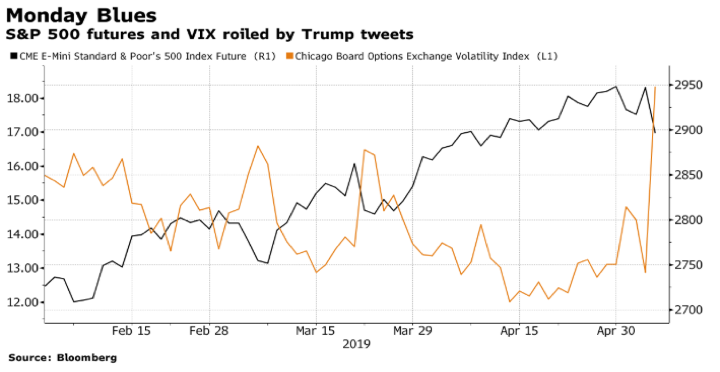

The president’s threat to increase tariffs on Chinese products from 10% to 25%, sent volatility way high yesterday (see chart below). Moreover, the president’s threat via two tweets caused the Chinese Shanghai market to tumble by 5.6% while also contributed to a sea of red in EU and US markets.

The market tranquility that has prevailed over the last few months could be problematic especially if complacency takes hold in investors’ mentality. Betting on markets’ calmness could even be seen in the “non-commercial” trading positions of hedge funds (by shorting futures contracts linked to VIX). The chart below shows that hedge funds have been shorting the volatility index in record numbers as shown below.

The last time this happened (February 2018), market turmoil caused several VIX-related funds to implode and contributed to one very significant market correction.

Wild Volatility has dominated the Argentinian and Turkish markets in the last few weeks. Analysts and investors have started questioning the policymakers’ capability of controlling a wave of bad financial developments that exacerbate risks, elevate inflation, pressure the local currencies in a downward trajectory, while intensifying uncertainty regarding capital flows to emerging markets if a crisis erupts.

In Argentina inflation is running to the north of 55%. The central bank reversed course again and now wants to use the country’s borrowed reserves to protect the peso, and the IMF which is bankrolling Argentina (whose funds the central bank will use to do that) is applauding the move! The rising risks could be seen in the yields of short-term bonds which reached distressed level a few days ago (see graph below). As for the so-called “century-bond” which matures in 2117, it traded at 66 cents on the dollar.

As credibility erodes (due to frequent policy stance changes including measures of price controls), asset prices are pressured while the exchange rate suffers, and thus inflation uncertainty is rising. Argentina experienced in the past two weeks an exit of investors in all asset classes, and that can be partially be attributed to the rising chances that former president Cristina Fernandez de Kirchner may be re-elected in October. If the latter happens, then we could predict a capital flight from Argentina which could also affect other emerging markets.

A deepening recession will be made worse by the fiscal tightness and the very contractionary monetary policy. If the spreads between US Treasuries and Argentinian bonds keep widening, an exodus from Argentina could be observed before October’s election which in turn will amplify a populist revival, and a further weakening of the peso.

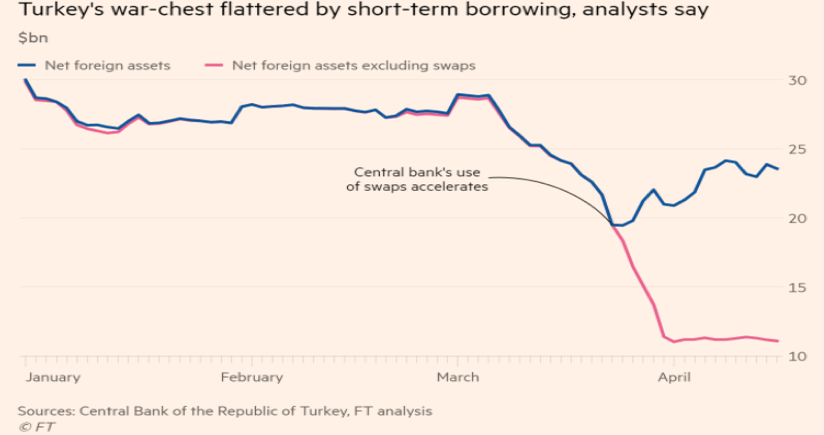

On the Turkish side now, short term dollar borrowing has become the main defensive tool of the central bank. Needless to say, that such myopic tactic undermines long-term stability and market confidence. Those repos (the central banks borrows dollars from local banks with a promise to reverse the transaction within a short-term period) add fears to investors who are concerned about the country’s adequacy of foreign reserves at a time of rising inflationary pressures, declining business and consumer confidence, big trade deficits, and some capital flight.

As it can be seen below, the net foreign reserves (ex-repos) have declined substantially in the last two months and they may point out to an impeding lira crisis.

The non-conventional measures by the Turkish central bank turn out also to lack transparency which in turn elevates international investors’ concerns, especially if we take into account the $177 billion in short-term external debt that comes due in the next 12 months.

The burning of cash by the central banks of Argentina and Turkey might serve as an omen of emerging market turmoil. The developments described above are taking place at a time of a challenging international environment signified by leaderless developed markets, weak institutional support, a sense of somehow overvalued markets, and debt abundance, the combination of which may be a recipe for higher volatility in developed markets too. If the latter materializes, then safe assets and the dollar could be strengthened which may exacerbate the pains inflicted on emerging markets which so far this year have done pretty well.

Ode to hedging!