Global Market News

Global equities gain after volatile week

Global narrowly gained after a volatile week in the markets. The S&P 500 and Dow Jones gained 0.79% and 1.17%, respectively, while the Nasdaq closed the week just barely down 0.06%. Meanwhile, the yield on the US 10-year Treasury rose several basis points to 1.61% and the price of a barrel of West Texas Intermediate crude oil increased several dollars to $79.35. Volatility, as measured by the CBOE Volatility Index, ended the week at 18.8.

OECD meets in Paris on global tax deal

This weekend, members of the Organization for Economic Cooperation and Development (OECD) are meeting in Paris to discuss a global minimum tax deal. So far, 136 countries have signed the agreement. Though initially reluctant, Ireland and Estonia joined the agreement this week after dealmakers decided to make the global minimum corporate tax just 15% instead of “at least” 15%. Ireland was also assured it could keep its treasured 12.5% tax rate for smaller companies operating in the country. Hungary is the last remaining holdout for the deal in the European Union. US President Biden and Treasury Secretary Janet Yellen are also onboard with the global minimum tax, but they will face challenges getting Congress to pass the proposal. If the OECD’s proposal is fully approved, an additional $100 billion in corporate taxes would be paid by international firms.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 219,000,000 Global Covid-19 deaths: 4,550,000

US Confirmed Covid-19 cases: 44,200,000 US Covid-19 deaths: 711,000

*As of Friday evening

Pfizer applies for FDA approval of vaccines for children, J&J seeks approval for booster

In vaccine news this week, Pfizer and BioNTech officially filed for FDA approval of their Covid-19 vaccine for children ages 5 to 11. If authorized, it would be the first Covid-19 vaccine approved for younger children. Also seeking FDA approval, Johnson & Johnson applied for authorization of its booster shot this week. As the virus continues to mutate, leading to breakthrough cases and a waning of vaccine effectiveness, vaccine developers are predicting a new formula may be needed next year to protect against future Covid-19 variants. CEO Ugur Sahin of BioNTech says he envisions two main streams of vaccination programs in 2022: booster shots for those that have been vaccinated and a continued push to vaccinate those who have had minimal access to vaccines.

International Developments

Chinese fighter jets fly near Taiwanese airspace

On Monday, China flew a one-day record of 56 military planes in Taiwan’s air defense identification zone. Chinese President Xi Jinping reportedly ordered the military to step up its pressure on Taiwan following joint military exercises carried out near Taiwan and in the South China Sea by the US, Japan, and other democratic nations less than a week ago. Despite China’s provocative actions, Taiwan remains unwavered. In a speech following the incident, Taiwanese President Tsai Ing-wen said, “Taiwan does not seek military confrontation…But Taiwan will also do whatever it takes to defend its freedom and democratic way of life.”

Moscow to meet with the Taliban

Russia will host the Taliban for international talks on Afghanistan in Moscow on October 20th. Moscow has also invited other Afghan factions to the talks. Unlike many other countries, Russia has not evacuated its embassy in Kabul and its ambassador met with the Taliban quickly after they took over the capital. Since the US has withdrawn its troops from Afghanistan and scaled back its involvement in the region, Russia is making moves to become the region’s power broker.

US Social & Political Developments

Senate approves deal to temporarily lift debt ceiling

On Thursday, the Senate passed a deal to temporarily lift the debt ceiling. The agreement will increase the borrowing limit by $480 billion and keep debt payments flowing until December 3rd, giving lawmakers additional time to negotiate a long-term solution. Shortly after the deal was announced, Senate Republican Leader Mitch McConnell took the floor to reiterate that he wants Democrats to pass the debt limit increase using the budget reconciliation process. Democrats have repeatedly rejected this plan, arguing that tying the debt limit to the budget reconciliation process would create a dangerous precedent and that Republicans should bear some responsibility for the debt that has already been accrued. Democrats prefer to broker a deal with Republicans which means bitter negotiations will likely continue for the next two months.

US and Mexico to overhaul security agreement

US and Mexican officials met in Mexico City yesterday to agree to overhaul the security cooperation agreement between the two countries, named the Merida Initiative. The multibillion-dollar security accord was signed 13 years ago to launch a “war on drugs.” The initiative has fallen short, failing to curb drug trafficking and violence. Homicide rates in Mexico remain at historically high levels and deaths in the US from fentanyl smuggled across the border have skyrocketed. Officials seek to negotiate a more comprehensive approach to security cooperation between the US and Mexico.

Corporate/Sector News

Global energy crisis fears spread

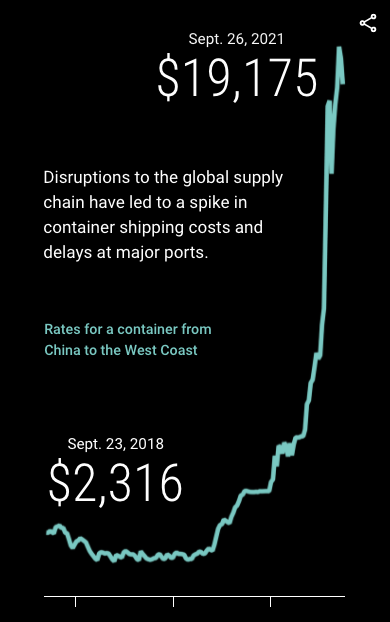

Energy prices continued surging to new records this week, heightening fears of a global energy crisis. This week, India said had only a few days of coal reserves remaining, power plants in Germany began running out of fuel, China ordered coal mines to boost output amidst continued widespread power cuts, and the UK warned energy bills could increase 30% this winter. Energy supply shortages abound as economies rebound from the pandemic-induced lull in demand. Exacerbating supply issues are logistical and transportation bottlenecks in the shipping sector.

OPEC decides against larger supply hike

Despite oil prices surging to multi-year highs, OPEC+ members decided against larger supply hikes in a meeting on Monday. The alliance of oil producers will stick with its plan to gradually raise oil output, arguing a hasty decision could lead to a sharp drop in oil prices. After a pandemic-induced demand and price collapse that sent oil-export income plummeting 43% last year, OPEC+ members are enjoying the boost in revenues.

Chip shortages turn into big profits for semiconductor giants

A global chip shortage has led to rising prices for electronics and, therefore, rising revenues for semiconductor giants like Samsung Electronics. Samsung, the world’s largest memory chip and smartphone maker, estimates a 28% increase in its third-quarter operating profit. According to analysts, the chip division’s operating profit could be as much as 79% higher than the previous year as semiconductors have accounted for about half of the company’s operating profit for the first half of 2021. On the other hand, Samsung’s stock has been under pressure due to fears that the semiconductor industry could be entering a prolonged downturn. Shares of Samsung have dropped more than 20% from their peak in January.

Recommended Reads

Key Findings from the Pandora Papers investigation

Countdown Starts on Chinese Company Delistings After Long U.S.-China Audit Fight

China’s Energy Crisis Highlights Weaknesses in Xi’s Power Plans

The Country That Makes Breakfast for the World Is Plagued by Fire, Frost and Drought

What do the German election results mean for markets?

Mr. Market Is Offering Us a Second Bite at Value Stocks

This week from BlackSummit

Crossroads – Rachel Poole

The Day After & the Era of Transformation – Rachel Poole and Tyler Thompson

Image of the Week

Video of the Week

Here’s why a global shortage of shipping containers could affect us all.

Source: World Economic Forum