Market Action

By noon on Friday, global equities had recovered some of the sharp losses recorded on Monday. The yield on the 10-year US Treasury note fell to 1.70% from 1.86% last week. In Europe, bond yields fell to record lows. In the United Kingdom, yields fell to levels lower than the ones posted in the aftermath of the 2016 Brexit vote. The price of a barrel of West Texas Intermediate crude oil decreased $1.50 to $54.25 while volatility held steady at 18.6, as measured by the Chicago Board Options Exchange Volatility Index.

In what is being seen as a countermeasure to a new round of US tariffs, China allowed the yuan to weaken past 7 to the dollar. The event was followed by heavy selling in the global equity markets earlier in the week, but efforts to moderate the currency’s fall have helped stabilize the markets. In response to the devaluation, the US Department of Treasury has labeled China a currency manipulator. In other trade war news, China has officially stopped their purchases of US agricultural products and US President Trump has declared the US will not be doing business with Huawei without a trade deal.

Central banks around the world have continued to cut interest rates following the cuts made by the US Federal Reserve last week. The Reserve Bank of New Zealand dropped its official cash rate 0.50% to 1% and the Reserve Bank of India cut its repo rate 0.35%, to 5.40%. The Bank of Thailand the Central Bank of the Philippines both cut their rates a quarter-point.

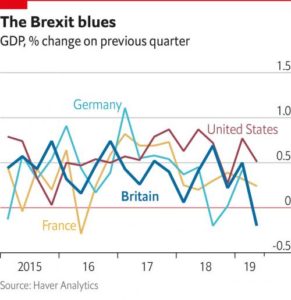

The British economy shrank for the first time since the fourth quarter of 2012. This comes after a rise in the likelihood of a disorderly Brexit or general election. A no-deal Brexit is being expected by the European Union.

The US Federal Reserve has announced that it is developing a faster payment system for banks which would allow instant round-the-clock payments starting in 2023 or 2024.

Former Fed chairs Paul Volcker, Alan Greenspan, Ben Bernanke, Janet Yellen wrote a Wall Street Journal op-ed this week promoting the independence of the Federal Reserve. They said policymakers need to be free of short-term political pressure and should be able to do their jobs without the threat of removal or demotion for political reasons. They also stated in their article that, historically, policy based on political motives has led to higher inflation and slower growth in the long run.

Italian Deputy Prime Minister Matteo Salvini has set in motion the dissolution of the country’s left-right coalition government. Salvini’s party, the League, with support from smaller right-of-center parties, is expected to be in a position to form the next government. With the looming concern that a League-led government will butt heads with the EU over budget deficits, Italian bond spreads widened on Friday.

India has decided to revoke the special status of the disputed Kashmir region, giving the Indian government greater control of the region. In response, Pakistan has suspended bilateral trade with India and expelled India’s ambassador in Islamabad.

What Could Affect the Markets in the Days Ahead

Saudi Arabia is contemplating additional production cuts as oil prices continue to fall.

After releasing some frightening industrial output figures this week, there is a growing fear of a major downturn in the eurozone. More reports, including the quarterly flash gross domestic product data for both Germany and the wider eurozone, will be released this coming week.

A flood of US market data will be released this week as well. U.S. July consumer price inflation is due Tuesday, while we can expect July retail sales, industrial production, the August Philadelphia Fed index and NAHB housing market indicators to be released on Thursday.

Following China’s currency devaluation on Monday, many fear a greater currency war is brewing. Markets are on high alert as pressure mounts on the Federal Reserve to cut rates again and as accusations of currency manipulation fly.

This Week From BlackSummit

The Compounding of Risks: Trade Wars in the Midst of Cheapening Currencies

John E. Charalambakis

Recommended Reads

Putin’s Pledge to Ditch the Dollar Is Slowly Becoming a Reality

A Deluge of Batteries Is About to Rewire the Power Grid

America’s Pension Funds Fell Short in 2019

A Quarter of Humanity Faces Looming Water Crises

Trump Is Risking a Recession—and His Reelection—With His Endless Trade War

America Needs an Independent Fed

India Just Put Democracy at Risk Across South Asia

Video of the Week

Bridgewater’s Ray Dalio Discusses the Impact of China’s Growth on the World Economy

Image of the Week

Source and more info: The Economist Espresso

Listen on the go! Subscribe to the podcast Market Commentary with BlackSummit on iTunes, Android, Google Play, Stitcher, Spotify or TuneIn.