Global Market News

Global equities make gains

Global equities made some gains this week after multiple weeks of decline. Markets rallied strongly early in the week but lost ground on Friday after President Trump announced he has tested positive for Covid-19 and the US labor department issued a mixed employment report. The yield on the US 10-year Treasury note remained at 0.69% while volatility, as measured by the CBOE Volatility Index (VIX) increased slightly to 27. The price of a barrel of West Texas Intermediate Crude oil dropped from $40 to $36.99.

US job creation has slowed but unemployment has dropped

Friday’s jobs report revealed that the US job creation pace slowed in September as only 661,000 positions were filled out of the expected 850,000. On the other hand, the U-3 unemployment rate has declined to 7.9% from 8.4% in August. The U-6 unemployment rate, a more comprehensive measure of the nation’s workforce is 12.4%, down from 14.3% in August, according to the US Bureau of Labor Statistics.The U-3 unemployment rate hit a peak of 14.7% back in April and has since been falling.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 34,400,000 Global Covid-19 deaths: 1,020,000

US Confirmed Covid-19 cases: 7,340,000 US Covid-19 deaths: 208,000

*As of Friday evening

Moderna vaccine won’t be ready before election

Despite pressure from the Trump administration for a vaccine prior to the November election, it doesn’t look like a vaccine will be ready in time. This week Moderna said it will not be able to apply for emergency use authorization in the US for their Covid-19 vaccine until November 25th at the earliest. The company also does not expect to be able to distribute the vaccine to the entire US population until spring 2021.

Geopolitics Spotlight

UK and EU to hold Brexit talks

British Prime Minister, Boris Johnson, and President of the European Commission, Ursula von der Leyen, will meet on Saturday to discuss the next steps as post-Brexit trade deal negotiations near the December 31st deadline. With or without a trade deal, the United Kingdom (UK) will officially break from the European Union (EU) on January 1, 2021. The European Commission gave the UK an official warning that the proposed Internal Market Bill violates the withdrawal agreement and is therefore in violation of international law. The British government has a month to pull back the bill.

Hong Kong police arrest dozens of protesters

On Thursday, Hong Kong police arrested at least 86 people on charges of unauthorized assembly. According to Hong Kong’s police, the protesters were in violation of the new national security law passed earlier this year. The controversial national security law which was consistently making headlines earlier in the year has been overshadowed by pandemic news. However, security forces continue to crackdown on Hong Kong’s pro-democracy movement in order to uphold mainland China’s authoritarian interests.

US Social & Political Developments

The Trumps test positive for Covid-19

President Donald Trump made the announcement on his Twitter feed Thursday night that both him and his wife Melania have tested positive for Covid-19. Though reports from White House staff say the president is experiencing only minor symptoms, Trump was admitted to Walter Reed hospital where he will be spending the next few days. As of now, it is unclear if the two remaining presidential debates will occur on schedule, if at all. Trump has cancelled the rest of his campaign schedule due to his diagnosis, which has brought a new level of uncertainty to the presidential race.

US fiscal stimulus talks fail to make progress

US Secretary of the Treasury, Steven Mnuchin, and Speaker of the House, Nancy Pelosi, have been unable to bridge the gap in their two proposals for a fifth economic rescue package. Mnuchin has proposed a plan totaling $1.6 trillion in additional spending whereas Pelosi’s offer stands at $2.2 trillion. The House voted to approve the $2.2 trillion package but it is not expected to pass through the Senate.

Corporate/Sector News

Energy sector sinks to 6-month low

The energy sector sank to a 6-month low on Thursday as rising Covid-19 cases continue to hurt the demand outlook. OPEC’s production increase announced last month is putting additional pressure on prices. WTI and Brent crude oil prices fell 8.1% and 6.7% on the week, respectively.

Palantir and Asana launch IPOs

The companies Palantir and Asana both went public this week in a direct listing on the New York Stock Exchange, challenging the traditional IPO process. Data mining company Palantir closed the first day of trading up 31% while the work management platform Asana jumped 43%.

Walmart in talks with India’s Tata Group on new super-app business

Walmart is in talks with India’s Tata Group for a potential $20 billion+ investment in an upcoming super-app business. The app will offer products and services including food delivery and bill payment. The two companies are likely to jointly run the new app but more foreign investors may be brought in.

Recommended Reads

The Most Important Election. Ever.

Is the US dollar shirking its “exorbitant duty”?

Climate Change Doesn’t Have to Stoke Conflict

Freedom, Barbarism, and Triremes

Malaysia’s Political Jockeying Is a Distraction

The volatility wake-up call for investors

This week from Black Summit

Crossroads: At the Intersection of Geopolitics and Geoeconomics – Rachel Poole

Where Corporate Profits Come From: Deficits and Covid-19 – Joel Charalambakis

Covid-19, US Elections, and the Day After – Tyler Thompson and Rachel Poole

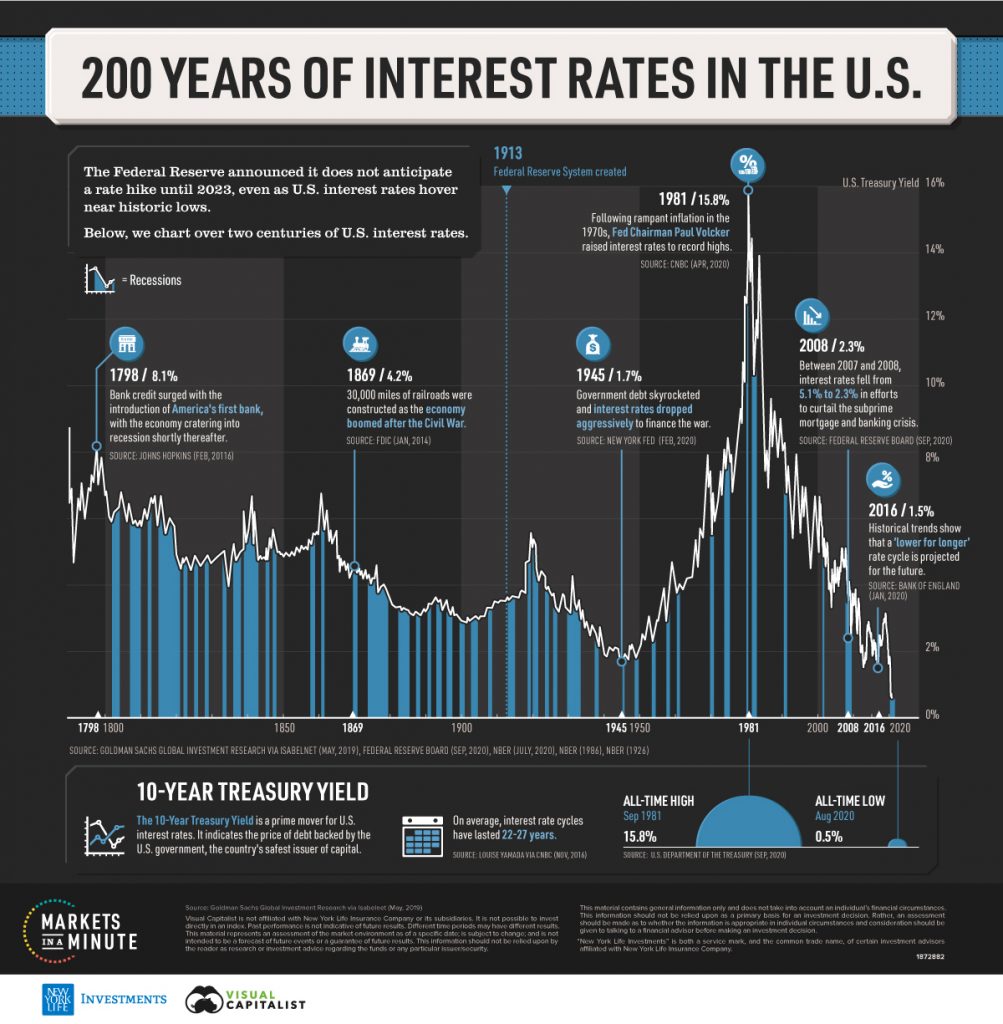

Image of the Week

Video of the Week

Global Outlook: bleak picture for international commerce

Source: Economist Intelligence Unit