Market Action

By the end of the week, US equity markets were trading slightly below all-time highs set earlier in the day on Friday. The yield on the US 10-year Treasury note and Volatility, as measured by the Chicago Board Options Exchange Volatility Index, changed little. The price of a barrel of West Texas Intermediate Crude oil rose about a dollar to $59.60.

Both US President Donald Trump and Chinese Vice Minister of Commerce Wang Shouwen confirmed the US and China have reached a preliminary agreement on phase one of a trade deal. The deal will include the cancellation of tariffs that were originally scheduled to take effect on Sunday and 15% of tariffs will be reduced to 7.5%. China has agreed to agricultural purchases, intellectual property protections, and opening up its market to US financial services firms. If China fails to meet their commitments, the US reserves the right to reinstate tariffs via a “snapback” provision.

In other US trade news this week, an agreement was reached between the White House and Democrats in the House of Representatives on the US-Mexico-Canada trade agreement (USMCA). Officials from each country met in Mexico this week to approve revisions and finalize details.

British Prime Minister Boris Johnson pulled out a majority for his Conservative Party in the United Kingdom’s (UK) general election this week. The Conservative Party won 364 seats in the 650-seat house while the Labour Party secured only 203, making it the party’s worst showing since 1935 and prompting Jeremy Corbyn to resign from his leadership role. Parliament is expected to pass the withdrawal agreement that Johnson negotiated with the European Union (EU) in October, by Christmas. After the agreement passes, the UK and EU would have until the end of 2020 to negotiate a trade agreement. In response to the greater Brexit certainty as a result of the election, the pound rallied.

A widespread strike continues across France. Workers have been protesting for over a week against a proposed gradual transition from the current pension system to a less generous universal plan. Under the new plan, those born before 1975 would remain under the current system, people currently in the workforce would fall under the new system beginning in 2025, and the new system would apply to those entering the workforce in 2022.

What Could Affect the Markets in the Days and Weeks Ahead

On Monday, advance PMI readings for November will be released globally, giving us an idea of whether or not Germany can avoid a fourth-quarter recession. Hopes are high that exports and private consumption can hold the economy up.

Several central banks have meetings scheduled for Thursday to discuss monetary policy changes. There is little expectation that the Bank of Japan will do anything to change monetary policy due to a fairly positive global economic outlook. The markets will be watching for any shifts on the Bank of England’s view on inflation and the interest rate outlook for 2020. Further gains of the British economy will center on Johnson’s new cabinet, progress on a Brexit deal, and how the trade war backdrop pans out. Sweden may go against the trend of lowering interest rates and instead deliver a 25 basis-point rate hike. This action would end five years of negative interest rates in the country.

This Week From BlackSummit

The Titan Has Fallen

John E. Charalambakis

Recommended Reads

Video of the Week

Image of the Week

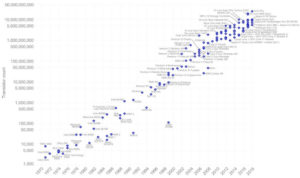

Moore’s Law was originally derived from an observation by Gordon Moore, the co-founder of Fairchild Semiconductor and later the co-founder and CEO of Intel.

In 1965, Moore wrote that the number of components in a dense integrated circuit (i.e., transistors, resistors, diodes, or capacitors) had been doubling with every year of research, and he predicted that this would continue for another decade.

Later on in 1975, he revised his prediction to the doubling occurring every two years.

Like the animation, the following chart from Our World in Data helps plot out the predictions of Moore’s Law versus real world data — note that the Y Axis is logarithmic:

Source: Visual Capitalist