Market Action

Global equities rose modestly this week, boosted by broad strength in commodities and a strong start to earnings season. The blended earnings growth rate, which combines the S&P 500 companies that have reported results with estimates for those that have not yet reported, stands at 18.2% on revenue growth of 7.3%.

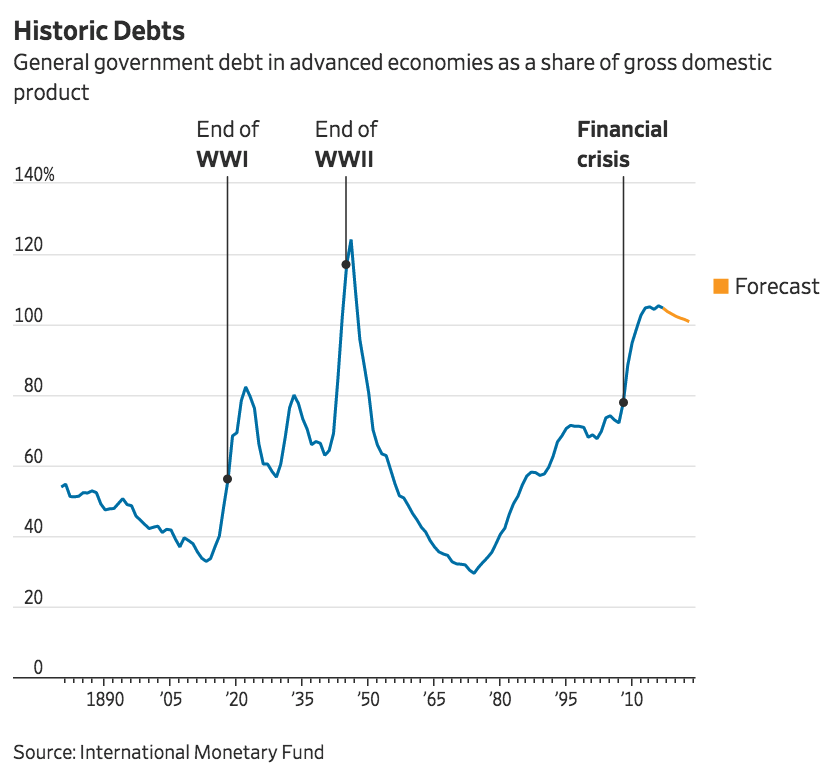

The global economy grew 3.8% in 2017, the International Monetary Fund said in its April World Economic Outlook, and is expected to grow 3.9% this year and next. The fund warned that while near-term upside and downside economic risks are broadly balanced, beyond the next several quarters the risks lean to the downside. The IMF cited growing trade tensions and dangers of a shift toward protectionist policies, tightening financial conditions and geopolitical strains as potential downside risks. The fund also warned about the rising level of global debt, which reached $164trn in 2016, higher than at the time of the financial crisis a decade ago.

China reported this week that its GDP grew 6.8% in the first quarter compared with the same period a year earlier, slightly better than expected.

Turkey’s president, Recep Tayyip Erdogan, announced that parliamentary and presidential elections will be held in June, 17 months ahead of schedule. He said the early polls were needed because of unrest in Syria and in order to help move the country to an executive presidential system, a shift approved in a referendum last year which will give Mr. Erdogan even more power.

Raúl Castro prepared to step down as president of Cuba, ending nearly six decades of rule by the Castro family. His successor is Miguel Díaz-Canel, though Mr. Castro will remain secretary of the Communist Party until 2021.

India’s finance minister, Arun Jaitley, assured markets that the country was not running out of money after cash machines in some parts of the country ran out. The amount of cash in circulation has returned to normal levels since the government abruptly voided most banknotes in 2016, but there has been a spike in demand for cash in the past few months.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Leverage, Valuations, and Earnings: Algorithmic Complexities, Monetary Gamesmanship, and Capital Protection

John E. Charalambakis

Recommended Reads

Fighting fit: China’s economy 2018-04-18

The Economist

Eastern Europe’s Dangerous Authoritarian Trend

Ivan Krastev

The President Is Not Above The Law

The Editorial Board of the New York Times

25-Year-Old Textbooks and Holes in the Ceiling: Inside America’s Public

Josephine Sedgwick

Video of the Week

https://www.facebook.com/bbcnews/videos/10155577857318129/

Image of the Week