In his sixth section of “Meditations in Time of Civil War”, the famous Nobel laureate Irish poet (and pillar of literature) William Butler Yeats writes: “We had fed the heart on fantasies, the heart’s grown brutal from the fare. More substance in our enmities than in our love.” And he will reiterate a few times in the same section: “Come build in the empty house of the stare.” The emphasis of the poem is the contrast of creative domesticity in the midst of rising uncertainty during a civil war.

Just two days ago (July 26th) we celebrated the bloodless emancipation of slaves that took place in 1833 in England. William Wilberforce led that bloodless revolution in England and just three days before he passed away, and while on his deathbed, he secured the freedom of slaves in the midst of a civil conflict that kept England on the edge of uncertainty.

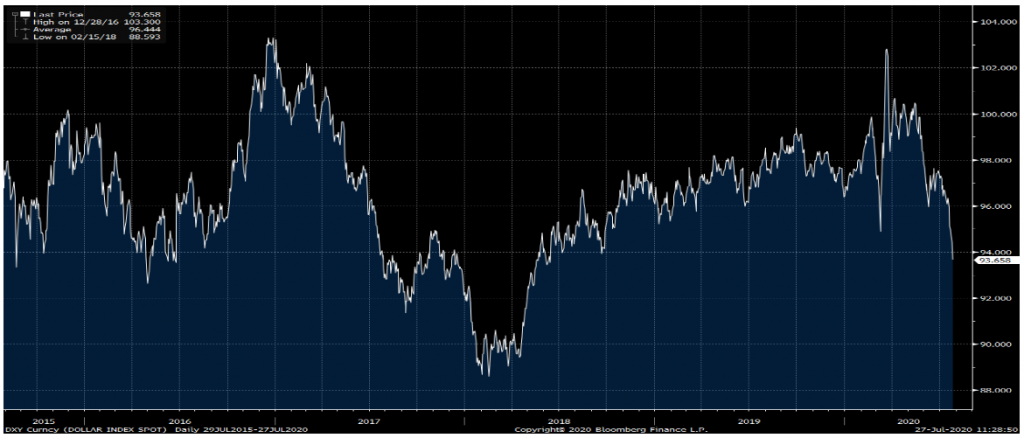

Nowadays, it seems that we live a surreal conflict having on one side paper money and profits, and on the other side the real economy and real money. Let’s distinguish from the very beginning and remind ourselves the difference between fiat (paper) money and real money. The former has zero intrinsic value. The latter represents the aggregate collection of inputs and outputs based on productive activities rather than declaration by central authorities that a piece of paper represents value. In the last couple of weeks we have witnessed the fact that the dollar index has been losing ground (see figure below), as well as the fact that gold prices has reached an all-time high level, exceeding (as of Monday evening) the record set in September 2011 of $1,921.

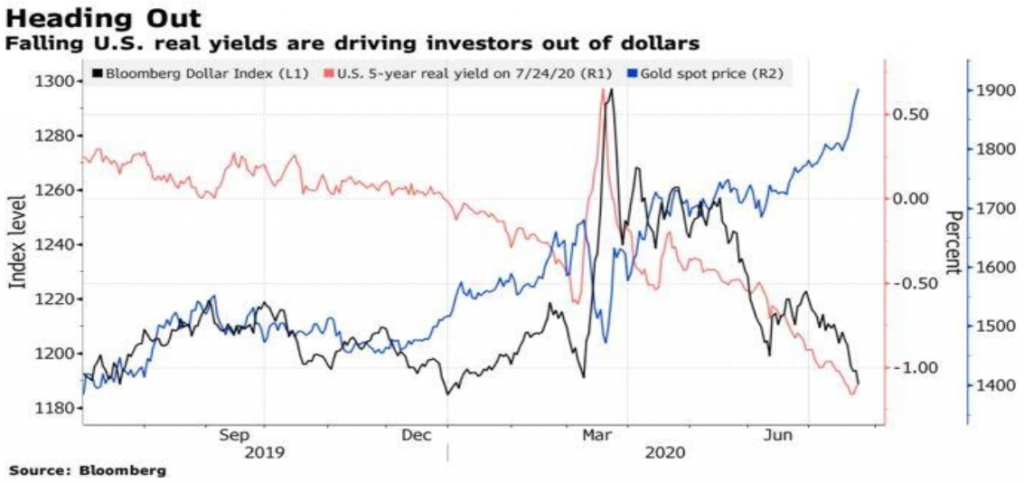

Of course, we cannot comprehend the facts (about relative dollar weakness and gold’s strength) when we operate in a vacuum. We should take into account the price of money and the interest rate differentials for or against the dollar. Within that context, when we take into account the fact that the interest rate differentials (in favor of the dollar) have disappeared, then it could make little sense to expect the dollar to remain as strong, and real money (gold) to stay neutral. Therefore, when we put these facts together, we get the following picture:

The figure above clearly tells us that as real yields on dollar assets decline, the dollar itself declines, while demand for real money (gold) is rising, and hence gold (as well as silver and other precious metals) prices rise as well. However, this picture is still incomplete as we should also be considering the following factors which are also at play, and which also partially explain the dollar’s weakness and gold’s strength:

– Decision of more government spending, weakens the fiscal picture and raises concerns of even higher deficits (which may be as high as 20% of the country’s GDP, a picture not so different from developments in other continents)

– The direct financing of those deficits by central banks (via purchases of the government bonds) raises concerns of inflationary pressures starting in the second half of 2021

– Rising Covid-19 infection cases in the US, Spain, China, Brazil, hint to potential stay-at-home alternatives which will slow down economic activity

– Economic activity is already stalling across the globe after the initial jump-start it experienced in May and June

– Rising geopolitical tensions with China signify deglobalization and less trade which in turn uplifts risks and advances demand for safety

– Forthcoming guidance from central banks most probably would be conducive to the current trends of dollar weakness and gold’s strength

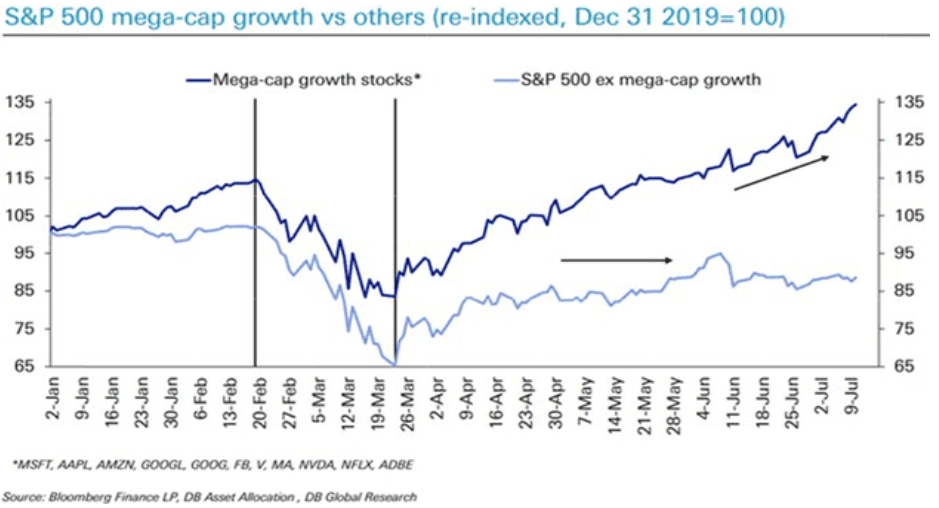

– A herd mentality of stashing cash into what is popular while absurd on its face, may help investors’ overall performance

– The contrast of the paper profits of the top 10 megacorps in the S&P 500 (FAANG and other similar stocks like Microsoft, Visa, Mastercard, Nvidia, and Adobe) vs. the performance of the other 490 stocks in the S&P 500 is revealing: The former have made gains of over 30% since the crisis started, while the latter have lost over 10%. The bias introduced by those megacorps distorts reality, and that distortion will eventually backfire.

We wrote last week that in our humble understanding of things, in the next few weeks we will be entering into the danger zone. While we are always suspicious of exponential growth in any asset class (after all, it was the exponential rise of gold prices that made us in 2011 to sell most of our gold holdings) we believe that the circumstances (as discussed above) are such nowadays, that it would not surprise us if gold prices keep rising.

The markets and the different asset classes are in a form of an internal civil conflict. There are sectors and classes that seek emancipation. On the other hand, there are stocks and sectors that defy reason. In the midst of this, and as some disruptors come on the top in defiance of fundamentals my mind recalls the words by Yeats “We had fed the heart on fantasies”, and those of George Orwell in 1984: “Don’t you see that the whole aim of newspeak is to narrow the range of thought?”