Market Action

Global equities struggled this week as worries over the coronavirus spread faster than the virus itself. Anxiety about the outbreak caused the yield on the US 10-year Treasury note to fall 17 basis points to 1.53%, as the yield curve flattened. Concerns about global growth weighed heavily on commodity prices, as the price of a barrel of West Texas Intermediate crude oil dropped from $54.50 to $51.50 on the week. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), rose sharply from 13.5 a week ago to 18.1 on Friday.

The World Health Organization (WHO) declared the coronavirus outbreak a global health emergency at their meeting on Thursday. As of Friday afternoon, 213 people had died from the virus and over 10,000 cases had been confirmed. Though the WHO said the virus did not necessitate sweeping travel and trade bans, many countries, including the United States, have warned against all travel to China. Fears around the outbreak continue to negatively impact both Asian and global markets though there is concern that the full effect has yet to be felt as the outbreak has coincided with Chinese markets being on holiday for the Lunar New Year. All eyes will be on Shanghai as the markets re-open on Monday.

The United Kingdom (UK) formally left the European Union (EU) last night, ending a 47-year partnership. It now enters a period of transition through 2020 in which it will remain in the single market and customs union but will no longer be represented in EU decision-making bodies.

The UK will allow Chinese telecommunications firm, Huawei, to build certain parts of its 5G network but capping the firm’s market share at 35%. The country has pledged to work with Australia, Canada, New Zealand, and the United States to develop alternative telecom suppliers. However, the UK’s move to allow Huawei into its 5G network directly goes against the US’ call for a complete ban and Washington’s warning that the firm poses a security threat.

This week US President Donald Trump unveiled his Middle East Peace Plan after meeting with Israeli Prime Minister Benjamin Netanyahu and Israel’s Blue and White party leader Benny Gantz. The plan proposes Israel’s control of a unified Jerusalem and all of its current settlements in the West Bank, as well as offers $50 billion in investments to a new Palestinian state. Palestinian authorities rejected the new plan before it was even unveiled, but Palestinian President Mahmoud Abbas plans to address the United Nations Security Council about the proposed peace plan in the next two weeks.

India and Brazil strengthened their ties this week by signing 15 new agreements that further their cooperation in a range of areas including trade and investment, cybersecurity and information technology, and oil and gas. To celebrate the relationship between the two countries, Brazilian President Jair Messias Bolsonaro was the chief guest at India’s Republic Day Parade on Sunday.

What Could Affect the Markets in the Days and Weeks Ahead

The US Senate voted 51 to 49 on Friday to block the consideration of additional witnesses and evidence in President Donald Trump’s impeachment trial. The vote clears the way for an expected acquittal in the next few days.

US President Donald Trump signed into law the US-Mexico-Canada agreement. This new agreement, an update to the former North American Free Trade Agreement, is expected to increase US gross domestic product by about 0.35% over the long term according to estimates from the US International Trade Commission.

US primary elections begin next week with the Iowa caucuses on Monday evening, followed by the New Hampshire primary on February 11th. Former Vice President Joe Biden and Vermont Senator Bernie Sanders are leading in the polls for the Democratic national primary, while President Donald Trump is running unopposed for the Republican party.

This Week From BlackSummit

Recommended Reads

Video of the Week

Image of the Week

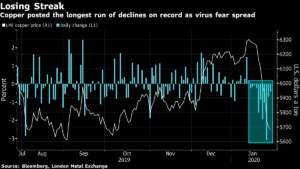

Copper’s Losing Streak