The dollar has been getting stronger at a time when the Chinese have started to price oil in renminbi. In simple statecraft language, such action by the Chinese could just be perceived as unacceptable at a time when the US trade deficit with China stands at such high level and while the Chinese with their “Made in China 2025” program envision to surpass the US in technological advancements including robotics, artificial intelligence, electronics, and telecommunications.

Again, in simple statecraft language, this is getting pretty close to a Thucydides Trap which may leave the US little room but to take corrective action. When we add to the mix the fact that the Iranians depend on China to absorb the quantities that the new trade sanctions on Iran will make available, then we can understand that things may be getting a bit complicated. And if that is not complicated enough, let’s make it a little bit more complicated and add to the mix MBS (the Crown Prince of Saudi Arabia) and the fact that the Iranians are increasing their influence in Yemen, Qatar, Iraq, Syria, and Lebanon. What then can we conclude? The dollar game is not just a function of interest rate differentials, but it is also a major instrument of foreign policy – and at a time of rising trade and geopolitical tension the dollar has to follow a particular trajectory and the US policy (foreign and trade) should also make room for that trajectory.

But now let’s take a breath and see some additional facts and how those facts could affect both the dollar trajectory as well as the short and medium-term market movements. Here are some indisputable facts:

- Growth in Europe seems to be slowing down. Therefore, some euro momentum due to EU growth potential seems to be giving in.

- The Fed is determined to keep raising short-term rates. The interest rate differentials should, under normal circumstances, give further boost to the dollar.

- Emerging market currencies have dropped significantly against the dollar in the last three weeks (forcing the Argentinian central bank to raise rates to 40%) and asset managers who have gone long on emerging markets need to take measures to protect their exposure to such markets, all of which point to a possible further strengthening of the dollar.

- Geopolitical tensions serve as a mutually reinforcing uplifting power to oil and dollar prices.

- The Fed is shrinking its balance sheet. Such an act creates dollar shortages at a time of higher dollar demand. The result should be stronger dollar.

- There has not been a period when rising rates and dollar shortages resulted in rising markets. I understand that gravity can be suspended but it may require something special!

- Global debt has ballooned, markets are above fair value and the US deficit spending, as well as Germany’s trade and balance surpluses (the former being 8% of its GDP), become forces of destabilization.

- While growth is still expected to be positive, shocks (trade and geopolitical) have the tendency to reverse such expectations (after all US housing prices used always to go higher until they started going lower ten years ago).

- There are trouble makers with a history of being on the wrong side of history at the wrong time and such trouble makers (e.g. Turkey) are in vulnerable economic position ruled by an autocratic government.

- Populism is on the rise and, as last week’s commentary indicated, markets cannot price rising illiberalism in a world of etatism.

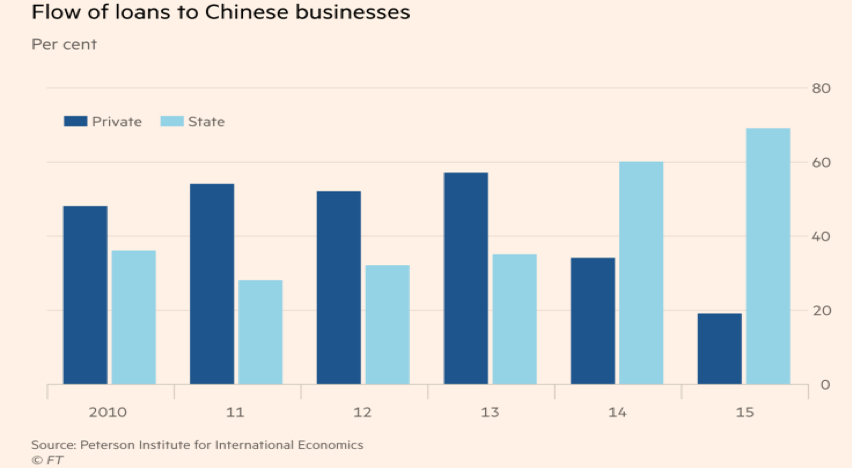

Let me close where we started with a fact that shows that rising etatism/statism may be setting the background for the New Thucydides Trap. It is a well-known fact that the Chinese growth of the last quarter century happened because of the local private sector. The very unfortunate fact is that the Chinese private sector is shrinking dramatically while the Chinese public companies and SOEs (state-owned enterprises) are expanding dramatically. As the following graph from the Financial Times shows, while until 2013 more than half of the credit facilities were going to the private sector, nowadays that percentage is less than 20%.

Welcome to the new etatism a.k.a. the new version of the Thucydides Trap!