Market Action

Global equity markets boosted slightly after a strong start to the third-quarter earnings season which has been offset somewhat by slow developments in global trade talks and Brexit dealings. The Chicago Board Options Exchange Volatility Index (VIX) reported that volatility was down more than 6% from the previous week. Compared to last week, the yield on the 10-year US Treasury note was up a basis point, to 1.74%. Meanwhile, the price of a barrel of West Texas Intermediate crude oil dropped to $53.91 per barrel.

The United Kingdom and European Union (EU) drafted a Brexit deal on Thursday, but an agreement has yet to be approved. British lawmakers will review the draft over the weekend and EU lawmakers will vote on the deal on Saturday. It has been reported that the deal will include a provision whereby Northern Ireland will remain part of the UK’s customs territory and also be the entry point into the EU’s single market. However, the Northern Irish Democratic Unionist Party says it will not support such a deal. If the deal is not agreed upon by all parties this weekend, there could be another Brexit extension and UK elections.

China would like another round of trade talks with the US before they would consider signing what US President Trump calls the first phase of a trade deal. There is no clear indication of when these trade talks would happen, but there is a possibility they could occur by the end of the month. China has agreed to address intellectual property concerns raised by the US and buy $40-$50 billion worth of US agricultural products. In return, the US has agreed to suspend a tariff increase on at least $250 billion of Chinese goods. China has also requested that all tariffs end before they sign a deal.

This week the International Monetary Fund (IMF) forewarned that the US-China trade war could cause 2019 global growth to fall to its lowest rate since the 2008 financial crisis. The outlook could worsen if trade tensions remain unresolved. The IMF projects 2019 GDP growth to be 3.0%, down from the 3.2% forecasted in July. The World Economic Outlook report details the economic challenges caused by the US-China trade war including market turmoil, reduced investment and lower productivity due to supply chain disruptions, and direct costs.

On Thursday, the US and Turkey agreed to a 5-day Turkish ceasefire after Turkey launched an offensive in northern Syria just last week. However, fighting reportedly continued on Friday in the border town of Ras al-Ain. Earlier this week, US President Trump signed an executive order sanctioning Turkish officials, raising tariffs up to 50% on Turkish steel, and stopping trade negotiations, but has since cancelled the tariffs. The Turkish offensive against Kurdish forces in Syria followed a recent withdrawal of US troops from the northern Syrian border.

German Chancellor Angela Merkel cut Germany’s 2020 growth forecast amid weakening global demand, Brexit, and lingering trade disputes. Germany’s economic ministry predicts the country’s gross domestic product will expand by 1% next year, compared with an earlier expectation of a 1.5% increase. This pace is notably slower than in previous years for Europe’s largest economy.

What Could Affect the Markets in the Days Ahead

Markets will be waiting in anticipation for the outcome of the proposed Brexit deal. If the proposal is agreed upon, the sterling may rally several percentage points and shares in domestic-focused British companies could soar. On the other hand, a Brexit extension will have less promising effects on markets.

More than 130 S&P 500 companies and over a third of Dow industrials will be reporting third quarter earnings in the coming days. Analysts expect third-quarter earnings to fall by 2.9% from last year, but expectations have improved as early reports have come in.

Next week, Europe’s third quarter season opens up and is expected to unfavorably compare to corporate America. Wall Street has outperformed Europe’s STOXX 600 index since 2013. Earnings across the STOXX 600 are expected to fall for the third quarter straight.

Turkey’s central bank will announce its latest interest decision on Thursday, with the general impression that the current 16.5% rate will be lowered. However, the lira is facing challenges brought on by Turkey’s geopolitical roller coaster. Turkey’s decision to launch a military offensive against the Kurdish forces in Syria has weighed on its currency.

Argentina is gearing up to face elections on October 27th. Current President Mauricio Macri’s surprise defeat in the August primary elections has shaken Argentina’s currency and debt markets. Investors fear a shift from Macri’s business-friendly style to populist-style policies that may be looming in the days ahead along with debt restructuring.

This Week From BlackSummit

Deteriorating Economic Sentiment: Down the Path of Guicciardini’s Maxims

John E. Charalambakis

Recommended Reads

What to make of the strife at the ECB

The Demolition of U.S. Diplomacy

Is the World Economy Sliding Into First Recession Since 2009?

The Long Rally in Bonds Might Be Near Its End

Our Republic Is Under Attack From the President

Trump’s Capitulation to Erdogan Is Complete

Trump’s Syria withdrawal is a boon for ISIS — and a nightmare for Europe

Abhijit Banerjee and Esther Duflo: The Nobel couple fighting poverty

Video of the Week

How the US has betrayed Kurds throughout history

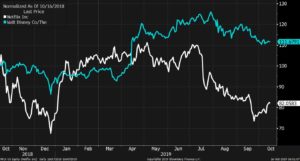

Image of the Week