Market Action

Global equities were dramatically lower on the week, officially entering bear territory for the first time in 11 years. On Thursday, the S&P 500 suffered its largest one-day percentage drop since 1987 while Europe suffered is largest one-day drop on record. The yield on the US 10-year Treasury note fell to 0.32% on Monday but recovered to 0.88% on Friday. Saudi Arabia and Russia’s price war caused oil prices to plummet. The price of a barrel of West Texas Intermediate crude oil dropped $11 to $31.75 on the week. Continued fear and chaos due to the global coronavirus outbreak, which has been labeled a global pandemic by the World Health Organization (WHO), caused a historic spike in volatility. The Cboe Volatility Index hit a high of 77 on Friday before easing to 57 as the markets closed.

Countries around the world have been taking drastic measures to contain the coronavirus. This week Italy imposed a lockdown on the entire country, forcing most businesses to close and only allowing grocery stores and pharmacies to stay open. US President Donald Trump declared a national state of emergency and banned travel from Europe in addition to allocating more funds towards containing and fighting COVID-19. Large public events, such as concerts and sporting events, are being cancelled across the world. All of these actions to prevent further spread of the virus will undoubtedly have major effects on economic growth, business, and consumer confidence.

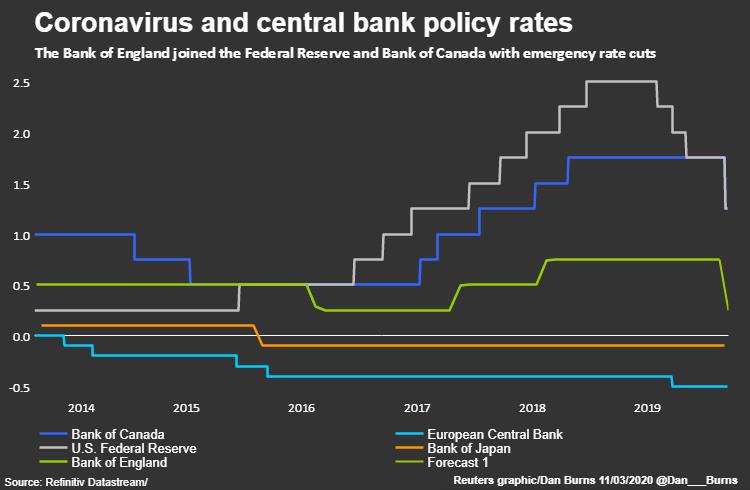

In an attempt to calm the markets and cushion the economic blow from COVID-19, the US Federal Reserve announced $1.5 trillion in repo operations and also said it will spread its monthly $60 billion of Treasury purchases along the yield curve for the next month. While the European Central Bank held rates steady, disappointing markets, the Bank of England cut its base lending rate by half a percent as did Norway’s Norges Bank. The People’s Bank of China announced Friday that it will cut reserve requirements to eligible banks by 50 to 100 basis points, freeing up around $79 billion for lending.

Early last week, OPEC proposed a production cut to try to stabilize oil prices during a demand shock caused by the coronavirus outbreak. However, Russia decided not to join the proposal, leading to an all-out price war with Saudi Arabia who has decided to ramp up production and slash prices on its oil exports. Many heavily indebted US shale oil producers have been caught up in the mix as the price war has resulted in massive losses in the oil sector.

Russia’s parliament approved a constitutional reform that allows President Vladimir Putin to run for two more terms which could extend his already 20-year reign to 2036. Russian lawmakers and President Putin himself claim such measures are necessary to guarantee “stable development” for the country.

The US conducted retaliatory airstrikes against five sites in Iraq belonging to the Iran-backed Kata’ib Hezbollah militant group. The strikes were carried out in retaliation for an attack that killed two Americans and one British soldier. The Iraqi government has condemned the US’ actions which have reportedly killed six people. This is the first attack launched by the US in Iraq since the killing of Iranian military general Qassem Soleimani.

What could affect the markets in the weeks ahead?

Former US Vice President Joe Biden won four Democratic presidential primaries on Tuesday and leads in a fifth that remains too close to call while Vermont Senator Bernie Sanders only won one state. Biden’s wins on Tuesday have pushed him to the front and have made him the likely Democratic presidential nominee. Campaigning will look a bit different in the coming weeks as both candidates have cancelled rallies due to the coronavirus.

Turkish President Recep Tayyip Erdogan will meet with European leaders on March 17th in Istanbul to discuss an immigration deal between Turkey and the European Union. Earlier this month, President Erdogan announced Turkey would not prevent migrants from crossing its border into Greece. As tensions escalate and conditions fail to improve in Syria, more and more Syrians are making the decision to flee the region.

Group of 7 (G7) finance ministers and central bankers will meet on March 24th and 25th to discuss global policy coordination. Instead of having the meeting in Pittsburgh as scheduled, the meeting will be held via video conference.

Recommended Reads

Why this Oil Crash is Different

Amazon ecosystem could collapse in less than 50 years

Vladimir Putin sets stage for retaining his grip on power

Lebanon’s sovereign default leaves creditors facing big losses

Argentina Stares Down Yet Another Default

China May Be Beating the Coronavirus, at a Painful Cost

Why More Car Makers Are Following Tesla Into the Battery Business

Greece left holding the gates of Europe

This Week from BlackSummit

When Volatility and Turmoil March On

John E. Charalambakis

Image of the Week

Source: Reuters

Video of the Week

Coronavirus expert: ‘War is an appropriate analogy’

Source: Channel 4 News