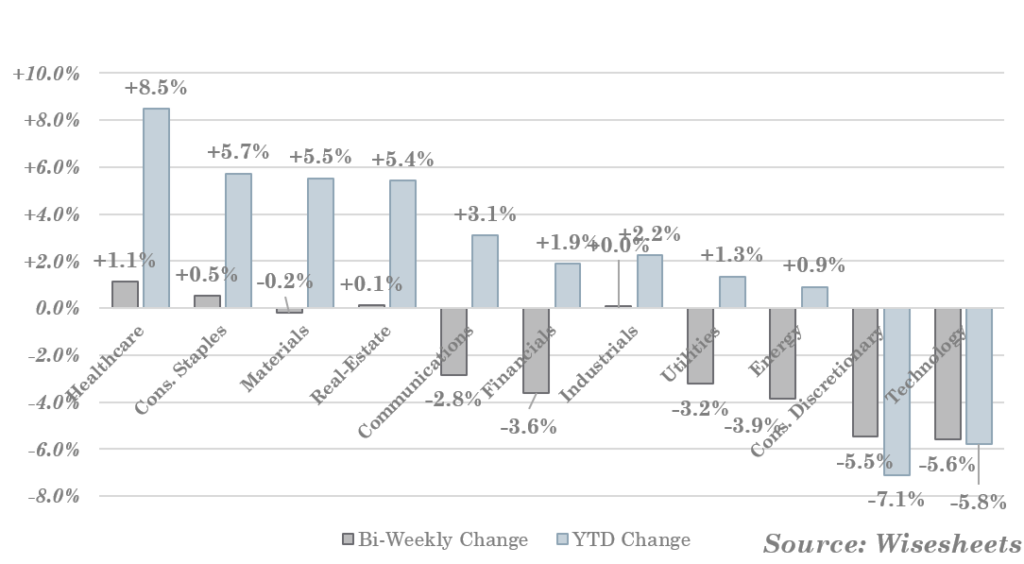

US Equity Markets

- Last week US markets saw the worst week of 2025 as investors remain cautious amid escalating concerns over trade policy uncertainty stemming from policy announcements from the Trump administration.

- Despite the announcement of one-month tariff exemptions on multiple goods for Mexico and Canada, US equities still suffered over concerns over economic growth and global trade tensions weighed on sentiment.

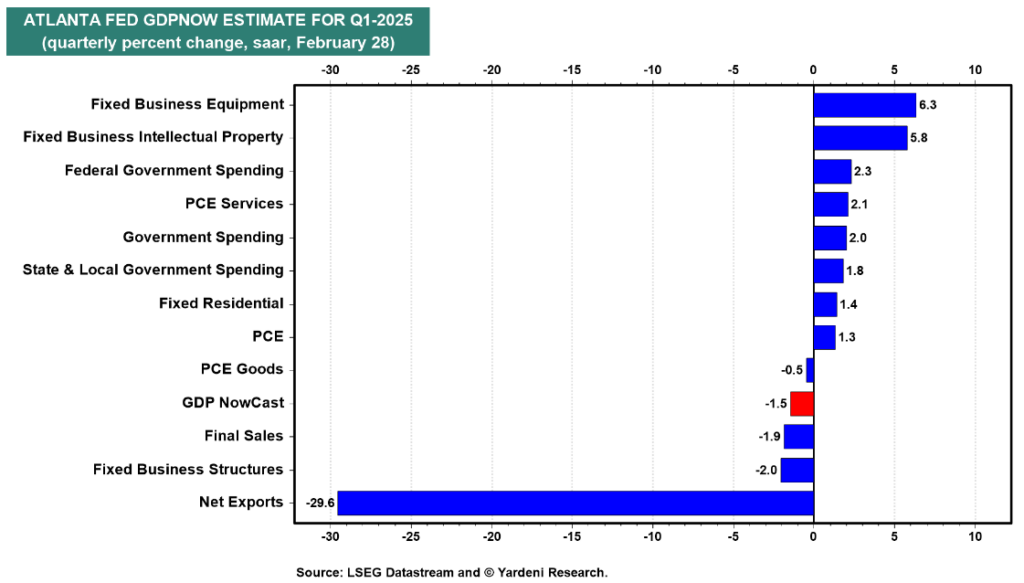

- The Atlanta Fed’s GDP forecast painted a gloomy picture of US growth, lowering its Q1 GDP forecast significantly. This drop was largely attributed to a surge in imported goods in January.

S&P 500 Sectors Bi-Weekly / YTD Performance

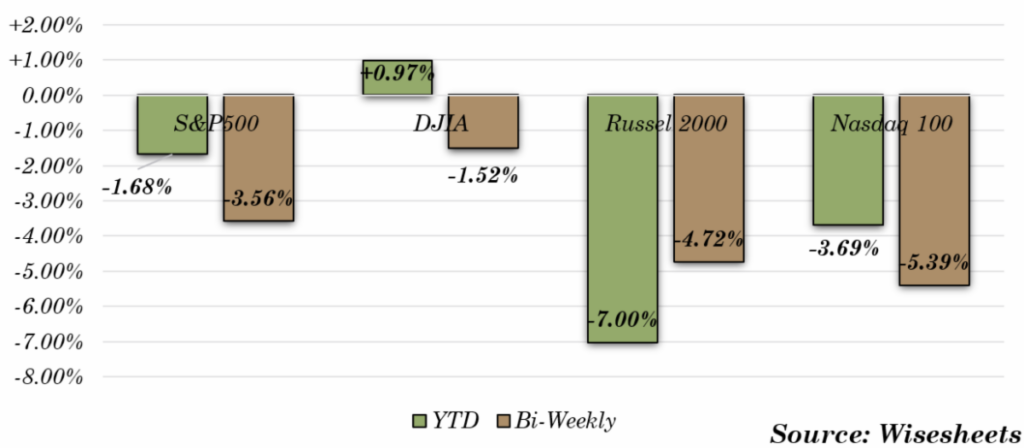

US Equities Indices

US Equity Markets

February 24, 2025 – March 7, 2025

| Index | Close | Bi-Weekly Change | YTD Performance |

|---|---|---|---|

| S&P 500 | 5,770.19 | -3.56% | -1.68% |

| DJIA | 42,801.73 | -1.52% | +0.97% |

| Russel 2000 | 2,075.48 | -4.72% | -7.00% |

| Nasdaq 100 | 20,201.37 | -5.39% | -3.69% |

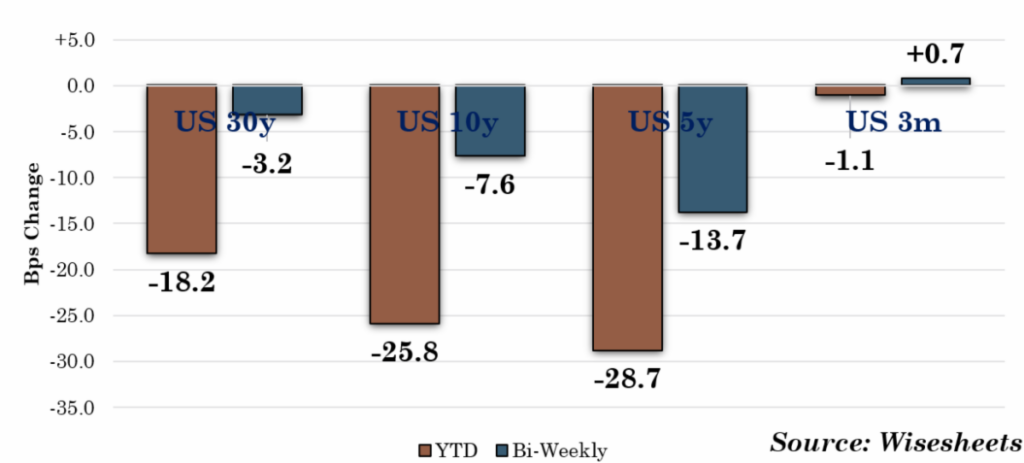

Bond Markets

- Fed Chair Powell acknowledged the uncertainty surrounding the economic outlook but indicated there is no immediate need to adjust policy. Following his remarks, yields edged higher, even though they had declined during the previous days, as investors digested February’s weaker-than-expected jobs report – which had increased expectations for potential rate cuts later this year.

- The bond market remains trapped between signs of an economic slowdown, which would typically lower yields, and sticky inflation, which might prompt the Fed to maintain higher interest rates for an extended period.

- As yields drop, Treasury prices rise, making bonds attractive assets to park funds.

- In addition, traders are now fully pricing in two-three quarter-point (potentially reaching a total of 75 bps) rate cuts by the Fed during the remaining months in 2025.

US Treasuries

US Treasuries

February 24, 2025 – March 7, 2025

| Maturity | Close | Bi-Weekly Change in Yield (in bps) | YTD Change in Yield |

|---|---|---|---|

| US 30y | 4.616% | -3.2 | -18.2 |

| US 10y | 4.317% | -7.6 | -25.8 |

| US 5y | 4.093% | -13.7 | -28.7 |

| US 3m | 4.197% | +0.7 | -1.1 |

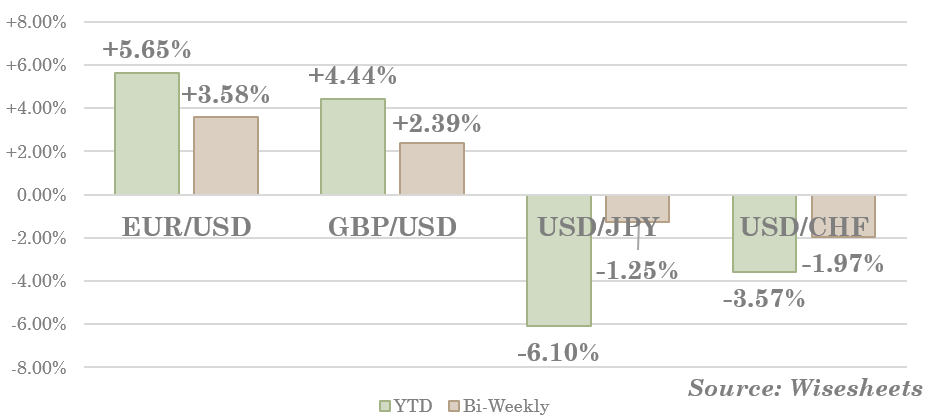

FX Currency Markets

- The euro strengthened further against the USD and reached a fresh four-month high after the ECB delivered a widely expected 25bps rate cut and acknowledged that monetary policy is becoming less restrictive, suggesting a potential pause in further rate cuts. While such a cut should have exercised downward pressure on the euro, the latter actually gained ground. The reason for that gain is threefold: Europe is attracting capital; US policy uncertainty pressures the dollar down; tariffs, fiscal, and Fed policy may be weakening the dollar.

- The British pound rose above $1.28, its highest level since November 12, driven by a USD sell-off along with expectations that UK interest rates will stay higher for longer, with traders reducing bets on BoE rate cuts to 52 basis points for 2025.

- The Japanese yen traded near 148 per dollar on Thursday, staying close to its strongest levels in five months, as the BoJ suggested that interest rates could be raised higher if economic forecasts are met, emphasizing that the exit from its extensive monetary easing program is just beginning.

Foreign Exchange Currencies

FX Currency Markets

February 24, 2025 – March 7, 2025

| Currency Pair | Close | Bi-Weekly Change | YTD Change |

|---|---|---|---|

| EUR/USD | 1.08405 | +3.58% | +5.65% |

| GBP/USD | 1.29238 | +2.39% | +4.44% |

| USD/JPY | 147.91 | -1.25% | -6.10% |

| USD/CHF | 0.87964 | -1.97% | -3.57% |

Commodities (Energy, Grain, Metals)

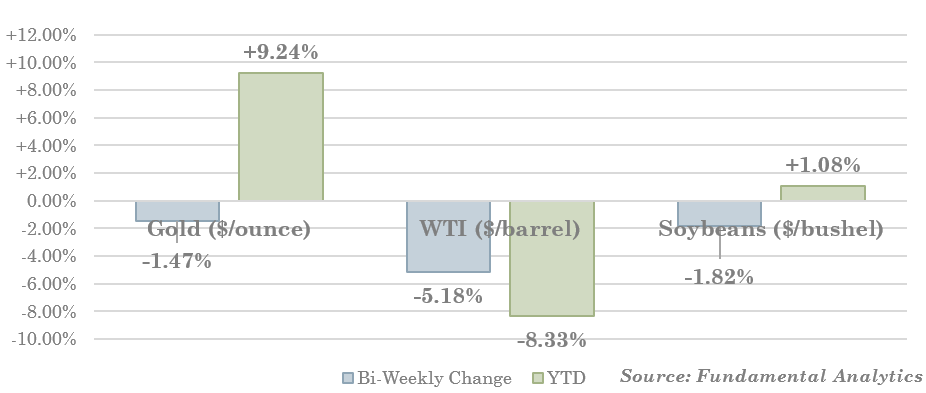

- Gold closed slightly above $2,900, pressing the brake from a multi-week rally, but remains in ATH levels, supported by a weaker US dollar and safe-haven demand amid geoeconomic uncertainty.

- WTI fell to around $66, as supply increases from OPEC+ and escalating trade tensions weighed on sentiment.

- Soybean futures dropped close to $10.00 per bushel, touching a 1-month-low, as China’s retaliatory tariffs on US agricultural products raised concerns over trade disruptions.

Commodities

Commodities

February 24, 2025 – March 7, 2025

| Commodity | Close | Bi-Weekly Change | YTD Performance |

|---|---|---|---|

| Gold($/ounce) | $2,904.70 | -1.47% | +9.24% |

| WTI($/barrel) | $67.04 | -5.18% | -8.33% |

| Soybeans($/bushel) | $10.10 | -1.82% | +1.08% |

Interconnections Across Markets

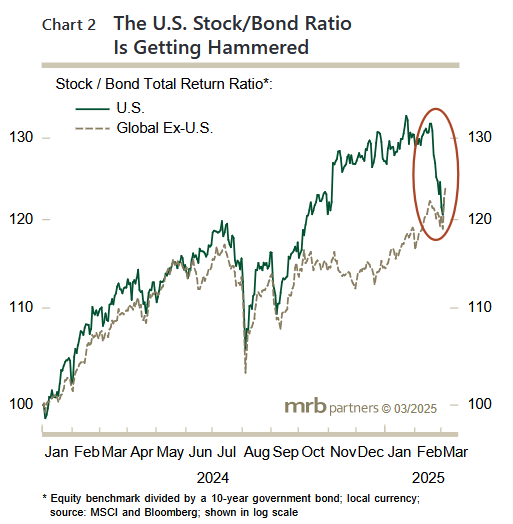

The US stock/bond ratio has fallen in recent weeks as equities have sold off. Investors’ flight to quality is another sign of falling sentiment in stocks, due broader market concerns (such as worries over tariffs, economic slowdown, and political uncertainty). This, coupled with mixed signals about economic growth from the Fed, makes for a muddled outlook for the US in 2025.

Source: MRB Partners

The Atlanta Fed’s Q1 GDPNow model fell from 2.3% to -1.5%, which contributed to concerns about the US economy. However, some analysts don’t believe that it necessarily means a slowdown is around the corner. First, imports rose in January (due to importers getting ahead of potential tariff increases), causing the trade deficit to widen 70% y/y, which weighed on GDP growth. Second, consumption in January was weak, as the US saw the coldest January since 2011. Analysts at Yardeni Research expect consumption to rebound while imports weaken in Feb and March.

Source: Yardeni Research

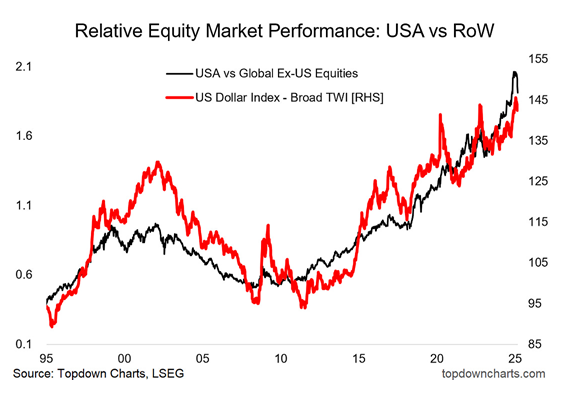

There is a rotation out of US equities to international stocks due to economic and policy fears in the US, as well as due to relative overpricing of US equities. Investing in international stocks carries additional gain when the dollar loses ground (as it does currently) against foreign currencies, as repatriated dollars can be bought cheaper.

Source: Weekly S&P500 ChartStorm