 companies

Toshiba is following the breakup trend displayed by companies like General Electric, which also announced this week that it will split. The once diversified conglomerates plan to split into three independent companies. Toshiba’s flagship name will manage a 40.6% stake in memory chipmaker Kioxia and other assets while it will spin off its energy, infrastructure, and heavy engineering core business into one company and its electronic device, AI, and quantum computing business into another. General Electric will split into 3 global public companies: one for aviation, one for healthcare, and another for renewable energy and power. There has been a shift in the corporate world towards leaner cost structures and simplified business structures which let individual assets speak for themselves in the markets. The traditional belief that central management can offset any downsides conglomerates bring is no longer proving true.

Airlines expect international travel to double as travel restrictions are lifted

This week, the US lifted pandemic travel restrictions which have prevented many international visitors from traveling to America. First implemented in March 2020, the restrictions included more than 30 countries including Brazil, South Africa, the UK, and most of Europe. International visitors will have to show proof of vaccination and a negative Covid-19 test 72 hours prior to arrival, but these requirements don’t seem to be standing in the way of many visitors making travel plans. Airlines are forecasting up to double the amount of international inbound travelers in the coming weeks. According to Hopper, an airfare-tracking app, international flight searches to the US have more than quadrupled since the Biden administration announced in September that it would lift travel restrictions.

Rivian has successful IPO

In its Nasdaq debut on Wednesday, shares of new electric vehicle maker Rivian Automotive Inc. soared as much as 53%, giving the company a market valuation of more than $100 billion. Its successful initial public offering (IPO) made it the second most valuable US automaker after Tesla Inc. The IPO allowed Rivian to raise about $12 billion, making it the biggest US IPO since Alibaba went public in 2014. The debut comes against the backdrop of COP26 where nations and private companies have made pledges to cut greenhouse gas emissions from global transport.

Recommended Reads

COP26: Draft deal calls for stronger carbon cutting targets by end of 2022

What Happened at COP26 on Wednesday

He predicted the dark side of the Internet 30 years ago. Why did no one listen?

Opinion: Stablecoins may not be stable. That’s a problem.

To Steer China’s Future, Xi Is Rewriting Its Past

What the 14th Century Plague Tells Us About How Covid Will Change Politics

Inflation in the economy today is different.

Despite Advances in Women’s Rights, Gender Equality Lags Around the World

This Week from BlackSummit

Portfolio Navigation Before Year’s End: Reflections from Augustus and Faust, Part II – John E. Charalambakis

The Day After & the Era of Transformation – Rachel Poole & Tyler Thompson

Image of the Week

Video of the Week

Infrastructure Projects to Boost Sales and Prices, Industry Executives Say

Source: The Wall Street Journal