Global Market News

Global equities rise

Global equities rose this week. The yield on the US 10-year Treasury note increased 3 basis points to 1.20% while oil prices continued to rise. The price of a barrel of West Texas Intermediate crude oil increased nearly 5%, closing the week at $59.60. Volatility, as measured by the Cboe Volatility Index (VIX) remained largely unmoved, ending the week at 20.63.

Covid-19 breaks federal deficit records

The US federal budget deficit has reached record highs, soaring past previous records thanks to the Covid-19 pandemic. In January, the budget deficit increased to an estimated $165 billion compared to only $33 billion in January 2020. The massive amount of government spending is sparking fears of inflation, though the Federal Reserve has signaled that there is nothing to worry about.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 108,000,000 Global Covid-19 deaths: 2,380,000

US Confirmed Covid-19 cases: 27,400,000 US Covid-19 deaths: 475,000

*As of Friday evening

Covid-19 could become an endemic disease

More and more public health officials and infectious disease experts are saying the Covid-19 virus could become an endemic disease, meaning it will always be present in the population but will circulate at a much lower rate. It is likely that people may need to get vaccinated against Covid-19 annually with a jab similar to the seasonal flu shot. A new CDC study reveals the number of Americans willing to get vaccinated is increasing.

Geopolitics Spotlight

Russia threatens to cut ties with the EU

Russian Foreign Minister Sergei Lavrov said his country is willing to end relations with the European Union (EU) if the bloc imposes more sanctions on the Russian economy. Larov’s statement comes shortly before EU diplomats are scheduled to discuss new travel bans and asset freezes on President Vladimir Putin’s allies in response to the imprisonment of Russian opposition leader Alexey Navalny.

Protests ramp up in Myanmar

Hundreds of thousands of people protested in Myanmar this week against the military junta who has seized power. The military has begun to crack down on the dissent by arresting hundreds of protesters and drafting a cybersecurity law that would allow the military access to internet user’s data. In response to the situation, the US has announced sanctions on Myanmar and has urged other countries to take similar action.

US Social & Political Developments

Biden has first call with Xi

President Joe Biden had his first call with China’s leader Xi Jinping this week. During the call, Biden expressed his concerns about issues including China’s human rights abuses in the Xinjiang province, its recent predatory economic activities, and the country’s escalated aggression towards Hong Kong and Taiwan. In response, Xi warned Biden against interfering in issues of Chinese sovereignty. However, the two leaders also noted shared challenges, suggesting cooperation is possible on issues such as the pandemic.

Senate proceeds with Trump’s impeachment trial

Despite the defense team’s efforts to argue the proceedings were unconstitutional, the US Senate voted 56-44 in favor of continuing former President Donald Trump’s impeachment trial. House managers allege that Trump served as “inciter-in-chief” for the insurrection of the US Capitol on January 6th.

Corporate/Sector News

Semiconductor shortage catches Biden’s attention

In response to the global semiconductor shortage, President Joe Biden will be signing an executive order in the coming weeks to authorize supply chain reviews for critical goods like silicon chips. Earlier this week, a group including Intel, Qualcomm, and Advanced Micro Devices sent a letter to the president asking for funding and incentives for semiconductor manufacturing as part of his economic recovery and infrastructure plans. The Covid-19 pandemic triggered a surge in demand for devices that require chips. The US’ trade war with China has also impacted the shortage.

Royal Dutch Shell ramps up transition to cleaner energy

Royal Dutch Shell is the latest company in the oil and gas industry to accelerate its plans to move away from fossil fuels. Shell has committed to cut net carbon emissions by 6-8% by 2023, 20% by 2030, 35% by 2035, and 100% by 2050. Previously the company had committed to cutting emissions by only 3% in 2022, 30% by 2035, and a mere 60% by 2050.

Financial institutions embrace Bitcoin

Several financial institutions are embracing Bitcoin, including Mastercard and Bank of New York Mellon Corp. The institutions have made it easier for customers to use cryptocurrencies, paving the way for large-scale adoption. Bitcoin soared to new highs on Thursday after the announcements. Earlier in the week, Tesla invested $1.5 billion in Bitcoin and announced it would allow customers to use cryptocurrency as payment in the “near future.”

Recommended Reads

IMF calls on Arab leaders to take action or risk new ‘lost decade’

6 reasons why Africa’s new free trade area is a global game-changer

He Helped End the Cold War With Kindness

From Lightbulbs to 5G, China Battles West for Control of Vital Technology Standards

Why the European Commission failed the vaccine challenge

The Case for a Third Reconstruction

Aristotle’s Pursuit of Happiness

Is GameStop a Bubble? History’s Spectacular Crashes, From Tulips to Beanie Babies.

This week from BlackSummit

Portfolio Construction in an Era of Transformation Pt. II – John E. Charalambakis

COVID-19 and the Day After – Tyler Thompson and Rachel Poole

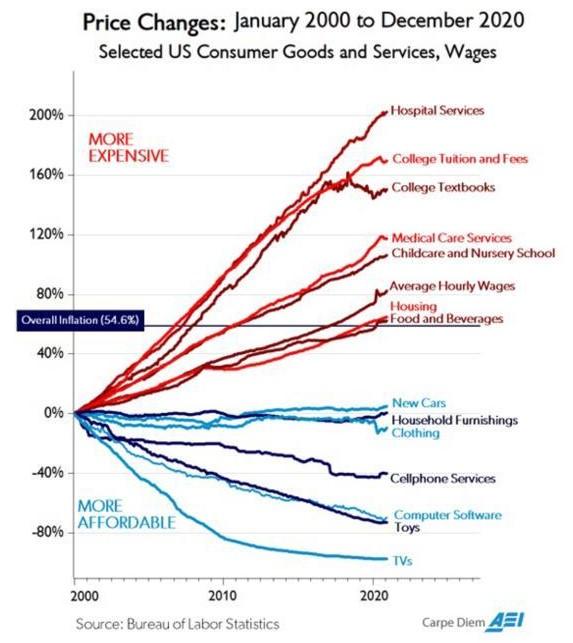

Image of the Week

Video of the Week

India: Pandemic forces children to drop out of school

Source: DW News