Over the course of the next few months, problems in emerging markets may intensify. Here is a list of the primary candidates: Turkey, Brazil, Argentina, and China. We certainly do not have the space to discuss all of them in this commentary, but at least we can touch on some important issues they face, and we can also attempt to see those issues from a different angle than purely economic in our concluding remarks.

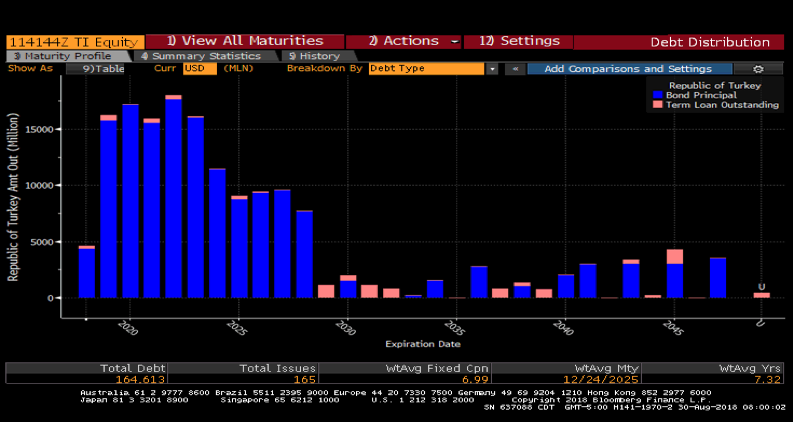

Last Sunday, president Erdogan of Turkey, threaten to stop using dollars in oil transactions with Russia. Of course, this follows a month when the Turkish lira lost about 30% of its value against the dollar and US-Turkish relations reached an all-time low. (We should also note here that the ruble also touched a two-year low against the greenback in August). Turkish economic woes will probably intensify given the fact that next July close to $180 billion in maturing bonds come due (representing close to 25% of Turkish GDP). Most of that debt is private debt but a good chunk (around $42 billion) is owed by the government or government-controlled entities (see figure 1 below, showing the government’s portion).

Figure 1

As with most debt-related instruments of big size, the idea is to refinance them when they come due. The problem of course in the Turkish situation is that rolling it over, may not be feasible given the lira’s troubles. If capital flows reverse course, the perfect storm could be formed for Turkey, especially with some EU banks (Spanish, Italian, French, German) having exposure to Turkish bonds. Those EU banks can handle the Turkish turmoil (given that most of them have Tier 1 capital in excess of 12%), and thus the fear of financial contagion is limited.

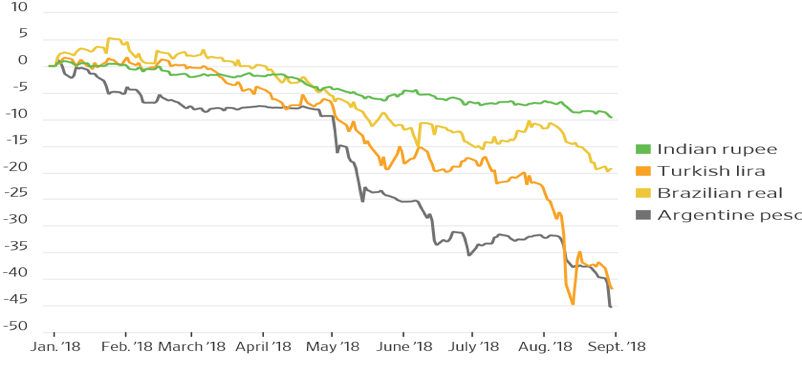

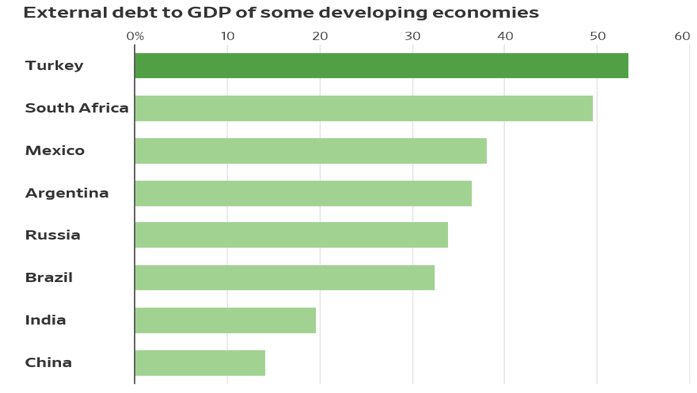

However, when we combine it with other emerging countries issues and geopolitical moves that involve Russia, we could see an aversion building up for emerging markets, that could manifest itself in capital outflows which in their totality could inflict some systemic pressure in the financial system, especially if a currency crisis – see figure 2 below – turns into a debt crisis for emerging market (see figure 3 below). Hence, we can understand Chinese efforts to deleverage, and the Argentinian plea to the IMF for the immediate disbursement of the remaining $35 billion bailout loan (out of a total $50 bailout).

Figure 2

Source: IMF, World Bank

Brazil faces mostly political turmoil given its elections next month. However, whether we are dealing with Brazilian political turmoil, Argentinian currency crisis, or Turkish problems, we cannot ignore the fact that the linkability of the world is done through trade. When the latter goes into trouble territory due to barriers to trade, commodities produced in Europe, the emerging world, or the US will suffer and the consequences of that suffering will spill over into the financial markets, especially when the US is probably entering into a period when political tensions will also have spillover effects.

Let me close this commentary by quoting Sir John Marks Templeton, warning us against the tribalism of a dialectic materialistic attitude which is only good for brainless societies made up of lemmings.

“Every economic system is built on a spiritual foundation. The foundation can be found in the personal ethics of the people that make up the economy. And it can be found in the economic system itself, which is an outgrowth of personal values. As we know, the economy is about trading material goods and services. Yet trade is made possible only by agreement on what is mine and what is thine. These are essentially ethical concerns. To even talk about the economy, there must be agreement about the rules of play. To get those rules, we must have some sense of fair dealing. Where does this sense of fair play come from? It comes through reference to an ethical order outside of ourselves and beyond our own times. In short, by reference to the transcendent. The transcendent is the beginning of economics.”