US Equity Markets

- President Trump’s aggressive tariff policies and rhetoric, especially towards China and the EU, are major drivers of continued market uncertainty and volatility over the past two weeks. This is evidenced by the elevated VIX (hitting a high of over 53 on April 8th), and the unusual divergence between the Dow’s significant drop (due to UnitedHealth’s earnings miss) and the S&P 500’s concurrent gain on April 17th.

- The S&P 500 triggered a “death cross” for the first time in 3 years, a bearish technical signal where the 50-day moving average crosses below the 200-day moving average, potentially signaling further short-term weakness. Having said that, too many pessimistic signals might serve a contrarian purpose for an upswing (even temporarily) in the next few weeks.

- Growing concerns about a potential recession are prompting some investors to seek safer assets, as seen in the increased holdings of gold (which hit an all-time peak of over $3,400.40 per oz this morning). Economic indicators like rising continuing jobless claims and warnings from Fed Chair Powell about the impact of tariffs on growth and inflation (not just an one-time price increase) contribute to these worries.

- Market volatility is expected to continue over the next few weeks, especially relating to trade policy announcements and economic data releases. Earnings reports along with progress on trade negotiations will be closely watched for further insights into corporate and trade progress performance in this challenging environment. That, coupled with the uncertainty between the US-China trade relationship suggest a continuous cautious outlook for equities, especially in the US.

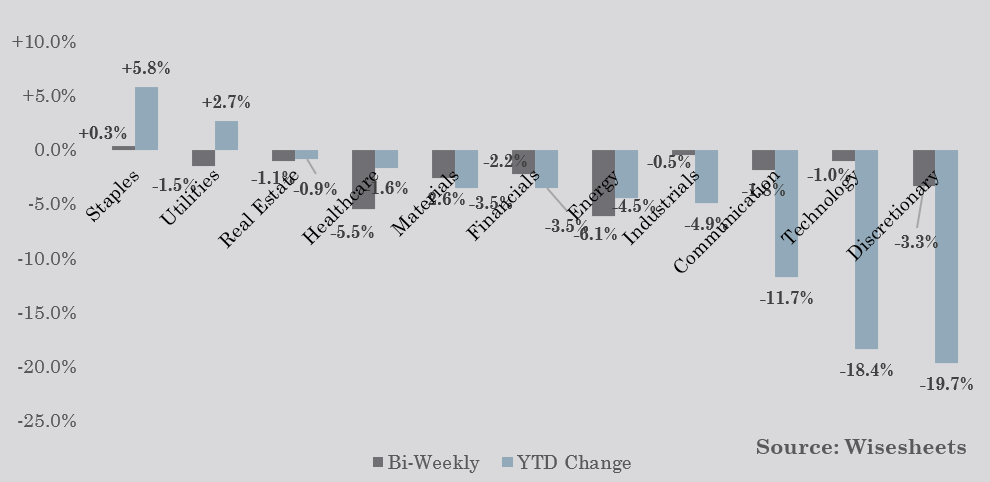

S&P 500 Sectors Bi-Weekly / YTD Performance

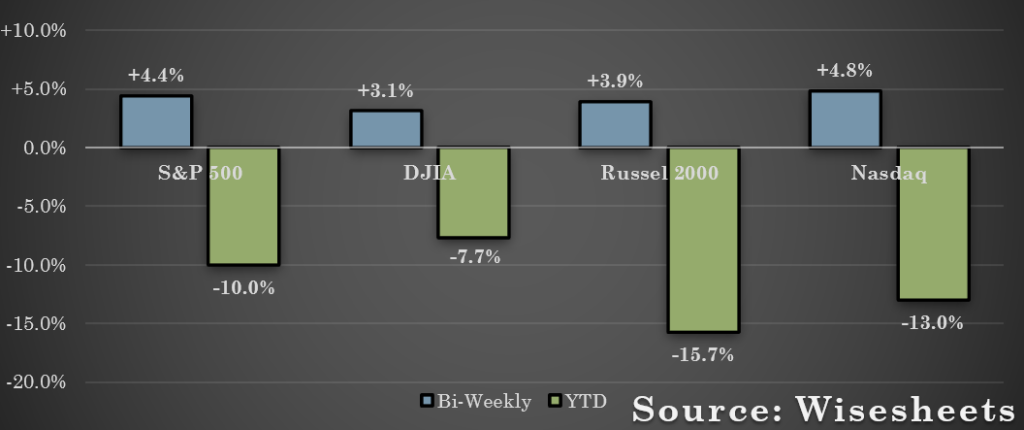

US Equities Indices

US Equity Markets

| Index | Close | Bi-Weekly Change | YTD Performance |

|---|---|---|---|

| S&P 500 | 5,283 | +4.4% | -10% |

| DJIA | 39,140 | +3.1% | -7.7% |

| Russel 2000 | 1,881 | +3.9% | -15.7% |

| Nasdaq 100 | 18,262 | +4.8% | -13% |

Bond Markets

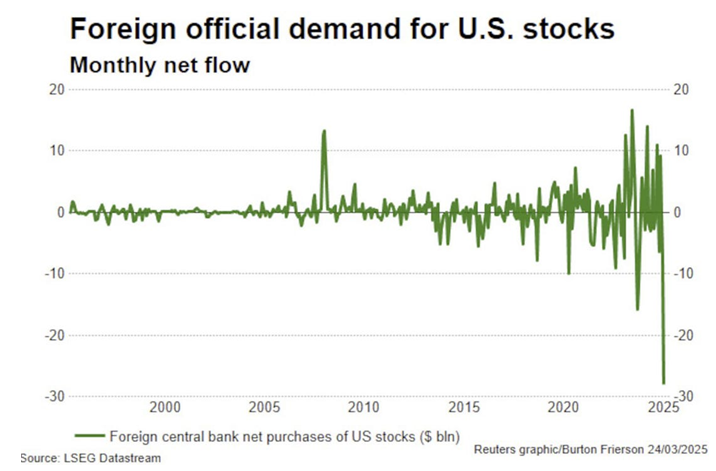

- Trump’s tariff policies are contributing to a rise in long-term US Treasury bond yields, pointing to investor concerns about inflationary uncertainty, as well as the preempting of fears and an environment of exodus from US assets.

- In contrast to the US, German 10yr bund yields have dipped, reflecting mounting investor concern about trade shocks, decreasing inflation in the eurozone, prompting flight to the relative safety of German government bonds.

- The Bloomberg Dollar Index’s sharp divergence from behavior predicted by interest rate differentials (the dollar’s performance is not behaving as expected based on interest rate differences between the US and other markets), along with rising US Treasury yields, raises concerns about eroding foreign confidence in US fiscal stability and trade policy, which may be leading to the beginning of a significant capital outflow from US assets.

- Warning signs in the bond market include a significant surge in junk bond capitulation and a record outflow from loan ETFs, signaling potential fragility in debt markets. It’s interesting also to note that the spreads between high yield bonds and Treasuries is rising, which signals the same fears on top of recessionary fears.

- Bond markets should also expect continued volatility influenced by – akin to equity markets – trade policy and economic data. Rising US yields may persist due to tariff-related concerns, and European bond markets, including German bunds and UK gilts, could see continued demand as investors seek safe assets in rising currencies amid economic and trade uncertainties. The potential for decreased foreign demand for US Treasuries remains a key risk to look out for.

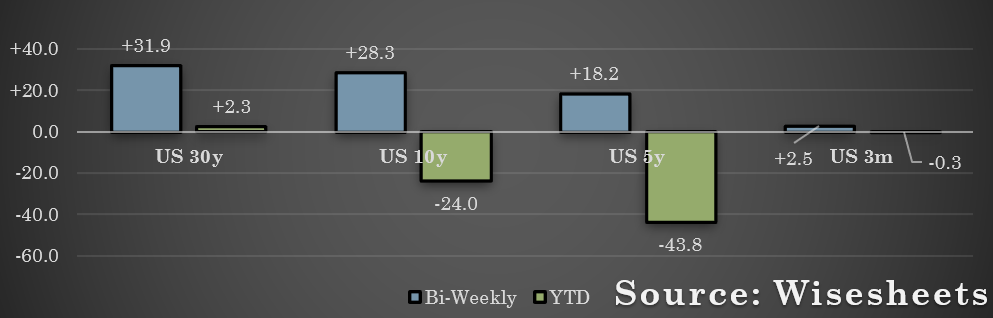

US Treasuries

US Treasuries

| Maturity | Close | Bi-Weekly Change in Yield (in bps) | YTD Change in Yield (in bps) |

|---|---|---|---|

| US 30y | 4.809% | +31.9 | +2.3 |

| US 10y | 4.333% | +28.3 | -24.0 |

| US 5y | 3.942% | +18.2 | -43.8 |

| US 3m | 4.205% | +2.5 | -0.3 |

FX Currency Markets

- The US dollar is facing downward pressure as recent economic data has been mixed, and ongoing concerns about Trump’s tariffs are weighing on investor sentiment and raising questions about growth and stability. This is reflected by the dollar index hovering near multi-month lows against a basket of major currencies.

- Following the European Central Bank’s widely anticipated interest rate cut of 25 basis points last week, the euro not only didn’t move but actually strengthen since then. The Japanese yen has seen some strengthening as investors seek safe-haven assets amid prevailing uncertainty. Meanwhile. the British pound is currently consolidating against the USD after a period of recent gains.

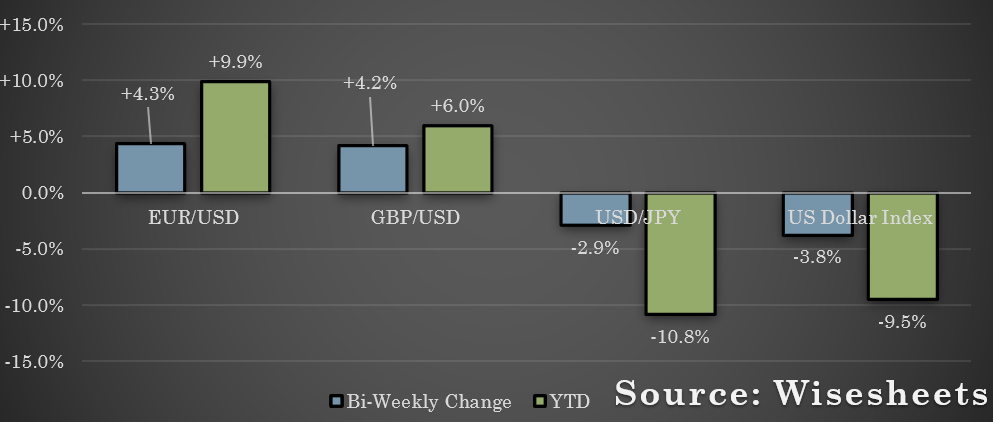

Foreign Exchange Currencies

FX Currency Markets

| Currency Pair | Close | Bi-Weekly Change | YTD Change |

|---|---|---|---|

| EUR/USD | 1.1372 | +4.3% | +9.9% |

| GBP/USD | 1.3265 | +4.2% | +6.0% |

| USD/JPY | 142.38 | -2.9% | -10.8% |

| US Dollar Index | 99.442 | -3.8% | -9.5% |

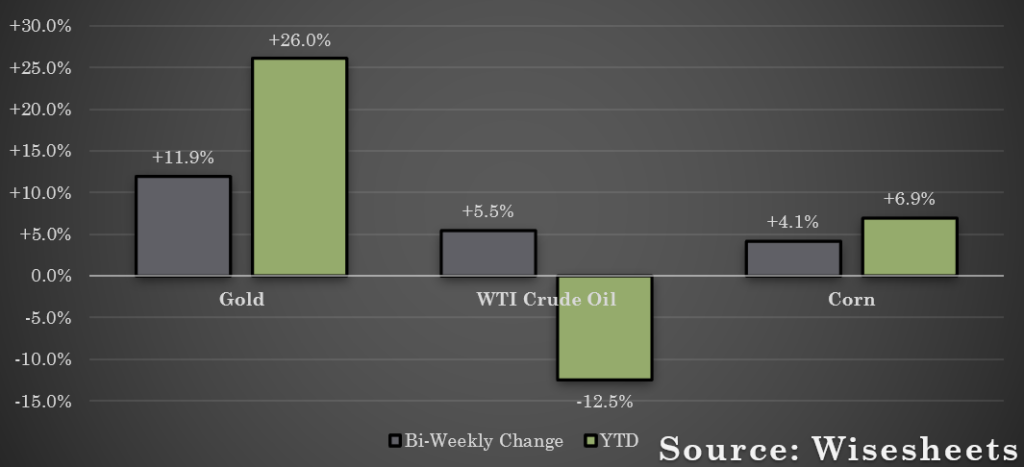

Commodities (Energy, Grain, Metals)

- Oil prices have climbed, supported by hopes for a trade deal between the US and the EU, as well as new US sanctions against Iran.

- The price of copper relative to gold hit a 38-year low. This ratio is often seen as an indicator of economic health, with weaker copper prices suggesting concerns about industrial activity and economic growth.

- Gold prices extended their surge to cross another record high as the increasing unpredictability regarding US trade policy and low demand for the US dollar and Treasury securities left gold as one of the main safe-haven assets in the market.

- Trump’s tariffs on solar modules, steel, aluminum, and other materials are expected to increase costs for the clean energy sector. The suspension of EV charging grants also signals a potential slowdown in the adoption of electric vehicles, which could impact demand for battery metals like lithium and cobalt in the long-term.

- Corn prices remain near their highest level since February 18th, after posting their strongest bi-weekly gain since May 2023. The rally was driven by President Trump’s decision to pause some planned tariff hikes, a tighter U.S. supply outlook from the USDA, and a sharply weaker dollar amid escalating U.S.-China trade tensions.

Commodities

Commodities

| Commodity | Close | Bi-Weekly Change | YTD Performance |

|---|---|---|---|

| Gold ($/oz) | $3,341.3 | +11.9% | +26.03% |

| WTI($/barrel) | $64.68 | +5.5% | -12.5% |

| Corn ($/bushel) | $4.82 | +4.1% | +6.9% |

International Markets Data

European Equity Markets

| Index | Close | Bi-Weekly Change | 2025 YTD Performance |

|---|---|---|---|

| Eurozone (STOXX 600) | 506 | -3.2% | -0.2% |

| United Kingdom (FTSE) | 8,276 | -2.3% | +1.3% |

| France (CAC 40) | 7,286 | -4.1% | -1.3% |

| Germany (DAX) | 21,206 | -2.4% | +6.5% |

European Government Yields

| Yield | Close | Bi-Weekly Change (in bps) | YTD Change (in bps) |

|---|---|---|---|

| German 1yr | 1.75% | -16.5 | -47.6 |

| French 1yr | 1.98% | -8.9 | -36.7 |

| UK 1yr | 3.75% | -11.0 | -86.9 |

| German 10 yr | 2.48% | -10.4 | +11.7 |

| UK 10yr | 4.57% | +11.7 | +0.2 |

| French 10yr | 3.24% | -9.2 | +4.7 |

Asian Markets

| Index | Close | Bi-Weekly Change | 2025 YTD Performance |

|---|---|---|---|

| China (SSE) | 3,276 | -1.85% | -2.13% |

| Japan (Nikkei 225) | 34,378 | -1.03% | -13.83% |

| India (Nifty 50) | 23,852 | +2.59% | +0.87% |

Asian Government Yields

| Yield | Close | Bi-Weekly Change (in bps) | 2025 YTD Change (in bps) |

|---|---|---|---|

| China 1Y | 1.42% | -4.7 | +40.2 |

| India 1Y | 6.13% | -24.8 | -54.2 |

| Japan 1Y | 0.52% | +1.1 | +9.3 |

| China 10Y | 1.65% | -13.5 | +4.0 |

| Japan 10Y | 1.31% | +15.6 | +21.9 |

| India 10Y | 6.38% | -8.7 | -43.9 |

Interconnections Across Markets

As tariffs erode the competitiveness of US companies and stoke fears of an economic slowdown, international investors are increasingly hesitant to hold US equities, triggering sell-offs and contributing to the observed market volatility. This decreased appetite for US stocks isn’t isolated; it appears to be symptomatic of a broader erosion of trust in US assets. In the bond market, this waning confidence can manifest as a reluctance to buy US Treasuries, potentially contributing to the unusual divergence where the dollar weakens despite rising yields, as investors seek safer havens or perceive increased risk in holding dollar-denominated debt. The FX market reflects this sentiment with a potentially weakening dollar, not behaving as predicted by interest rate differentials, suggesting potential forthcoming capital flight as foreign investors move their funds out of US assets. Even commodities are indirectly affected, as trade disputes create uncertainty about global demand and supply chains, impacting prices of industrial metals and energy. The broader story emerging from these interconnected movements points towards a concerning trend: a loss of international faith in the institutional stability and predictability of the US economic and policy environment, potentially foretelling a challenging period ahead for not only US financial markets across all sectors, but also for the geoeconomic order that has been functioning since the end of the second world war.