By 460 CE the Roman Army was dominated by Germanic troops. By that time they had also forgotten a basic lesson that it is the army that elects the Emperor. By 475 CE, the barbarian chief Odoacer replaced the Roman emperor with himself. The citizens of Rome selected people who had not been integrated into their society – possibly because of the Romans’ neglect – to defend their causes and the empire itself. The fall of the Roman Empire was unfolding…and the defenders became the masters.

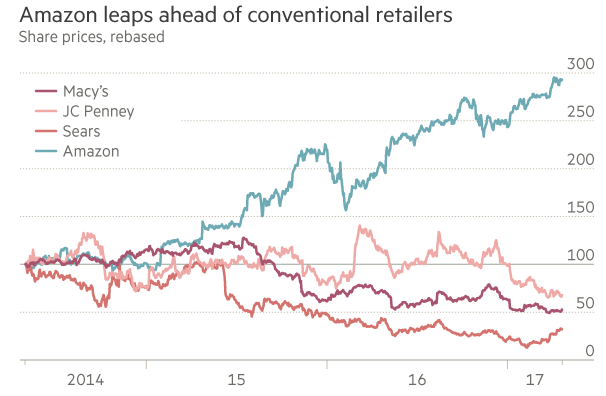

Could we see something parallel unfolding in the American retail sector? Let’s carefully review the graph below. Powerhouses such as Sears, Macy’s and JC Penney have seen their prices lose significant ground in a short period of three years, while Amazon’s price is skyrocketing despite its hefty valuation metrics.

Are those powerhouses losing the boat? Did they fail to see the train-wreck coming? Did they perceive the light at the end of the financial crisis as the end of the tunnel and not as the Amazon train coming?

And if that were to be the case, who is to follow that pattern? Shopping malls, retailers, and generally speaking commercial real estate?

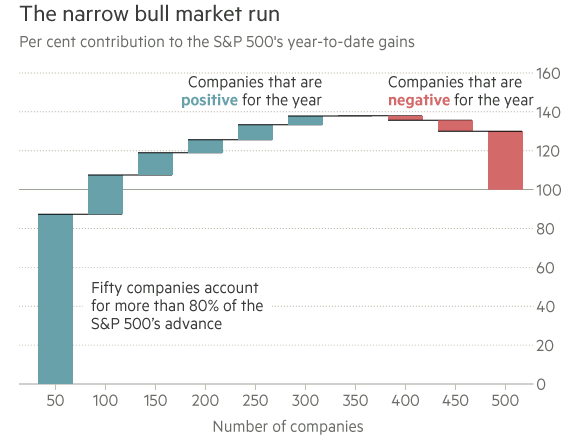

However, it is one thing to be talking about failure to anticipate the structural changes happening and being unable to adopt and change, and completely another thing to perceive a market (S&P 500) upswing as an overall economic turnaround that can justify higher valuations and metrics. The truth of the matter is that just two stocks (Apple and Facebook) account for more than 20% of the index’s gains this year. If we extend our list and include Amazon, Google, and few others, then we will discover that those few stocks constitute 80-85% of the index’s gains in 2017, as the figure below shows.

The lack of co-movement among the majority of the names in the S&P 500 may signify an asymmetrical market development that needs to be watched, since those asymmetries could be exploited. At the same time those asymmetries increase the tail risks since they are directly related to employment, growth, and spending.

Having said that we should also state that global and US-specific latest data are encouraging. Global trade is expanding and Asian economies’ exports recorded healthy growth, which also reflects rising demand for goods in both Europe and the US, as shown by the volume of trade and the number of shipments.

Corporate sales and profits are rising in the US at pretty satisfactory rates, indicating sustainable demand and good prospects. The concern of course is over policy regarding trade, budget, taxes, regulation, and other areas that could undo much of the expectations built up over the course of the last few months.

How then should we think about our portfolios? For the next several months and without precluding the possibility of a correction, our opinions is that given the positive developments capital could be re-allocated to recent winners especially if they show some price weakness.