John Charalambakis & Joel Fingerman

The world experienced a creative ascent in the mid to late 15th century that culminated in the first half of the 16th century. If Renaissance marked the birth of the modern world, then Marsilio Ficino and his translation of Plato’s dialogues acted as the midwife. The influx of Greek scholars into Italy – just before and after the fall of Constantinople – such as Gemistos Plethon whose lectures on Plato were attended by Cosimo de’ Medici, or John Argyropoulos whom Leonardo da Vinci followed, was the beginning of that creative ascent. In a similar manner we may be at an inflection point of a new era in a market transformation marked by climate change/energy, and monetary transitions. The energy market developments of the last few weeks brought to our minds Plato’s description of a Socratic cave where people are chained on a blank wall, watching shadows projected on the wall from objects passing in front of a fire behind them, and giving names to these shadows. The shadows are the prisoners’ reality, and we are just those prisoners trying to explain the reality of those shadowy images.

What are those shadowy images and what do they tell us about the future? How about:

- Energy futures prices?

- Evergrande and its potential collapse in relation to an adverse power supply shock that is taking place in China?

- Playing politics with the debt ceiling?

- The forthcoming slowdown in earnings and economic growth?

- The pandemic and its never-ending end?

- Market valuation?

- The geopolitical unfolding with China and Russia?

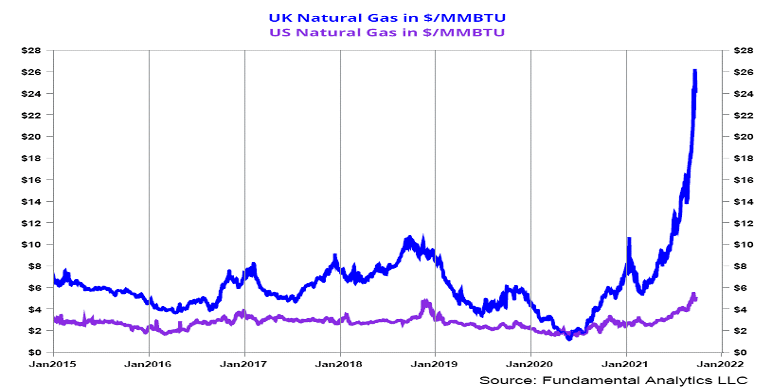

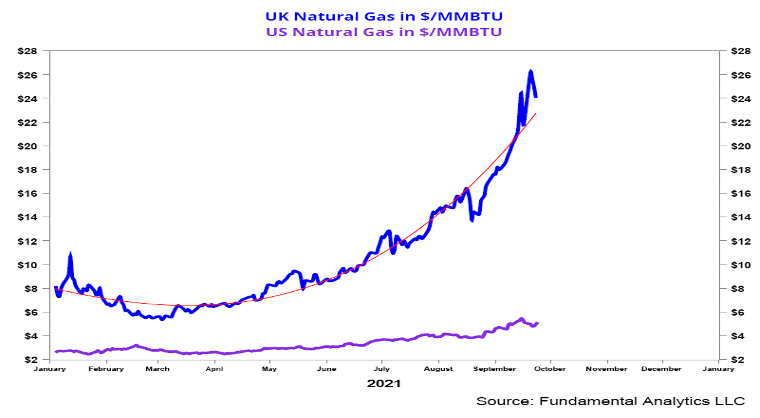

On September 18th in our weekly (Saturday) publication we published a graph showing the dramatic increases in the natural gas spot prices in the United Kingdom. In the graph below, we show the same development, but we also incorporated the US natural gas prices.

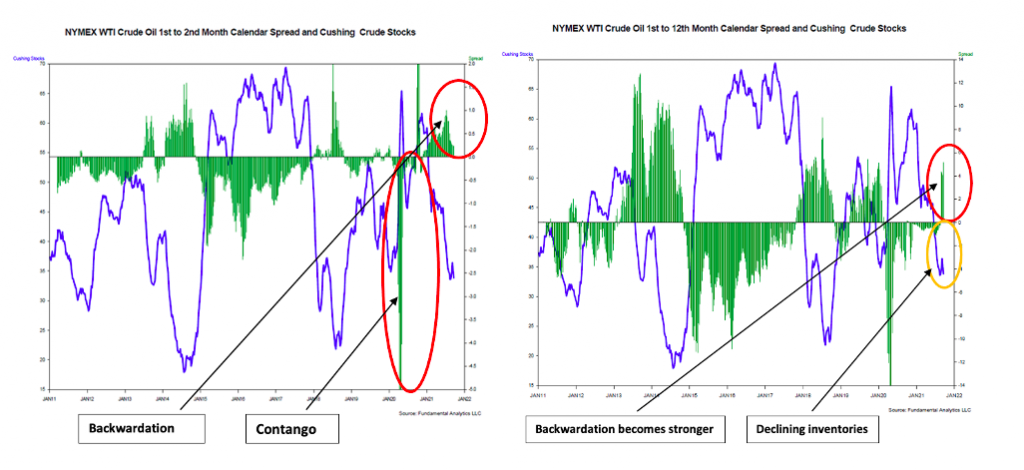

The exponential rise in natural gas prices in Europe has the potential to destabilize the crucial energy market. This prompted us to consider the trajectory of US oil prices (WTI) by looking at the calendar spreads in relation to the stock levels of WTI Crude Oil futures contract. There is a strong inverse relationship between Cushing stocks levels and the front-to-back spread, as shown below. The NYMEX WTI Crude forward curve is backwardated when the prompt month (“front month”) is at a higher price than the deferred months contract (“back month”). Backwardation is denoted by the positive green spikes in the chart below. A contango market takes place when the deferred months contract prices are greater than the nearby, prompt month; denoted by the negative green spikes.

During the last few weeks, the backwardation in the 1st to 2nd month spread was reduced from about $1.00 to about $0.25, as Cushing crude oil inventories have stabilized around 35 million barrels.

In comparison, when we consider the 1st to 12th month spread, we observe a weak contango spread changing to a strong backwardated 1st to 12th month spread of more than $5. Initially, this was due to Hurricane Ida, which hit the US mainland on August 26th. The prompt month week average crude price jumped by $2.69 for the week ending Friday, August 27th, while the 12th month average price actually declined $1.91. However, the 12th month prices have been recovering. Should the front month continue to ratchet up and the backwardation strengthen due – in part – to continued lower Cushing crude oil stock levels (see declining blue line in the graph which signifies lower inventories), this suggests continuing higher WTI Crude Oil prices.

Ficino not only translated Plato’s works but also, with his Platonic Academy, reinvigorated a thirst for beauty, truth, the structure of the cosmos, divine love, the interaction of the mind and soul with the unity of knowledge which, in turn, opened new horizons of understanding for humankind. Ficino effortlessly merged Plato’s theoretical framework with the Augustinian perspective of divine love and hence opened the door to Italy’s love poets, Dante and Petrarch. Th production of paintings, sculptures, books, and buildings was the natural outcome of what Ficino taught: the artists, the authors, the architects were exemplars of humankind’s perennial urging toward a higher realm of the self, giving birth to true virtue. For Plato and Ficino, that is possible because of the soul’s yearning for divine perfection, fired by the perfection’s palpable trace in the realm of appearances as the soul becomes a partaker of divine nature. When we admire Botticelli’s twin masterpieces “Spring” and “The Birth of Venus” at Florence’s Uffizi Gallery, we can’t help but only think of Plato and Ficino and the unity of knowledge the emerges from their writings about divine love and beauty. When we come to that level of understanding, we can discover perfection in imperfection and harmony where others see discord. Ficino even claims that in Timaeus Plato locates order at the very heart of primeval Chaos from which cosmic order emerges.

And if the European energy turmoil was not enough, yesterday Bloomberg reported: “China may be diving head first into a power supply shock that could hit Asia’s largest economy hard just as the Evergrande crisis sends shockwaves through its financial system. The crackdown on power consumption is being driven by rising demand for electricity and surging coal and gas prices as well as strict targets from Beijing to cut emissions. It’s coming first to the country’s mammoth manufacturing industries: from aluminum smelters to textiles producers and soybean processing plants, factories are being ordered to curb activity or — in some instances — shut altogether.”

Most certainly then, nowadays when someone takes a look at what is happening in the energy and power/electricity markets – especially in Europe and China – they would believe that a chaotic disorder is at play where all the elements of a dystopian future are at play. When we look at price hikes ranging from 200-400%, we discover an array of culprits, such as:

- Low levels of reserves in the midst of a series of extreme weather events and unusual seasonal patterns

- Strong commodity (mainly natural gas) prices, which in turn has led to much higher carbon and coal prices mainly due to higher gas prices but also due to the reduction in emission credits

- Low energy output from renewable sources

- Higher demand as the economy rebounds at a time of tight supplies which infuses nervousness into the market

- LNG competition stemming from Asian markets

- Russia’s games with natural gas supplies as it is trying to squeeze Europeans and get approvals for Nord Stream 2

- Higher gas prices which led to firms’ shutdowns, and which in turn exacerbated the problem of higher energy prices as power distributors closed shop.

Furthermore, when we think deeper about these developments, we should start thinking about food security issues, as fertilizer production is affected, which in turn impacts carbon dioxide production used in meat production. All of these developments lead us to believe that the unfolding situation is a harbinger for more volatility.

However, like in Plato’s writings, the shadowy images discussed above reflect a transitory reality related to climate change and monetary affairs which may look chaotic but at its core hides the elements of an order which as history tells us holds profound truths about the forthcoming era, and as it usually happens, those profound truths are the ones most heavily veiled.