Market Action

Stocks globally suffered steep losses for the week against a turbulent geopolitical backdrop including growing trade frictions between the United States and China. The declines took most of the indexes back into negative territory for the year to date.

US president Donald Trump announced tariffs on about $60 billion in imports from China and also imposed restrictions on technology transfers and acquisitions in response to unfair trade practices, such as the theft of intellectual property. The Trump administration also removed earlier steel and aluminum tariffs from many countries in Europe, and South Korea, but left them in place for Japan. The TOPIX Index fell more than 3.5% in the session—reaching its lowest level in more than five months.

In response to the US tariffs, China announced it will add tariffs of $3 billion on imports from the US and called for a dialogue to address trade conflicts. China also threatened to halt purchases of some agricultural products from states that President Trump won in the 2016 general election. Legal action under WTO rules is also being considered.

Peru’s president Pedro Pablo Kuczynski resigned. (It is expected that Vice President Martin Vizcarra will take over the presidency.) Kuczynski, who took office in 2016, had been accused of bribery and lying about whether his consulting firm received payments 10 years ago from Brazilian construction firm Odebrecht, which has been at the center of the region’s biggest graft scandal. The Peruvian economy is accelerating, with growth expected to be around 3.8% this year. On the week, the Peruvian sol gained about 1% against the U.S. dollar.

European stocks dipped to lows not seen since early 2017, and trade tensions saw both the euro and the British pound rise against the U.S. dollar. The eurozone private sector expanded at the weakest pace in more than a year in March, according to flash data from IHS Markit’s composite output index, which dropped to 55.3 from 57.1 in February. Are trade concerns delivering a blow to business and consumer confidence?

On Wednesday, the US Federal Reserve announced another quarter-point rate hike, as was widely expected. Policymakers also shifted their expectations for future rate increases slightly higher.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Rotation Strategies: Earnings Prospects and Fed’s Tightening Cycle

John E. Charalambakis

Recommended Reads

Almost 6 billion people will suffer from water shortages by 2050, U.N. report finds

Ciara Linnane

African countries agree to continental free trade area

Deuche Welle

Crown Prince Mohammed bin Salman’s next target: Iran

John Kilduff

The Dollar’s Doldrums

Barry Eichengreen

The looming global trade war – A tariffically bad idea

The Economist

Video of the Week

How an ‘untouchable’ learnt to fight for her rights

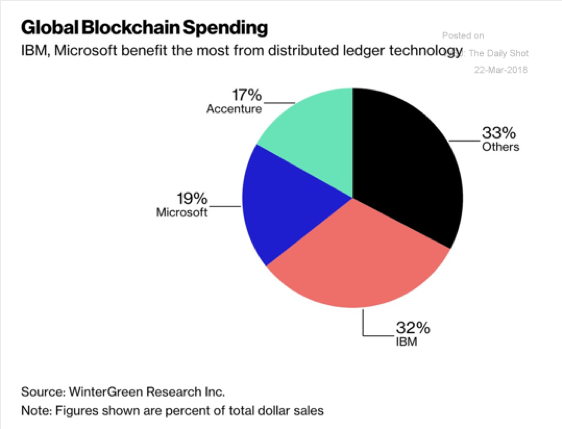

Image of the Week