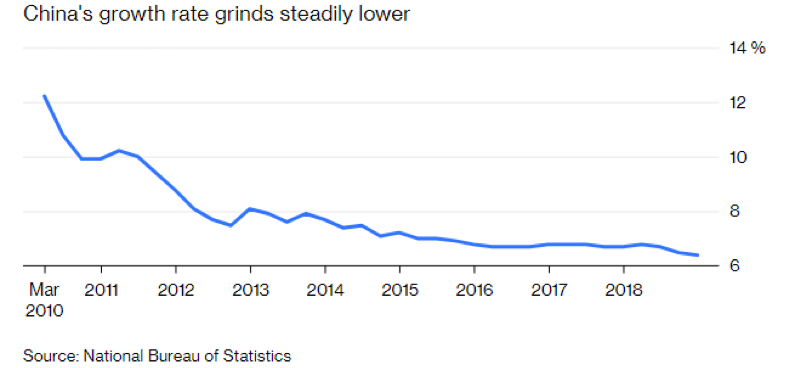

Just a couple of days ago, the Chinese authorities announced that growth this year is expected to range between 6-6.5%. A number of publications pointed out that this is the slowest growth rate in a couple of decades, but our opinion is that it is pretty healthy under the current circumstances.

But first let’s look at the historical record of the Chinese GDP growth rate, shown in the graph below.

The fact is that China is currently facing a triplet of significant challenges (among others), namely: Huge debts, significant trade disputes with the US, and the prospects of a maturing economy. Therefore, under the current circumstances, even a 6% GDP growth rate should be considered pretty good.

As we have pointed out since late last year, we expect that the Chinese markets (and especially Chinese internet-related stocks) will perform well this year due to expansionary monetary and fiscal policies as well as due to the expected trade deal with the US. As the Chinese economy matures, its growth rate is anticipated to drop to about 4% between now and 2022 and probably not exceed 3% between 2023 and 2028, assuming of course that China avoids a hard landing due to its excessive on- and off-balance sheet debts.

Speaking of debts, we should also point out that they have the basic attribute of slowing down future growth and/or demanding more debt if growth is to remain at relative stable levels. When we take that into consideration, and also incorporate the fact that we are reaching again the pre-crisis debt levels of almost 300% of global GDP, then we can formulate our expectations about sales and earnings growth under the lenses of the financial cycle. The financial cycle is approaching its maturing phase and hence our position for some caution in portfolio management.

The special purpose bonds that China has been deploying since 2015, and whose issuance will accelerate in the near future, not only could support the goal of government spending and help China reach the growth target, but they also represent an off-balance sheet financing scheme a.k.a. financial engineering/manipulation. The attractiveness of those special bonds is that they pay higher than normal yields. Of course, such high yields keep the capital within the country, but also exacerbate the fiscal deficit which should be around 8% of GDP (i.e. double the official amount reported).

China has tried the recipe of uplifting its economy via infrastructure spending twice in the past decade (see graph below), and we expect that they are in the process of doing it again while also loosening their monetary policies by infusing a large amount of liquidity into the markets (hence our optimistic view about China at the end of 2018).

It should also be noted that since the Fed signaled that it is pausing its hiking of interest rate, the borrowing costs across emerging markets have tumbled as investors embrace local government bonds, as shown below.

Assuming then that the dollar does not appreciate – or as expected loses some ground to other currencies – emerging market bonds could remain attractive to active investors in the near future.