US Equity Markets

- President Trump’s aggressive global tariffs, imposed across virtually all the United States’ major trading partners, have ignited fears of a full-blown trade war and potential global recession. The tariffs could raise prices, invite retaliation, slow down the growth rate, decrease earnings, and create a downward spiral that could shake up trade and investments.

- Economists and analysts are increasingly predicting a recession, with some raising the probability to more than 50%.

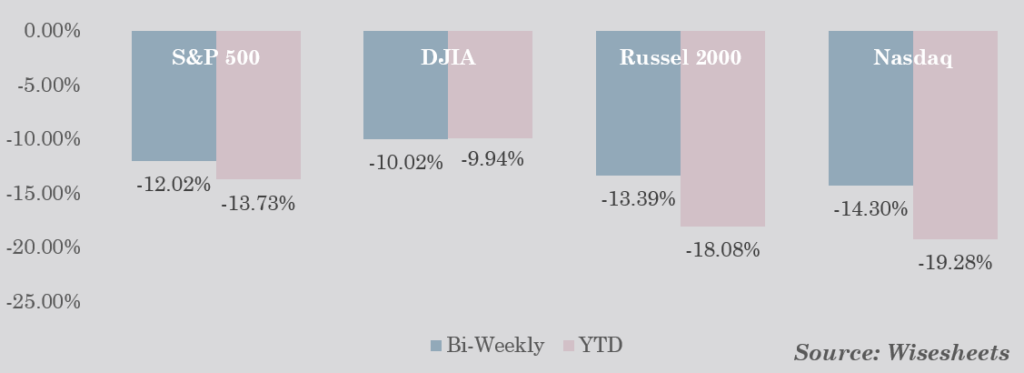

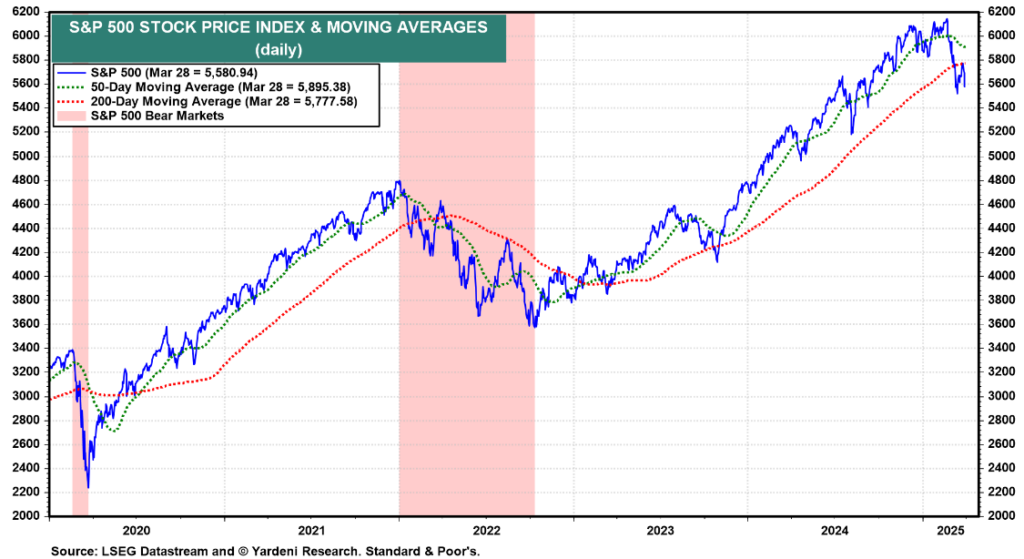

- In response, the stock market has experienced dramatic declines, with the S&P 500 (down -13.54% YTD), Dow Jones (down -9.62% YTD), and Nasdaq (down -19.15% YTD), all suffering significant losses. The CBOE’s Volatility Index (VIX) is up over +88% for the week starting March 31.

- Meanwhile, the core PCE price index rose +2.8% y/y in February, surpassing forecasts, while consumer spending grew 0.4% over the same period

- The short-term outlook for US as well as for global equity markets is not positive, with volatility likely extending into this and possibly next week, as governments and investors continue grappling with the implications of Trump’s tariffs, especially if Trump imposes new tariffs on China as he threatened to do today. While the market has experienced significant declines and some technical indicators might suggest oversold conditions, any short-term bounces are likely to be met with renewed selling pressure as fundamental concerns around trade and the economy persist. Per our commentary before the announcement of the tariffs we still believe that the S&P 500 may find a bottom at 4765 without recession (reflecting the long-term 200-week average plus the long-term S&P 500 dividend yield, see related comment under FX section).

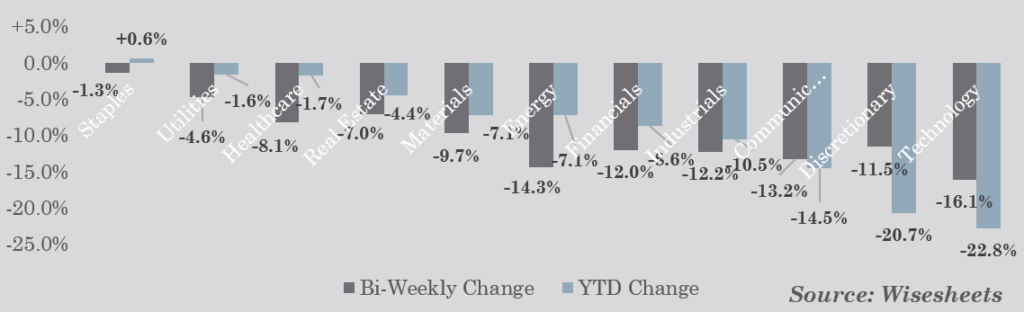

S&P 500 Sectors Bi-Weekly / YTD Performance

US Equities Indices

US Equity Markets

March 24, 2025 – April 4, 2025

| Index | Close | Bi-Weekly Change | YTD Performance |

|---|---|---|---|

| S&P 500 | 5,074 | -12.02% | -13.73% |

| DJIA | 38,315 | -10.02% | -9.94% |

| Russel 2000 | 1,827 | -13.39% | -18.08% |

| Nasdaq 100 | 15,588 | -14.30% | -19.28% |

Bond Markets

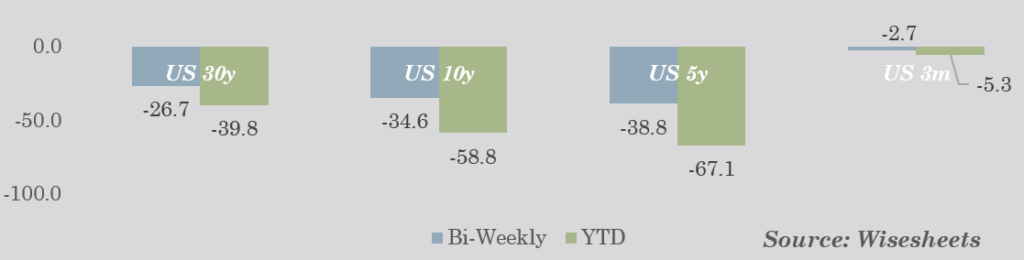

- The 10YR Treasury yield has fallen to its lowest level in 2025 so far, as demand rises from investors seeking the safety of government bonds amidst market chaos, sending prices up and yields down. The lower rates on the 10-year Treasury are a clear sign of economic slowdown and reflect the concerns about an impending recession.

- Investors have not only shifted towards defensive portfolio strategies (Treasuries and gold), but they have also made a move away from US equities towards international equity funds and money market funds. This reflects a growing concern about the risks associated with US equities in the current geoeconomic client, as well concerns that the dollar will take a hit.

- Furthermore, Fed Chair Powell warned that tariffs could have a greater-than-expected economic impact and stressed the need to prevent inflation, with markets now pricing in at least two-three 25bps rate cuts this year.

US Treasuries

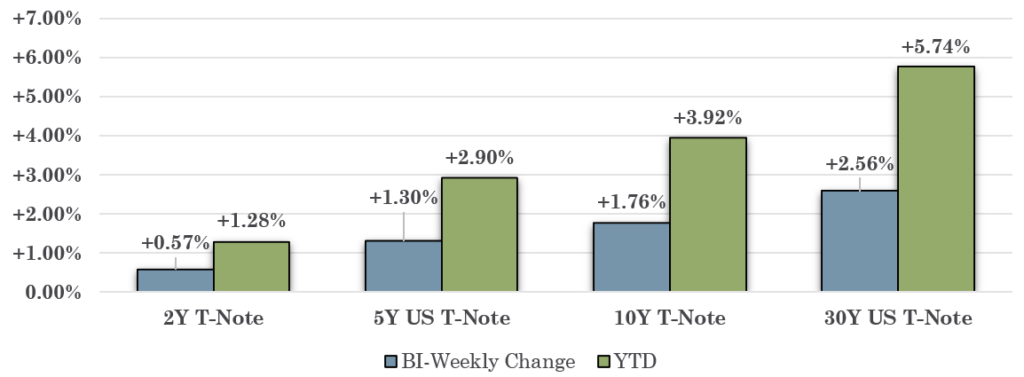

US T-Notes

US Treasuries

March 24, 2025 – April 4, 2025

| Maturity | Close | Bi-Weekly Change in Yield (in bps) | YTD Change in Yield |

|---|---|---|---|

| US 30y | 4.388% | -26.7 | -39.8 |

| US 10y | 3.985% | -34.6 | -58.8 |

| US 5y | 3.709% | -38.8 | -67.1 |

| US 3m | 4.155% | -2.7 | -5.3 |

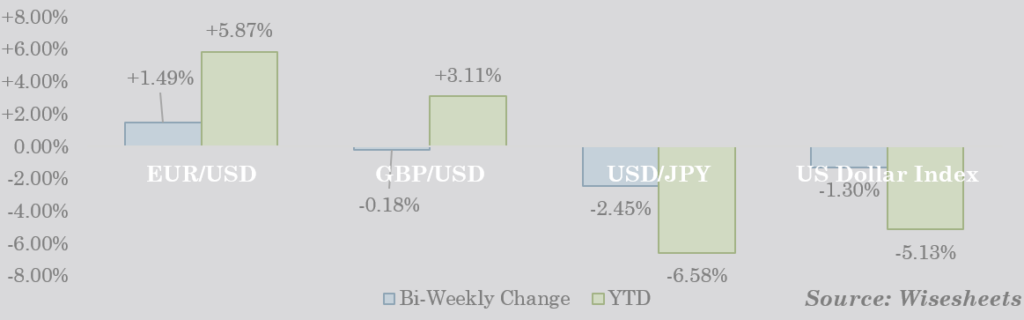

FX Currency Markets

- The US dollar has significantly weakened, trading near its lowest levels in six months (Dollar Index around 103), primarily driven by growing investor anxiety over the negative economic impact of President Trump’s sweeping tariff policy and an increased probability of a US recession. This unusual dollar weakness, contrary to typical tariff reactions, suggests markets believe the US economy is particularly vulnerable, and may reflect early capital outflows from the US which may intensify in the future. If that were to happen equity markets may decline even more and beyond the 4765 support level even if recession doesn’t occur. If a recession takes place the support level could be significantly lower than 4765.

- The euro has hovered near its strongest level since early October 2024 (around $1.10) as the dollar remains weak and trade war tensions escalate. Despite this relative strength, Europe is also concerned, with France urging companies to pause US investments and the European Commission preparing countermeasures against US tariffs.

- The British pound has fallen below $1.29, pressured by concerns over rising global economic risks stemming from the US tariff policy.

Foreign Exchange Currencies

FX Currency Markets

March 24, 2025 – April 4, 2025

| Currency Pair | Close | Bi-Weekly Change | YTD Change |

|---|---|---|---|

| EUR/USD | 1.096 | +1.49% | +5.87% |

| GBP/USD | 1.290 | -0.18% | +3.11% |

| USD/JPY | 146.960 | -2.45% | -6.58% |

| US Dollar Index | 102.922 | -1.30% | -5.13% |

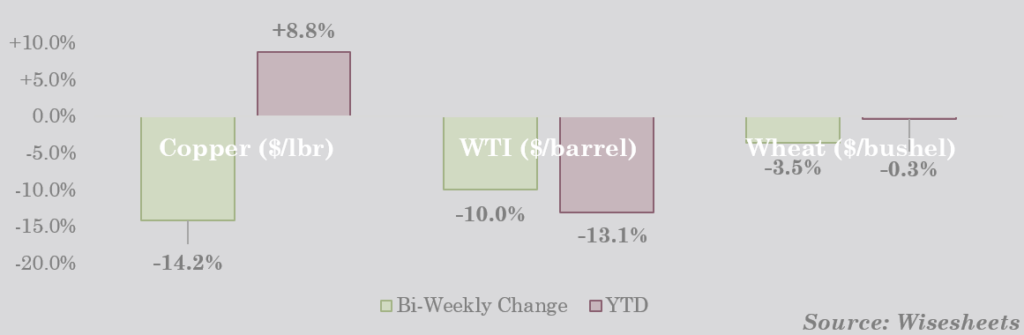

Commodities (Energy, Grain, Metals)

- The Bloomberg Commodity Spot Index fell a substantial 6.8% over April 3 & 4, marking the largest two-day loss since 2011. Worries about a global recession induced by Trump’s tariffs have ignited serious concerns about global economic growth, and thus the demand for raw materials.

- The impact was felt across most commodity sectors, from agriculture, energy (oil was hit also by a decision by OPEC+ to increase output significantly), industrial and precious metals.

- Copper futures dropped over -14% to $4.4 per pound, due to concerns that US tariffs and retaliatory actions from trading partners could lead to a global recession. President Trump announced broad import tariffs, including on major copper-consuming economies such as China (54%), the EU (20%), Japan (24%), and India (27%)

- Even gold, usually a safe-haven asset, took a hit, falling over 2% on April 4. Analysts suggest this is from investors selling off their liquid assets, including gold, to cover losses in other parts of their portfolios as margin calls increase during broader market declines. Still, gold is a safe haven against turmoil and is still significantly up for the year (over +14%), however that play may be getting a bit overcrowded.

- The prevailing sentiment in the commodities market is of concern about a potential global economic slowdown, which would decrease demand for raw materials.

Commodities

Commodities

March 24, 2025 – April 4, 2025

| Commodity | Close | Bi-Weekly Change | YTD Performance |

|---|---|---|---|

| Copper ($/pound) | $4.4 | -14.2% | +8.8% |

| WTI($/barrel) | $62.3 | -10.0% | -13.1% |

| Wheat ($/bushel) | $557.5 | -3.5% | -0.3% |

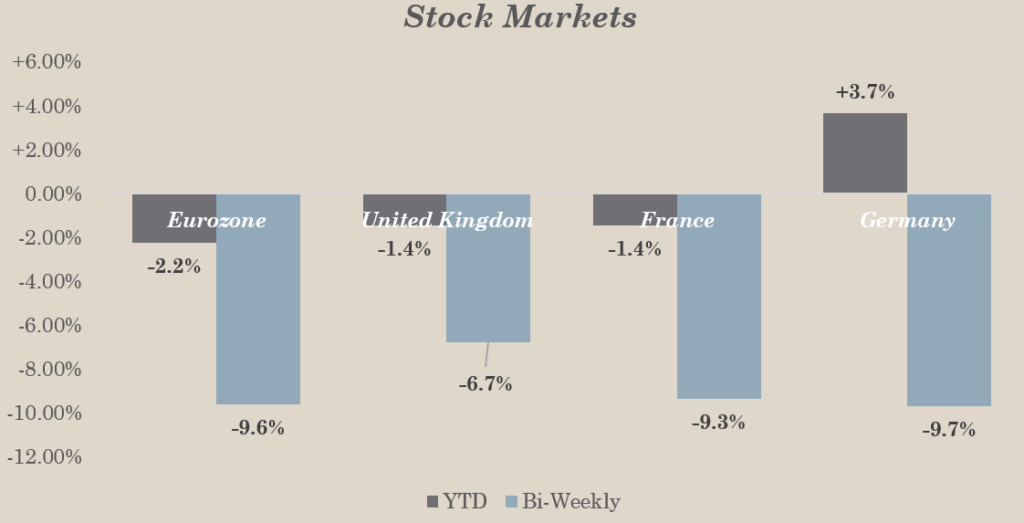

International Markets Data

European Markets

European Equity Markets

March 24, 2025 – April 4, 2025

| Index | Close | Bi-Weekly Change | 2025 YTD Performance |

|---|---|---|---|

| Eurozone (STOXX 600) | 496 | -9.6% | -2.2% |

| United Kingdom (FTSE) | 8,055 | -6.7% | -1.4% |

| France (CAC 40) | 7,275 | -9.3% | -1.4% |

| Germany (DAX) | 20,642 | -9.7% | +3.7% |

Government Yields

March 24, 2025 – April 4, 2025

| Yield | Close | Bi-Weekly Change (in bps) | YTD Change |

|---|---|---|---|

| German 1yr | 1.92% | -13.2 | -31.1 |

| French 1yr | 2.06% | -18.1 | -27.8 |

| UK 1yr | 3.86% | -30.0 | -75.9 |

| German 10 yr | 2.58% | -17.9 | +22.1 |

| UK 10yr | 4.45% | -26.9 | -11.5 |

| French 10yr | 3.33% | -13.3 | +13.9 |

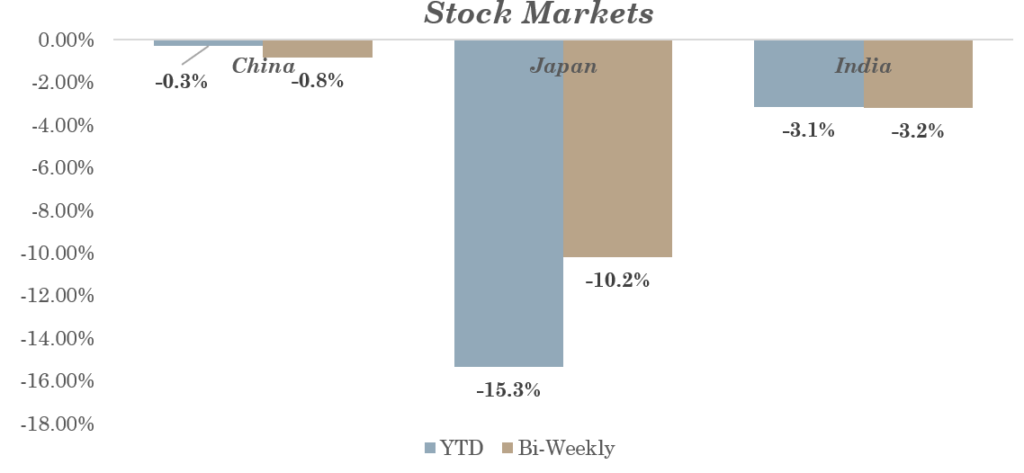

Asian Markets

Emerging Economies Equity Markets

March 24, 2025 – April 4, 2025

| Index | Close | Bi-Weekly Change | 2025 YTD Performance |

| China | 3,342 | -0.83% | -0.29% |

| Japan | 33,781 | -10.18% | -15.32% |

| India | 22,904 | -3.19% | -3.13% |

Government Yields

March 24, 2025 – April 4, 2025

| Yield | Close | Bi-Weekly Change (in bps) | 2025 YTD Change |

| China 1Y | 1.47% | -8.6 | +44.9 |

| India 1Y | 6.37% | -22.9 | -29.4 |

| Japan 1Y | 0.51% | -9.7 | +8.2 |

| China 10Y | 1.79% | -11.5 | +17.5 |

| Japan 10Y | 1.16% | -36.2 | +6.3 |

| India 10Y | 6.47% | -16.2 | -35.2 |

Interconnections Across Markets

The looming threat of stagflation, a scenario characterized by rising inflation and slowing economic growth, is causing analysts to have a gloomy outlook for financial markets, and not only. For equity markets, stagflation signifies a significant downturn, as corporate profits are hurt by higher input costs and weakened consumer demand, leading to a bear market. Bond markets, typically seen as a safe haven during times of economic decline, are likely to see continued falling yields unless higher inflation down the road forces the Fed to raise rates. The dollar is also feeling the strain, weakening as the country’s growth prospects fall and inflation eats away at its purchasing power, prompting investors to seek refuge in other countries.

Source: Yardeni

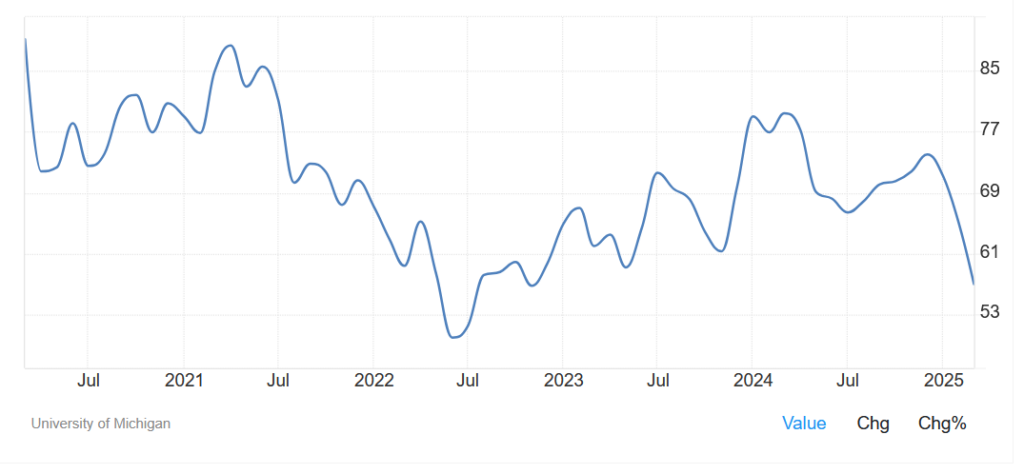

Confidence has eroded across key economic stakeholders, from executives to consumers. The loss of faith in the US economy’s resilience has created what some analysts deem to be a negative feedback loop, further destabilizing markets. In equities, dwindling consumer confidence translates to reduced spending, directly impacting corporate earnings & valuations, while cautious CEOs shrink capital expenditures, hindering economic growth. Bond markets, while likely benefiting from an initial flight to safety, will be hurt by the expected inflation from tariffs, which reduces the real value of the bonds. The Fed needs to grapple with both rising inflation from tariffs and supporting growth, the outlook for which has dimmed from the recessionary effects of the tariffs themselves.

Source: Yardeni, US Michigan Consumer Sentiment