European Markets

Corporate and Business News

- German commercial property prices fell 5.4% in 2024, a fourth consecutive year of declines, but showed some signs of stabilization as the country’s real estate sector tries to shake off its worst crisis in decades.

- German producer prices rose less than expected in January, increasing by 0.5% on the year.

- British house prices rose at their fastest pace in almost two years in the 12 months to December, according to official data, adding some signs of a recovery in the housing market. Average house prices rose by an annual 4.6% to 268k pounds.

- Pay increases granted by British employers held steady in the three months to January at the lowest level since 2021, signaling a shift towards more restrained rises as businesses try to cope with economic pressures.

- Commerzbank plans to axe 3,900 mostly local jobs to help it deliver more ambitious profit targets as part of its strategy to fend off UniCredit’s advances for a tie-up between the German and Italian lenders.

- German engineering company Siemens has raised roughly 1.45 billion euros ($1.5 billion) after selling a stake in healthcare subsidiary Siemens Healthineers with proceeds expected to help pay for its acquisition of U.S. software firm Altair Engineering.

- Nestle reported slightly better than expected annual sales growth on Thursday, driven by price increases, but the world’s largest packaged food company warned of a narrower profit margin in 2025.

- Denmark’s Orsted has decided to cut its 2030 investment program by 25%, the renewable energy firm said on Wednesday, as the offshore wind industry grapples with rising costs and supply chain issues.

Debt and Monetary Policy News

- The European Central Bank (ECB) hopes that President Donald Trump’s plan to support cryptocurrencies pegged to the US dollar will speed up legislative backing for the digital euro.

- Higher US tariffs on European exports are likely to have little effect on euro-area inflation, according to ECB’s policymaker Panetta, adding that the main risk remained that of medium-term inflation falling below 2%.

- Investor morale in the Eurozone brightened in February to its highest since July with Germany also benefiting from the rise in confidence.

- The Bank of England (BoE) lowered interest rates by 25bps, judging that the sharp upward revision to its inflation forecasts for this year will prove temporary, while two officials called for a bigger rate cut against the backdrop of weaker growth.

Asian Markets

Corporate and Business News

- Shares of Dongfeng Motor soared as much as 85.8% in Hong Kong after the Chinese automaker said its parent was planning a restructuring, stoking speculation that some of the state-owned players could be merged as competition grows.

- Cash-strapped China Vanke said its major shareholder, state-owned Shenzhen Metro, is giving it a $383.12 million loan, in a sign the government is stepping up efforts to stabilize the property developer. Vanke, in return, will pledge 211.5 million shares, or 18.3%, of its listed property services unit, Onewo Inc, as collateral.

- China’s car sales posted the biggest drop in almost a year in January, declining 12% compared to the same month last year. The decline was influenced by several factors, including the timing of the Lunar New Year and intense competition among automakers.

- India could impose a temporary tax of 15%-25% on steel from China in as soon as six months because of the “serious challenge” to domestic producers from cheap imports, Steel Minister H.D. Kumaraswamy said.

- Chinese tech company Lenovo reported hefty gains in quarterly revenue and net profit that beat expectations and said it would benefit from the adoption of DeepSeek’s artificial intelligence model in its products. Driven by robust demand for its AI-powered servers, Lenovo’s third-quarter revenue surged by a fifth to $18.8 billion.

- Japanese cosmetics giant Shiseido said its full-year profit slumped 73%, partly due to a drop in consumer spending in a key overseas market, China, a trend the company expects to continue into 2025. Shiseido said its operating profit came in at 7.58 billion yen ($49.9 million) in the 12-month period ended December 31st, compared with 28.13 billion yen the prior year.

- Japan’s SoftBank Group is set to make a quarterly net profit of 234 billion yen ($1.54 billion) as shares in its telecommunications holdings edge up and the post-listing performance of Swiggy is seen boosting the value of its portfolio of unlisted technology startups.

- Nissan and Honda ended merger talks to forge a $60 billion car company, pitching Nissan deeper into uncertainty and highlighting the pressure on legacy automakers from Chinese rivals upending the industry.

Debt & Monetary Policy News

- China’s consumer inflation accelerated to its fastest rate in five months in January while producer price deflation persisted, reflecting mixed consumer spending and weak factory activity. Deflationary pressures are likely to persist in China this year unless policymakers can rekindle sluggish domestic demand, with US tariffs on Chinese goods adding pressure on Beijing to spur growth in the world’s second-largest economy.

- New bank loans in China surged more than expected to a record high in January as the central bank moved to shore up a patchy economic recovery, reinforcing expectations for more stimulus in coming months as US tariffs threaten to pile more pressure on the economy.

- Japan’s current account surplus jumped to a record last year, data from the finance ministry showed, as a weaker yen boosted returns on foreign investments that helped to comfortably offset a trade deficit. The surplus in the current account stood at 29.3 trillion yen in 2024, the largest since comparable data became available in 1985. It represented a 29.5% increase from the previous year.

- Japan’s annual wholesale inflation jumped to a 7-month high of 4.2% in January and accelerated for the fifth straight month, highlighting persistent price pressures and reinforcing market bets of another interest rate hike this year.

- Japan’s core consumer inflation hit 3.2% in January for its fastest pace in 19 months, data showed, reinforcing expectations that the central bank will keep raising interest rates from levels still seen as low. Bond yields rose on the data, as markets factor in the chance that the BoJ could hike interest rates more aggressively than initially thought as inflationary pressure mounts.

Latin American Markets

Corporate and Business News

- Mexican telecommunications giant America Movil reported a 48% fall in its fourth-quarter net profit, well below analysts’ expectations, with the company citing foreign exchange losses even as its revenues rose.

- Mining giant Grupo Mexico reported a drop in its net profit during the fourth, missing analysts’ estimates and dragged down by losses in its infrastructure division and a smaller profit in its transport unit. Net profit in the quarter fell 6.5% to $686.5 million, from revenues which were up 13% to $3.85 billion.

- Mexican airport operator GAP announced a $2.53 billion investment spread across five years, part of what it described as a development plan that aims to support economic growth and the country’s key tourism sector.

- Colombia will impose a 1% tax on the production of fossil fuels, including oil and coal, its two biggest earners, until the end of the year, under a state of emergency that was declared last month. The government will also impose a 19% sales tax on online gambling, the finance ministry said in a statement.

- Brazilian state-run lender Banco do Brasil expects its adjusted net profit to grow by up to some 8% in 2025. While posting near in-line fourth-quarter results, the bank also announced fresh dividends. Banco do Brasil said its adjusted net profit is expected to settle between $6.5 billion and $7.2 billion this year.

- Latin American e-commerce giant MercadoLibre posted a better-than-expected quarterly net profit, up nearly four-fold from the same period a year earlier and sending its shares up more than 12% in after-hours trading. MercadoLibre, said net income for the October-to-December quarter came in at $639 million, up 287% year-on-year.

Debt and Monetary Policy News

- Global equity funds saw their second weekly outflow in seven weeks, as investors became more cautious following US President Donald Trump’s announcement of steep tariffs on Mexico, Canada, and China. However, the selling pressure eased after Trump postponed the tariffs on Canada and Mexico.

- Mexico’s annual inflation rate slowed slightly more than expected in January after the central bank accelerated the pace of its interest rate cuts and signalled more monetary easing ahead. The headline annual inflation rate hit 3.59%, down from 4.21% the previous month.

- Brazil’s inflation rate slowed in January from the previous month, but the 12-month rate was still above the upper end of the central bank’s target range, keeping expectations intact for another rate increase next month.

- Argentina’s monthly inflation rate dropped to 2.2% in January, its lowest since mid-2020 after libertarian President Javier Milei took office just over a year ago ushering in austerity measures that have helped stabilize the embattled economy.

- Brazil’s government cut its economic growth forecast for this year to 2.3% amid ongoing monetary tightening and lifted its inflation outlook, though it projected a more benign scenario than the market. The finance ministry’s economic policy secretariat now expects consumer prices to rise 4.8% this year, up from a previous forecast of 3.6% in November, when it projected GDP growth would reach 2.5% this year.

- Brazil’s central bank monetary policy director said that the base scenario for policymakers is to proceed with an upcoming 100bps interest rate hike, as the bank had previously indicated.

- Brazil’s Treasury raised $2.5 billion in a new 10-year dollar-denominated sovereign bond, with a 6.75% yield. The so-called Global 2035 aims to further the Treasury’s strategy of enhancing liquidity in the country’s external yield curve.

Commodities Spotlight

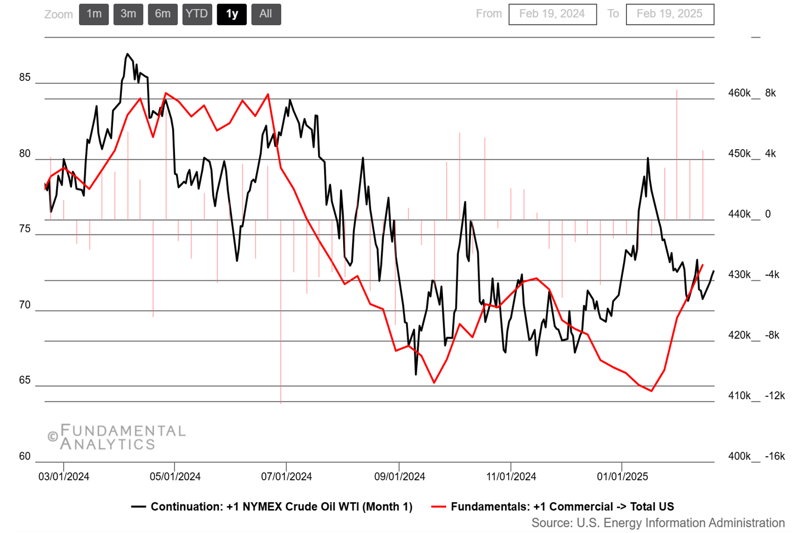

Crude Inventory Rose for 4th Consecutive Week, Sending WTI Lower

WTI crude oil futures extended their early gain to $73 per barrel on Thursday, supported by a weaker dollar and lingering risks of lower supply. OPEC+ delegates indicated they may delay supply increases, citing concerns of a fragile market as members of the cartel previously struggled to cut output to target. Cold weather also threatened US oil supply, with North Dakota’s output estimated to drop by up to 150k bpd. However, further oil price gains were capped by a slight easing of geopolitical risks as the US and Russia engaged in diplomatic talks to end the Ukraine war.

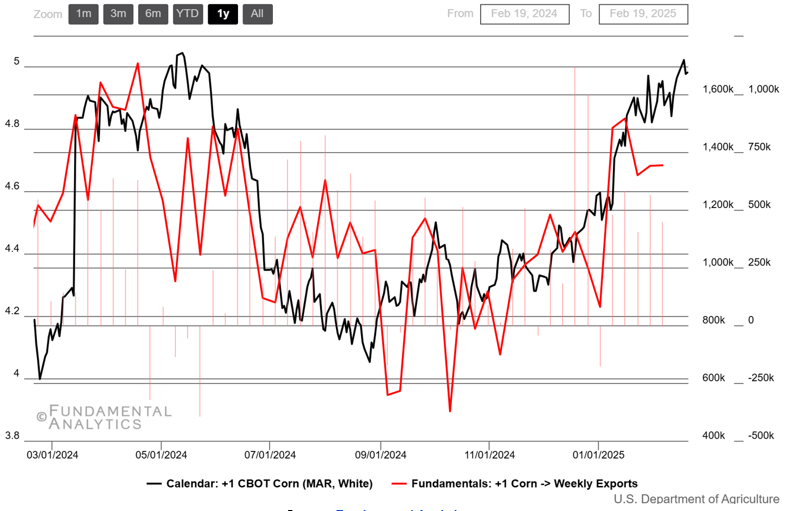

Corn Exports Soared y/y, Helping Corn Reach 1-Year High Above $5 Mark

Corn futures rose toward $5.00 per bushel, the highest since October 2023, as tightening global supply and strong demand offset trade-related uncertainty. Argentina’s drought-driven yield cuts and Brazil’s delayed planting are expected to lower global ending stocks by 3 million tons according to the latest WASDE report. Meanwhile, US ethanol production continues to exceed expectations, reinforcing domestic demand for corn feedstocks, while robust US exports, driven by strong foreign buying, have added further support. However, downside risks remain, including the potential for increased Argentine exports and uncertainty over President Trump’s tariff policies, which could disrupt global trade flows.