Market Action

Trade war threats shook the markets this week and drove them down. US President Donald Trump said he would impose tariffs on $50bn of Chinese goods because Beijing is not dealing with American complaints about stealing intellectual property. In response, China announced penalties on $50bn of American goods, prompting Trump to threaten additional tariffs on goods worth $400bn.

The energy sector was particularly volatile this week, dropping through Thursday then rallying on Friday after OPEC ministers announced a smaller-than-expected increase in oil production.

Index provider MSCI is reclassifying Argentina as an emerging market and will also start including Saudi Arabia in that classification.

Greece and its eurozone creditors reached a deal on debt relief, deferring repayment deadlines by ten years and raising a final bailout package to €15 billion. News sources reported that the agreement brings to a close eight years of bailouts for the nation. Greek equity markets rallied on the news, and the yield on Greece’s benchmark 10-year note declined.

Turkish president Recep Tayyip Erdogan stands for re-election on Sunday in a general election that was originally set for 2019, but which Erdogan brought forward 18 months. The economy has become a major issue as inflation is at 12% and the currency has dropped to a record low against the U.S. dollar. Erdogan has suggested he wants to control interest rates.

Two mayoral candidates in two different Mexican towns were killed in less than 24 hours, marking a total of at least 18 candidates killed so far in campaigns leading up to the July 1 elections.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Market Swings and Policy Moods: Kafka, Verdi, and Pink Floyd

John E. Charalambakis

Recommended Reads

How China’s Economic Aggression Threatens the Technologies and Intellectual Property of the United States and the World

White House Office of Trade and Manufacturing Policy

Millions at financial risk over Brexit contract issue, warns TheCityUK

Catherine Neilan

Barricades and Empty Streets: Nicaragua’s Leader Loses Control

Juan Montes

Steep Oil and Strong Dollar Make Toxic Brew for Global Economies

Paulo Trevisani in São Paulo and Tom Fairless in Frankfurt

After a President’s Shocking Death, a Suspicious Twin Reshapes a Nation

Marc Santora

Just the Fear of a Trade War Is Straining the Global Economy

Peter S. Goodman, Ian Austen, and Elisabeth Malkin

Video of the Week

Remembering the Berlin airlift

Image of the Week

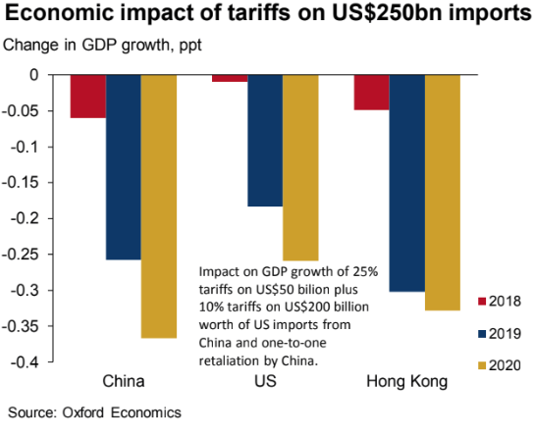

25% US tariffs on US$50bn plus 10% tariffs on US$200bn worth of imports from China, with one-to-one retaliation by China, would reduce real GDP growth in China and the US by about 0.3 ppt and 0.2 ppt, respectively, in 2019-20. Source: Oxford Economics