As a starting point, let’s briefly review a few of the forces that are shaping up equities in a positive trajectory during at least the first few months of 2018. Growth has been picking up pace globally – the much celebrated synchronized recovery – and sentiment is strong for both consumers and businesses. Interest rates continue to be low, monetary policy is still accommodative, inflation is very low, employment levels are rising, market volatility is also very low, business spending is rising, spreads are narrowing, and credit risks are either stable or on a declining trajectory.

The above observations are not just for the US; they also equally apply to Europe, Emerging Markets (EM) and also to Japan. The region that may be showing some signs of a slowdown is China, but for the foreseeable future, we do not anticipate major turmoil there that could shake up the markets in a manner similar to what took place in the summer of 2014 or in the early part of 2015.

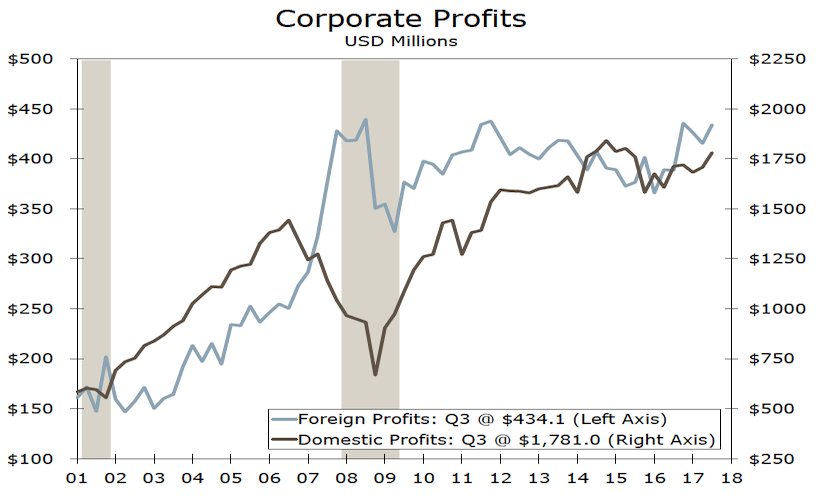

The following graph portrays the corporate earnings trend (the major driver for equity markets) for the US, but the same trend can be observed for European, Japanese and emerging markets.

Source: Federal Reserve Board U.S. Department of Commerce and Wells Fargo Securities

Actually, given valuations (especially for EM) we would not be surprised if EM as well as the Japanese market surpass in performance both the US and European equity markets.

Regarding the US equity markets, we should also take into consideration the tax effects of the recently enacted tax legislation. When we do so, and when we also consider the repatriation of profits, we could possibly make a solid case for US equities. Furthermore, some fiscal expansion and the moderation of the Fed’s tone related to normalization lead us to believe that unless we face significant political crisis, the US equity markets seems to be on a solid upswing. As far as the strength of the dollar is concerned, our expectation is that the dollar (possibly in the second half of the year) will reverse some of the losses against other major currencies.

Could we say that there are particular sectors that we like more than others? I would say that given the macro-fundamentals and taking into account overall sectors’ trajectories, the following sectors are positioned to do better: Industrials, materials, consumer discretionary, and financials. Having said that, we should also think beyond traditional sectors and also investigate the potential of the not-so-beloved sectors such as biotech and shipping (especially dry bulk carriers, a sector that was in depression for a long time and has started recovering recently).

What could derail this trajectory? As we have previously explained, geopolitical developments pose the greatest risks. The Middle East is very unstable and becomes even more so as weeks pass by. The other risk, of course, is the unsustainable debt levels in China. However, we are of the opinion that for the foreseeable future China may experience a slowdown but not the bursting of its bubbles, given global dynamics and spending prospects.

Should we also include then the risk of a recession in our assessment? A well-known theory states that the inversion of the yield curve is an indication of forthcoming recession. Some prefer to predict recessions using the federal funds rate and the ten-year Treasury yield (when the former crosses the lowest point of the ten-year Treasury in the current cycle, then recession is very probable within 17 months). We choose to simply state that when corporate profitability reverses course and the rates are rising, then recession may be forthcoming, something that we do not see in the immediate future.

In closing, let me state that as the current cycle may be approaching its late cycle, it may be prudent to contemplate a cyclical rotation into more value-oriented strategies.