Warning: This is not a commentary about warnings. Forecast: Why should anyone desire to be proven wrong?

Market Indexes: Distorted and inadequate to capture market movements let alone the undercurrent fundamentals.

In the not too distant past, when we look at the intersection of geopolitics and geoeconomics, August has been marked as a very important month that changed the course of world history. Here is a partial list of some world-shaking events during the month of August:

World War I begins (1914)

The 19th Amendment to the US Constitution is ratified giving women the right to vote (1920)

Adolf Hitler is extended superpowers by 90% of voters in Germany (1934)

Social Security Act is signed into law (1935)

Sicily is captured by the Allies signifying the turn of WWII (1943)

Atomic bomb explosions in Japan forced Japan to surrender. End of WWII (1945)

The Berlin Wall is erected. Cold war takes a decisive turn (1961)

March on Washington takes place and Martin Luther King delivers his speech “I Have a Dream” (1963)

President Johnson is extended the right for a full-blown war in Vietnam (1964)

The US de-links the dollar from gold. The beginning of the 1970s pains (1971)

The US abandons the Bretton Woods Agreement. The rules of international trade and finance need to be rewritten. The world is thrown into a crisis (1973)

President Nixon resigns (1974)

Paul Volcker is appointed Chairman of the Fed. The upswing starts (1979)

Solidarity, the workers’ trade union, is formed in Poland. The beginning of the end for communism is at hand (1980)

Opposition leader Aquino is assassinated in the Philippines. The downfall of Marcos starts (1983)

Paul Volcker resigns from the Fed. Era of credit overextensions and bubbles starts (1987)

Iraq invades Kuwait (1990, Gulf War I)

Soviet hard-liners stage a coup against Gorbachev. The Communist Party is suspended and the end of communism is near (1991)

Mexican debt crisis that became the predecessor to the 1997-’98 crisis begins (1995)

The financial crisis starts (2007)

Russia invades Georgia (2008)

S&P downgrades the US (2011)

By no means do we imply that history repeats herself. However, ignoring history and not taking into account its relevance makes us perpetrators of the Heraclitus fallacy which results in poor judgment and decision-making process. On the other hand, we cannot fall into the Parmenides fallacy where we compare the present with the past, failing to take into account the undercurrent developments. In order to avoid falling into the Parmenides trap, we should take into account the undercurrent developments and compare the present with the potential outcomes yet to come, and thus prepare ourselves for such outcomes.

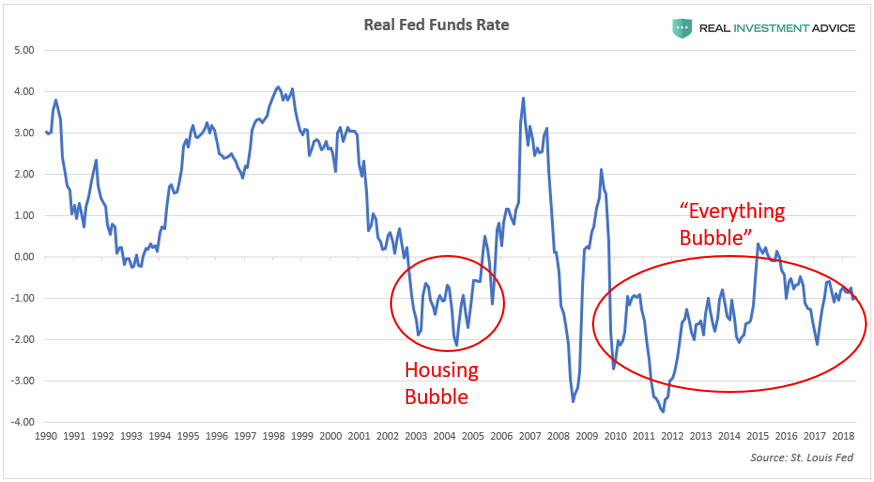

In our humble opinion, credit overextensions – sometimes based on questionable and inflated collateral – created bubbles and advanced financial/paper instruments to levels which could prove to be unstainable if a correction takes place, let alone a bear market surfaces. Recent events with Facebook and Twitter taught us that we could see declines of 20%+ in a day, which if magnified with geopolitical news or unmet expectations by more companies down the road, could translate to significant losses within a few days, let alone the turning of the momentum. Negative real interest rates have become culprits of downturns in the part.

Of course, we could mention other signs of overvaluation (CAPE, margin debt, reaching the top of the credit cycle, the VIX, the market capitalization relative to GDP and GDP growth, etc.), all of which call for caution as we may be turning a page in the credit cycle.

Even more concerning is the deception in the average investor’s mind portrayed by the gains in just a few stocks (among them Facebook, Apple, Amazon, Netflix, and Google, the famous FAANG) which have accounted for the vast majority of gains in the market lately. The fact is that just 10 stocks accounted for all the gains in the S&P 500 this year. Again, in our humble opinion this is not healthy and a significant drop in those few stocks could become the catalyst for a major correction where other stocks that have not gained as much will lose a lot in a major downturn.

In conclusion, we would say that the distortion caused in the indexes by very few stocks (market index oligopolization) is nurturing complacency and misbehavior. Over-indebtedness, rising uncertainty and insecurity, Chinese tremors, and the tightening of monetary policy point out to a turning in investment strategy towards value-oriented securities whose fundamentals are strict and pretty conservative.