Whether we look north or south, east or west, we discover powerful forces that crown this era of metamorphosis and change. With this and the forthcoming commentary on Feb. 9, we would like to share with you our views of the most important forces which, in our opinion, shape up the trajectory of portfolios under the prevailing circumstances. From afar, we can see Sophocles observing as the inevitability of tragedies is shifting ideas, values, and priorities. Participants are looking for some consolation or enlargement of understanding. However, Sophocles believes that the frustration of such expectations carries some vital lessons for survival and progress.

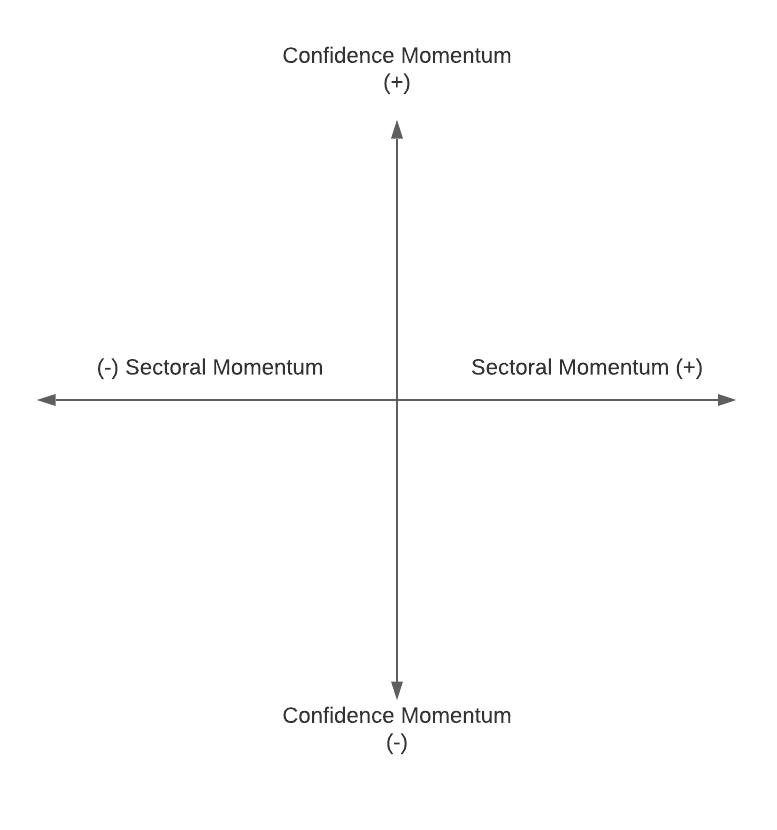

In 1995, Steven Solomon published a book titled The Confidence Game: How Unelected Central Bankers are Governing the Changed World Economy. Globalization has imposed on the world economy a reality where indebtedness, currency turmoil, fiscal and trade deficits, along with stochastic unpredictable factors, rise up as angry oceans ready to toss about the mightiest ships. The navigational officers are primarily the central bankers whose actions are praised and feared in the midst of tragedies told and untold. The sailing to safe ports is inhibited several times by additional tragedies of mysterious forces, related to obscure financial instruments, as storms threaten to wreak the ships without an anchor. To the game of confidence, we should add the game of momentum we have observed being played out in the last 20+ years (tech, real estate, gold, semiconductors, cloud computing, to name just a few sectors), the combination of which leads us to the first schematic of this commentary.

When the world economy finds itself in the upper right corner (e.g. the late 1990s), then exuberance feeds the markets, possible bubbles are created and some extraordinary profits may be generated in equities and/or bonds. On the other hand, when confidence collapses and sectoral momentum goes in reverse (lower left corner in our schematic), then equity bear markets prevail and losses overwhelm the equity investors as money flows to safe havens. What happens when the world finds itself in the lower right corner or in the upper left corner, is nothing but a play taken out from Sophocles’s writings, where protagonists die on the stage, questions are left unanswered, the private and public interest comingle, and unequal actors squabble over important but also over petty things while looking for “divine” intervention at a time when the gods have chosen to withdraw from the stage. But more on that below as well as in the forthcoming Part II.

The fact is that nowadays we find ourselves in situations where parabolic moves in hot sectors remind us of froth markets. On top of this, there are other developments (SPACs, Bitcoin, etc.), that certainly would render the first schematic insufficient in providing answers as to the markets’ trajectory and consequently to the weights assigned in the construction of a suitable portfolio. Furthermore, trade-related activity sends us some sobering messages when we discover that the investor margin debt increased by a record of $200 billion in 2020. The previous records in the last 30 years were in March 2000 when investors margin debt rose by $130 billion, and in July 2007 when the margin debt surged by $160 billion. Unfortunately, in both cases the play ended up in a tragedy.

However, looking at the tragedy of the markets in 2000 or in 2008 without monetary/central bank context, as well as outside the fiscal policy framework, also provides a biased and incomplete perspective. The reality is that in both previous record-setting periods when margin debt surged the monetary conditions were contractionary, while right now they are very expansionary with the easy money policies of the central banks. So, while valuations are pretty high (in the 90th percentile), the combination of fiscal and monetary expansionary policies allow (some would say justify) the frothy valuations to continue, and thus the bullish sentiment observed when looking at the Put/Call ratio could be explained. Moreover, the fact that yields are rising since late December may be indicative of growth to come which could provide another boost to confidence building, sectoral momentum, and stability requirements.

The discussion above leads us to our second schematic that complements the first. As it can be seen below, in addition to the monetary and fiscal forces, we should take into account consumer sentiment, developed and emerging markets confidence and stability, as well as geopolitical tensions and currency stability. Finally, we cannot ignore the stochastic factor where unpredictable events and/or rogue players could introduce havoc into the markets.

Our preference is to start the analysis that leads to the portfolio construction with the second schematic. Such analysis will help us determine into which of the four quadrants the market trajectory is leaning, which in turn, will allow us to assign weights to particular sectors.

Historical amnesia tells us that enslavement awaits us if we fail to be liberated from our fears and allow ourselves to be carried by emotion without proper consideration of the surrounding facts and the relevant context. Sophocles reminds us that harshness (whether institutional, decree-generated, or market-originated) originates in weakness (recall Creon), while triumph is found when superiority (which is purpose-driven and in portfolios conviction-driven) trumps (moral, fundamentals in market circumstances) superficiality (Antigone).

Sophocles teaches us that we become masters of our stories when we transform a tragedy into a heroic narrative. Ode then to heroic tragedies!