There is little doubt that stock market indicators (besides the rally itself until recently) pointed to a recovery that is better than the one expected by the majority of analysts, economists, and market watchers. The equity markets recovered most of the losses that took place earlier this year, with tech companies leading the way. In the last few weeks, other non-tech companies also started carrying some of the recovery’s load. Market-breadth indicators, until early last week (see figures below), signified that the comeback was widening, given that a wider-ranging group of equities was rising in lockstep with the large-cap tech companies.

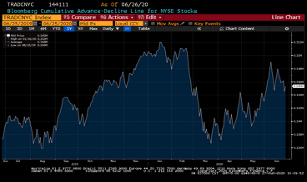

Technical indicators of momentum and breadth until early last week pointed to a strong recovery. The number of stocks trading above their 200-day moving average kept rising, while the cumulative number that signifies the total number of stocks rising minus those declining, also kept rising. Analysts who studied those momentum metrics believe that the fact of a rising swath of stocks participating in the rally is indicative of an upswing that will keep on going.

We are certainly happy about those gains, but we are wondering if we have counted all the risks. This euphoria could signify an overbought market where we are betting for the best under pretty bad conditions. Nike’s results might be indicative of the pressures expected. There is little doubt that violent selloffs could be followed by strong outperformance (as sales and earnings improve). However, we cannot exclude the fact that a speculative frenzy (such as betting heavily on the stocks of bankrupt companies) also introduces biases into the market.

The market decline last week might be indicative of what could take place when reason rather than emotion prevail. The rising numbers of infections paused the rally and made investors skeptical of what might be happening.

Given this kind of mixture, we believe that investors should outline the number of factors that could affect markets’ direction in the next few weeks and months, and make a judgement call as to the market direction. Here is then a list of those factors which, in our humble opinion, will directly affect the markets’ momentum and direction:

- Infection cases: If the number keeps rising, governments may not order lockdowns, but consumers will restrain from spending and thus economic activity will decline and the growth expected will slowdown.

- Corporate bankruptcies: A rising number of bankruptcies will undermine confidence and will affect the financial sector. A rising number of zombie companies whose earnings are less than the liability of paying their loan/debt installments, will have a cascading effect in the whole economy.

- Government support measures: The extensive government deficits and helicopter money by the central banks, are primarily responsible for the markets’ upswing. Some measures are expiring in a few weeks and thus the spending support may be suspended.

- U.S.-China relationship: This could turn out to be one of the key issues in the US presidential election in November. We believe that both candidates will take a strong stance against Chinese manipulations and the relationship will deteriorate which will have negative effects on international trade and consequently on the markets.

- U.S. elections: This is too early to call. The uncertainty of that outcome that will affect fiscal, trade, and foreign policies (among others) is a wildcard that most probably will push volatility higher come August and September.

- Developments within Europe: The EU seems to be getting its act together and the fiscal measures announced if enacted could give a boost to European equity markets. Assuming that the infection cases are controlled, and also that economic activity keeps growing (as PMIs indicate), then given the low valuation of European equities (see graph below), we could see an upswing in European equities (and possibly in the Euro itself) which could become a catalyst for other markets too. Of course, we cannot ignore the Brexit case which could well become a major issue come October/November.

What should we then conclude from the above discussion? It is our opinion that risks for the foreseeable future are tilted on the downside, however the hedge to that would be some limited exposure to European names with solid fundamentals that are relative less expensive than US names.