The risks of an economic slowdown is compounded by trade war rhetoric, a Brexit without a deal, the reduction of short-term rates (Asian central banks lowered their rates in the last couple of days) and the talk about ECB’s new round of monetary stimulus, the designation of China as a currency manipulator, and the reaction/retaliation of the latter in the form of reduced imports of oil and soybeans from the US.

The escalation of tensions make the possibility of a trade deal more difficult and may be a prelude to financial developments (imported inflation) which may prevent the Fed from lowering the rates more than 25 bps this year. At the same time the rising probability that the UK will crash out of the EU, has increased the pressure on the sterling pound at a time when the EU’s fundamentals are weakening which in turn implies a weaker Euro. This amalgam of pressures may tempt the Treasury to talk the dollar down and this dangerous path of cheapening currencies increases the overall economic risks.

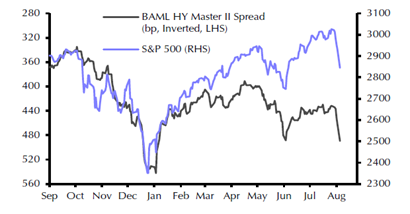

Financial conditions are tightening as can be seen below, in the sense of rising spreads (inverted left axis) which in turn correlates with the downward trend in the markets.

Source: Capital Economics

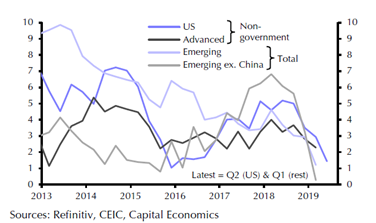

The rising tensions as described above will have negative effects on consumer and business confidence, financial conditions, capital expenditures and real investments. Speaking of fixed capital investments the figure below shows that since the trade tensions started, investments have been declining, implying that the escalation of disputes have indirect consequences much greater than originally anticipated, undermining confidence and growth, while pushing financial investors into safe havens, and hence the significant gains of gold which today surpassed $1500/troy ounce, as well as the deterioration of the yield curve’s inversion signifying rising risks of recession.

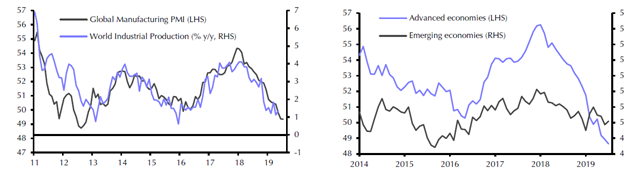

The declining fixed capital investments are further deteriorating industrial production and supply management with the result being the declining PMIs around the world as it can be seen below.

Source: Market & Capital Economics

At this stage our position is that anchoring portfolios with hard real assets while enhancing them with hedging strategies that lower risks, and setting aside some cash ammunition would help investors be prepared for potential unpleasant developments.