Global Market News

Global equities slightly down

Global equities were slightly down on the week. The US 10-year Treasury note was also little changed this week, yielding 0.62% at the end of the week. Though market volatility, as measured by the Cboe Volatility Index (VIX), held steady at 37, oil price volatility remained extremely high. The price of a barrel of West Texas Intermediate crude rose from $2.50 last Friday to $19.72.

Alarming economic data

Economic data reports revealed US gross domestic product (GDP) fell 4.8% on an annualized basis in quarter 1. White House economic advisor, Kevin Hassett, is forecasting a shocking 40% annualized GDP decline in quarter 2 as well as an unemployment rate between 16% and 20%. So far, the eurozone is faring much worse, with growth declining 3.8% in the first quarter, about 15% annualized. Despite the economic warning signs, markets remain more or less un-phased by the poor figures.

Coronavirus Updates

Covid-19 by the numbers

Global Confirmed Covid-19 cases: 3,300,000 Global Covid-19 deaths: 235,000

US Confirmed Covid-19 cases: 1,120,000 US Covid-19 deaths: 65,230

*As of Friday evening

Central banks battle Covid-19

The US Federal Reserve, the European Central Bank (ECB), and the Bank of Japan (BOJ) all modified their monetary policies this week in order to combat the coronavirus pandemic that continues to wreak havoc on the global economy. Each of these central banks have expanded programs to improve market liquidity and keep credit flowing. The ECB and BOJ’s lending rates are already in negative territory while the Fed’s is at its effective lower bound. The Fed lowered the minimum loan size of the Main Street Lending Program and expanded it to make it available to more companies. The BOJ increased asset purchases and removed the 80 trillion-yuan annual limit on Japanese government bond purchases. The ECB lowered the lending rate on its long-term refunding operations to -1%, encouraging banks to borrow from the central bank so that they can effectively lend to clients.

A Chinese stimulus package in the works?

The annual meeting of China’s National People’s Congress, originally scheduled in early March, will begin in Beijing on May 22nd. Over 5,000 delegates will convene to discuss the budget which is expected to include a stimulus package. If a stimulus package does result from the meeting, it is predicted to fall short of the extraordinary stimulus rolled out by Beijing in 2008 and 2009. It is unknown whether or not China will set a growth target for this year especially after the country’s economic contraction of 6.8% in the first quarter.

Remdesivir produces promising results

Dr. Anthony Fauci, federal infectious disease chief and member of the White House coronavirus task force, announced the promising results of a government trial of the antiviral drug remdesivir. Dr. Fauci explained the drug has been found to modestly speed recovery. The trial found the average time to recovery was four days faster in people who received remdesivir. US regulators are exploring emergency approval for use of the drug while Japan is also hoping to fast-track its approval. Dr. Fauci also believes it is “doable” to have a vaccine ready for widespread distribution in January.

Geopolitics Spotlight

Political stalemate no more

Israeli Prime Minister Benjamin Netanyahu is ready to present his national unity government to the Knesset next week. Netanyahu’s party, Likud, and the Blue and White party headed by Benny Gantz, reached a coalition deal a few weeks ago after 17 months of political stalemate. The two men have until May 7th to receive support from Israel’s parliament for the new government which would include approval for the rotation agreement that would see Netanyahu as Prime Minister for the first 18 months, and Gantz as Prime Minister after.

Mexico-EU finalize free trade agreement

Mexico and the European Union finalized a new free-trade agreement this week, wrapping up four years of negotiations. The new agreement will eliminate virtually all duties on trade. The deal also includes measures to fight corruption and money laundering, in addition to investment protection and sustainable development in line with the Paris climate accord.

Recommended Reads

‘This Feels Very Different’

Millions Had Risen Out of Poverty. Coronavirus Is Pulling Them Back.

Failure of oil price war may cost Putin dear

Developing Countries Draw Down Reserves to Shield Currencies

How China Sees the World

Nobel-Prize Winning Economist Dr. James Heckman on Social Mobility, the American Dream, and how COVID-19 Could Affect Inequality

Pandemic Triggers a Wave of Distress, Bankruptcy in Corporate America

The Next Chapter of the Oil Crisis: The Industry Shuts Down

Inside the Dystopian, Post-Lockdown World of Wuhan

This week from BlackSummit

From Westphalia (1648) to Vienna (1815) and onto Paris (1919), Bretton Woods (1944), Camp David (1971) and the forthcoming Paradigm Shift: Part IV (final), Rebalancing of Power

John E. Charalambakis

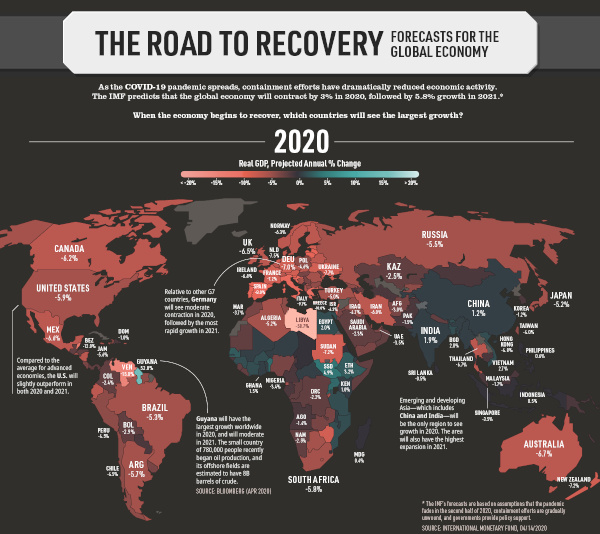

Image of the Week

Animated Map: An Economic Forecast for the COVID-19 Recovery (2020-21)

Video of the Week

The Legal Case Against China in the Pandemic

Source: DW News