In this week’s commentary, we would like to discuss our perspective for the short-term based on some changes we have been observing in the market. However, before we show this – mainly through some graphs – allow us to clarify the cross-determination part of the commentary’s title. By “cross-determination” we mean the interaction and co-determination between fundamentals (such as profits) and market momentum. Furthermore, we imply that while under normal circumstances fundamentals should be driving the market, we may be at a cross point where market momentum matters more than fundamentals. Thus, under such watershed conditions, the market could in the near future turn decisively to the negative.

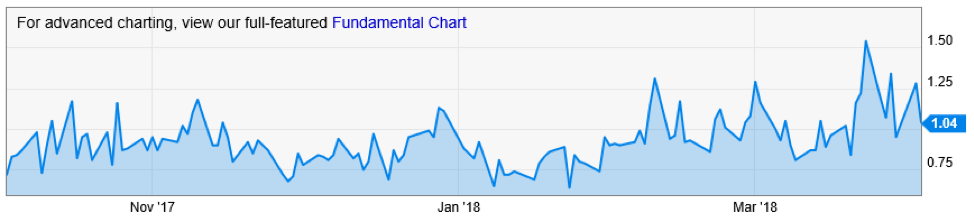

Let’s start with one of the most basic charts: The market (using as a proxy the S&P 500, shown as the blue line below) vs. its 200-day moving average (SMA200, the green line below) as well as against its 50-day moving average (SMA50, the black line below).

Source: MarketWatch

As is clear from the graph above, the market (indicated by the S&P 500 shown as the blue line) crossed its 50-day moving average quite a while ago, and it is very close to crossing its 200-day moving average. Given how close the S&P 500 is to crossing its 200-day moving average, we would say that momentum is turning against an optimistic market outlook.

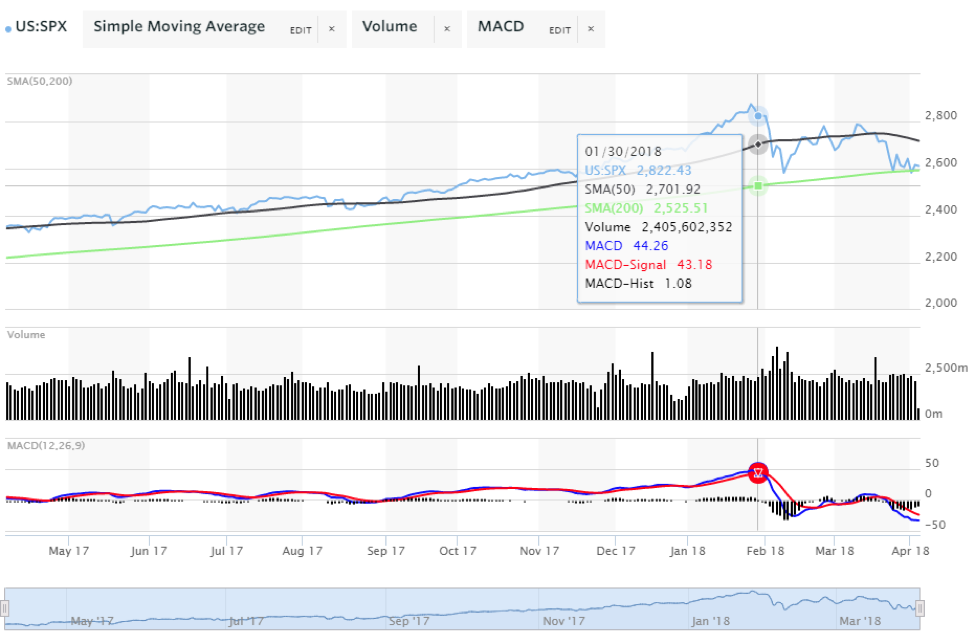

Next, we would like to show the breadth of the market (i.e., the difference between the number of stocks advancing vs. the number of stocks declining in the market).

Source: Index Indicators

As depicted in the graph above, the number of stocks advancing vs. stocks declining has decisively turned for the worse over the last few weeks.

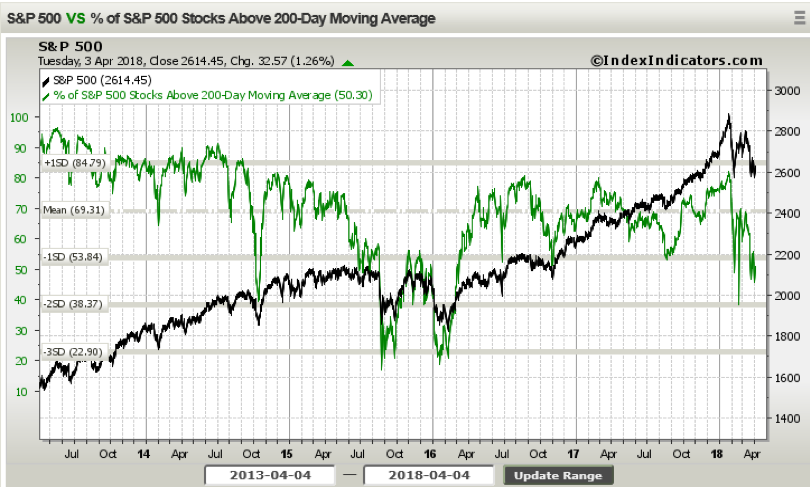

Thirdly, we offer the total market Put/Call Ratio, shown below, which signifies market expectations. (A high number reflects bearish momentum.) Based on the graph below, we could say that the bearish momentum is building up which raises concerns regarding the strength that even good expected earnings could have in the market.

Source: YCharts

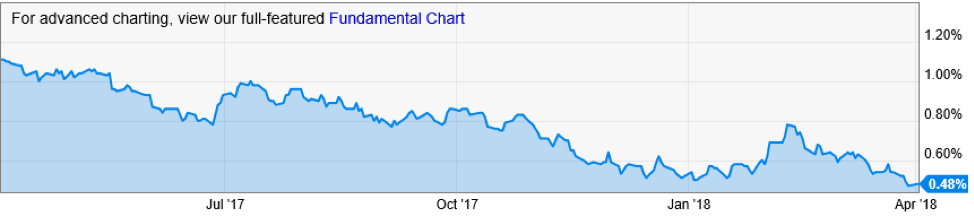

On top of these developments, we all can comprehend the effect of rising levels of volatility which has been well-documented. In an environment in which cross-determination takes place, with momentum driving the co-determination, even some fundamentals may be changing. The graph below reflects such fundamental change in the macroeconomy. The graph shows what is known as the “flattening of the yield curve”, where the yield curve is the difference between the yield on a 10-year Treasury and the yield on a 2-year Treasury. A flattening yield curve is usually associated with declining economic prospects.

Source: YCharts

Are any other fundamental changes happening in the market? Certainly there are several, but at this point we would rather concentrate on two: First, there is an escalating tariff war which may lead to a trade war. There are no winners from such wars and the reality is that such rhetoric and action adds fuel to a negative market momentum. Yesterday, we observed the effects of Chinese retaliation on the prices of soybeans following the additional tariffs that the US administration announced on Tuesday. The graph below shows the negative impact on soybean prices.

Source: Fundamental Analytics

The second fundamental change is that there is rising political uncertainty in the US and possibly in Europe. This is due to not only the absence of US leadership in geopolitical developments around the world but also a shaky US administration that has no clear direction at a time when it is investigated on many fronts.

Let’s close by demonstrating the above with one more graph where pricing and fundamentals point to this watershed co-determination phenomenon in which momentum overtakes fundamentals.

Source: Fundamental Analytics

Under normal circumstances, lower crude oil inventories would imply higher prices. However, while Wednesday’s inventory numbers showed a clear decline, oil prices also declined – as shown in the graph above – possibly signifying lower economic prospects and the possibility that momentum in equity prices may overtake the fundamental dynamics.