Welcome to our monthly newsletter which covers key developments in non-US markets. With this newsletter, we highlight corporate, debt, and monetary policy news in European, Asian, and Latin American markets. We end this piece with a spotlight on commodities.

European Markets

Corporate and Business News

- Tariff turmoil casts a shadow over European banks’ 2025 earnings potential. HSBC, for instance, took a $150 million hit due to increased economic uncertainty, while Deutsche Bank added $80 million to its provisions in the first quarter specifically to reflect concerns over tariffs and the macroeconomic outlook.

- European corporate profits are projected to fall 3% in Q1, largely due to tariff-related disruptions.

- Volkswagen Group’s EV sales more than doubled in Europe in Q1 but declined by over 30% in China, reflecting contrasting regional performance.

- Tesla’s new vehicle sales in Europe fell 28.2% in March year-over-year, despite a 23.6% increase in overall battery electric vehicle sales.

- European companies reassess cloud provider strategies amid intensifying trade tensions. European cloud service providers such as Exoscale and Elastx have reported a surge in interest from businesses looking to move away from US hyperscalers.

- Germany’s private sector activity contracted in April, as indicated by the German flash composite Purchasing Managers’ Index (PMI), which fell to 49.7 from 51.3 in March, driven by service sector weakness and trade-related uncertainty. Despite this, the manufacturing sector showed some resilience, growing for the second consecutive month, with a PMI reading of 51.6.

- German producer prices fell 0.2% year-over-year in March, while wholesale prices rose 1.3% and building permits declined by over 2% in February. German investor sentiment drops to its lowest level since the start of the Ukraine war, with inflation surpassing the ECB’s 2% year-over-year target.

Debt and Monetary Policy News

- The European Central Bank (ECB) cut interest rates for the seventh time in a year, lowering key interest rates by 25 basis points. The central bank gave little guidance on future moves, cautioning that erratic U.S. trade policy could hamper growth and increase economic volatility.

- ECB policymaker Peter Kazimir noted the bank may reach its 2% inflation target within months, but the broader economic outlook remains too uncertain to signal the next policy step.

- The ECB anticipates a significant easing of wage growth in 2025. The central bank’s tracker shows that wage growth, including one-off payments, is expected to decrease from 4.8% in 2024 to 3.1% in 2025.

- The ECB warned that the fragmented structure of the EU banking sector makes it vulnerable to financial shocks. The ECB’s supervisory priorities for 2025-27 focus on strengthening banks’ ability to withstand such shocks.

- The Swiss National Bank reported a Q1 profit of $8.08 billion, driven by a surge in gold prices that offset losses from a stronger Swiss franc and weaker equity markets.

Asian Markets

Corporate and Business News

- India recorded a trade deficit of $99.2 billion with China in the 2024/25 fiscal year ending in March, driven by a surge in imports of electronics and consumer durables.

- Advanced Micro Devices expects to incur charges of up to $800 million due to new Trump administration restrictions on exporting advanced processors to China.

- The Trump administration is considering penalties to block China’s DeepSeek from acquiring U.S. technology and may restrict American access to its services.

- China’s automobile exports reached 1.54 million units in Q1, up 16% year-over-year, including 570,000 units exported in March alone.

- BYD’s first-quarter profit soared 100.4% from a year earlier, the fastest growth in nearly two years, as the EV giant extended its lead in China amid an ongoing price war.

- Alibaba Group launched Qwen 3, an upgraded AI model featuring new hybrid reasoning capabilities, amid intensifying competition in China’s tech sector.

- Nomura will acquire Macquarie’s U.S. and European asset management units for $1.8 billion.

- Nissan Motor expects a record net loss of $4.91 billion to $5.26 billion for the fiscal year ending in March, citing impairment charges linked to its ongoing restructuring.

Debt and Monetary Policy News

- UBS has downgraded its 2025 China GDP growth forecast to 3.4%, assuming that tariff hikes between China and the United States will remain and that Beijing will implement additional stimulus measures.

- China’s fiscal revenue decline slowed in Q1, with revenue totaling $821.54 billion from January to March, down 1.1% year-over-year, an improvement from the 1.6% decline observed in the first two months of 2025.

- Asian bonds saw the largest foreign inflows in seven months in March, totaling a net purchase of $7.16 billion, driven by expectations of rate cuts from regional central banks and concerns over U.S. tariffs. Specific countries like South Korea, India, Indonesia, Malaysia, and Thailand saw notable inflows, with South Korean bonds alone attracting $3.99 billion.

- The International Monetary Fund lowered its economic growth forecast for Japan from 1.1% to 0.6%, predicting that the central bank will raise interest rates more slowly than expected due to the impact of higher U.S. tariffs.

- Core inflation in Japan’s capital accelerated to a two-year high in April, rising 3.4% due to surging food prices, exceeding the forecasted 3.2% increase.

Latin American Markets

Corporate and Business News

- Hyundai Motor has launched a task force to address U.S. tariffs, noting that production of some Tucson crossovers has been shifted from Mexico to the United States.

- Brazilian airline Voepass has filed for bankruptcy protection, citing actions by Chile-based LATAM Airlines as a major factor in its financial crisis. Meanwhile, Gol has postponed the deadline for investors to review proposals for a $1.9 billion financing due to the volatility created by tariffs.

- Embraer reported that its order backlog reached $26.4 billion at the end of the quarter through March, marking a 25% increase from the previous year, according to a securities filing.

- Brazil’s 2025/26 coffee crop is forecast to decline by 3% to 6.4% compared to the previous cycle, primarily due to dry weather in 2024. Rabobank projects a 6.4% drop, estimating the coffee output at 62.8 million 60-kilogram bags, down from 67.1 million bags in 2024/25.

- Carrefour Brazil’s gross sales, including fuel, totaled $4.93 billion in the first quarter, a 3.6% increase compared to the previous year.

- Brazilian reforestation startup Mombak has raised $30 million in a funding round led by Union Square Ventures.

Debt and Monetary Policy News

- Brazil’s central bank has kept the size of its upcoming interest rate hike in May open, citing an uncertain economic outlook that prevents a clear assessment.

- Brazil’s central bank will begin auctions on April 28th to roll over $18.4 billion in traditional currency swaps expiring on June 2nd.

- The World Bank has lowered its 2025 economic growth forecast for Latin America and the Caribbean to 2.1%, down from its January forecast of 2.5%.

- Argentina’s economic activity rose 5.7% in February compared to the same month last year, marking its fourth consecutive month of year-on-year growth.

- The Mexican peso strengthened nearly 1% in international trading following a phone call between U.S. President Donald Trump and Mexican counterpart Claudia Sheinbaum, both calling it “very productive.”

- Peru’s economy grew 2.68% in February, falling short of estimates despite growth across most sectors.

- The International Monetary Fund’s board approved a 48-month, $20 billion extended fund facility arrangement for Argentina, with an immediate disbursement of $12 billion.

Commodities Spotlight

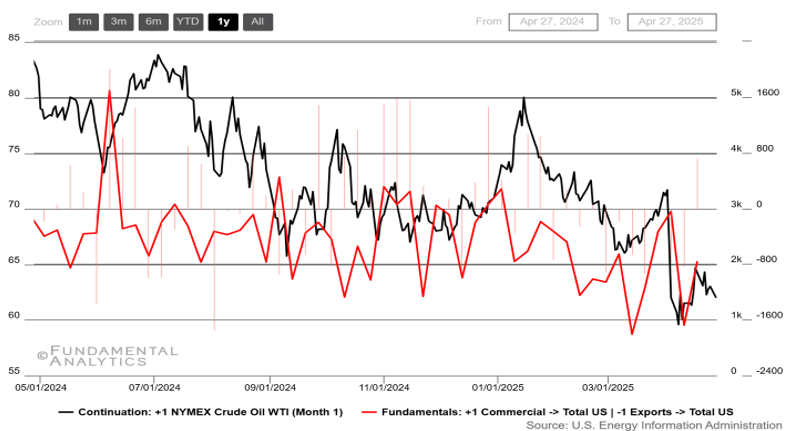

Net Imports in Crude Oil are Falling Amid US-China Tensions

Source: Fundamental Analytics

WTI crude oil futures dropped below $62 per barrel, reaching a two-week low, as global trade tensions and weak U.S. economic data dampened the demand outlook. Crude is on track for its steepest monthly decline since 2021, down 15% in April, as concerns rise that President Trump’s escalating tariffs could push the global economy into recession. U.S. consumer confidence also slumped, adding to signs of economic strain. Meanwhile, OPEC+ may accelerate its planned output hikes at its May 5th meeting, with Saudi Arabia and other members expected to boost supply.

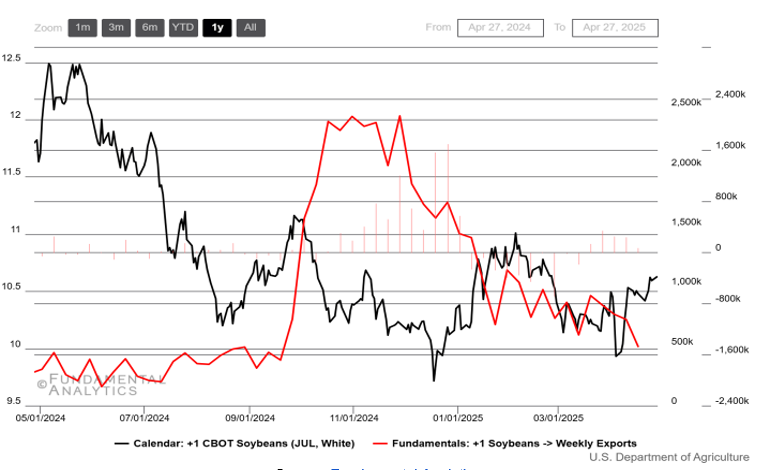

Soybean Prices Reach 2-Month High Driven by Strong Year-on-Year Seasonal Exports

Source: Fundamental Analytics

Soybean futures advanced above $10.40 per bushel, a level not seen since late February, driven by technical buying amid concerns over a slowing economy and ongoing U.S.-China trade tensions. USDA data revealed that China has halted U.S. soybean and corn imports since mid-January, opting for Brazilian supplies instead. Additionally, weather disruptions in Argentina have raised concerns, with dry conditions potentially impacting the development of 40% of the country’s double-cropped soybeans, according to Commodity Weather Group. Meanwhile, the U.S. weather outlook calls for widespread rain that could delay soybean planting after some progress was made last week. As of April 20th, the USDA reported that 8% of the U.S. soybean crop had been planted, surpassing both the 7% market estimate and the five-year average of 5%.