Global Market News

Global Equities Make Gains

Global equities made gains this week. The S&P 500 and Dow Jones gained 1.47% and 0.55%, respectively, while the Nasdaq increased 2.58%. Despite spiking to 4.65% on Wednesday after the release of strong US inflation data, the US 10-year Treasury note closed the week at 4.48%. The price of a barrel of West Texas Intermediate crude oil also decreased, ending the week at $70.67. Volatility, as measured by the CBOE Volatility Index, dropped more than 8% over the week to 14.77.

US Inflation Heats Up

US inflation accelerated unexpectedly in January, rising by 0.5% on a monthly basis since December and notching an annual rate of 3.0%. Markets dropped on the news and bond yields skyrocketed, but both reversed course on Thursday. The unexpected rise in inflation is likely to influence the Federal Reserve’s decisions on interest rates, as they may choose to delay any further rate cuts to keep inflation in check.

International Developments

Ukraine War Talks Begin as Trump and Putin Agree on Negotiations

US President Donald Trump and Russian President Vladimir Putin initiated talks aimed at ending the war in Ukraine following a “productive” phone call on February 12th. Trump, who emphasized the need for peace and invited Putin to meet in Saudi Arabia, was joined by Defense Secretary Pete Hegseth in calling for negotiations. However, both dismissed the likelihood of Ukraine joining NATO. Meanwhile, Ukrainian President Zelensky spoke with Trump and reaffirmed his commitment to a “lasting, reliable peace,” despite concerns about territorial concessions. As the conflict continues with drone attacks on Ukraine’s regions, Western allies urge Ukraine’s inclusion in any peace discussions, emphasizing the need for robust security guarantees.

Fragile Ceasefire Amidst Israeli Withdrawal and Trump’s Gaza Proposal

Israeli troops recently completed a withdrawal from the Netzarim Corridor, a key military zone dividing Gaza, in accordance with the Israel-Hamas ceasefire agreement reached on January 19th, which has so far seen the release of 16 Israeli hostages and 566 Palestinian prisoners. While Trump’s controversial proposal to remove Gaza’s civilian population has escalated tensions, the ceasefire remains under strain, with Hamas accusing Israel of violating the deal by limiting aid and obstructing evacuation efforts. On February 12th, Hamas delayed the next phase of hostages’ release due to Israeli actions, while both Israel and the US expressed concerns over Hamas rebuilding its strength. Negotiations continue under the fragile truce, with the next phase yet to be finalized.

Paris AI Summit Highlights

The Paris AI Summit highlighted tensions over AI governance, with US Vice President JD Vance criticizing European regulations and warning against cooperation with authoritarian regimes like China. The US and UK declined to sign a diplomatic declaration on “inclusive and sustainable” AI, further illustrating the divide among global leaders. The pace of AI development, highlighted by figures like Sam Altman and Demis Hassabis, pointed to transformative shifts in labor markets and technological capabilities, while discussions also focused on AI’s environmental and societal impacts. The summit was also overshadowed by Elon Musk’s near-$100 billion bid for OpenAI, which led to speculation about his influence on the company’s direction.

US Social & Political Developments

Federal Judge Temporarily Restricts Musk’s DOGE Access to Treasury Payment System

A federal judge temporarily restricted Elon Musk’s Department of Government Efficiency (DOGE) team from accessing the critical Treasury payment system, citing potential risks to confidential data and heightened vulnerability to hacking. This decision follows a lawsuit filed by 19 state attorneys general, arguing that the DOGE team, led by Musk and staffed by non-government associates, unlawfully gained access to sensitive systems. The Treasury payment system is crucial for distributing tax returns, Social Security benefits, and federal salaries, impacting millions of Americans. The ruling is part of ongoing judicial action against the Trump administration’s efforts to drastically cut government costs and overhaul federal operations, sparking legal battles and political tensions.

Trump Escalates Steel and Aluminum Tariffs Amid Global Trade Tensions

President Trump signed orders on Tuesday to escalate tariffs on steel and aluminum imports, increasing the steel tariff to 25% and the aluminum tariff to 25% from 10%, set to take effect on March 12th. This move is part of Trump’s broader trade reset strategy aimed at strengthening US manufacturing, despite criticism that it could stoke inflation and harm consumers. In retaliation, China imposed new tariffs the same day, further straining global trade relations, while key allies like Canada voiced concerns over the destabilizing effect of the tariffs. Economic experts and industries, particularly in auto manufacturing, warned that the tariffs might lead to higher prices and job losses, undercutting Trump’s promise of a manufacturing revival.

Corporate/Sector News

Gold Soars Amid Trump’s Tariffs and Global Uncertainty

Gold prices hit a new record high of $2,938 per ounce this week continuing a strong rally fueled by President Trump’s recent imposition of a blanket 25% tariff on aluminum and steel imports. Over the past year, gold has surged 44%, outperforming other asset classes, and experts predict it may break the $3,000 mark by mid-2026. The rally is driven by fears of inflation and geopolitical instability, with central banks, notably China’s, increasing their gold purchases to safeguard against currency risks. Despite strong US economic indicators, gold remains a preferred safe haven amid growing global policy uncertainty.

Musk Announces He Will Withdraw $97 Billion OpenAI Bid if it Maintains its Nonprofit Status

Elon Musk has stated he will cancel his $97.4 billion bid to acquire OpenAI if the nonprofit’s board halts its conversion into a for-profit company, escalating his dispute with CEO Sam Altman. Musk’s legal team claims Altman violated his fiduciary duties by rejecting the offer without board approval, highlighting the tension between the two after their 2015 co-founding of OpenAI. Musk’s bid is in stark contrast to OpenAI’s potential $260–300 billion valuation, fueled by a $40 billion investment from SoftBank. The ongoing legal battle over OpenAI’s future could extend into 2027, with Musk seeking to prevent the nonprofit’s transformation, which he contends contradicts the terms of his original $45 million donation.

Honda and Nissan End Merger Talks Amid Strategic Differences

Honda and Nissan have officially ended their merger discussions, which were initially announced in December 2024, aimed at creating the world’s third-largest automaker. The companies cited differences in structural proposals, with Honda suggesting it would become the parent company and Nissan a subsidiary, leading to the termination of their memorandum of understanding. The merger was seen as a way for both companies to better compete with Tesla and Chinese automakers in the electric vehicle market, but was canceled after concerns over decision-making speed and market volatility. Despite the collapse of the merger, both companies, along with Mitsubishi, will continue collaborating on electric and smart car technology.

Recommended Reads

How Silicon Valley Swung From Obama to Trump

Europe Threatened by Yet Another Energy Crisis

DOGE Cuts Pose Risk to Largest Government Contractors

Farmers on the hook for millions after Trump freezes USDA funds

US: The danger of an imperial presidency

This week from BlackSummit

On Sentiments, Expectations, and the Vitality of Institutions: The Role of Gold

John E. Charalambakis

BlackSummit Team

BlackSummit Team

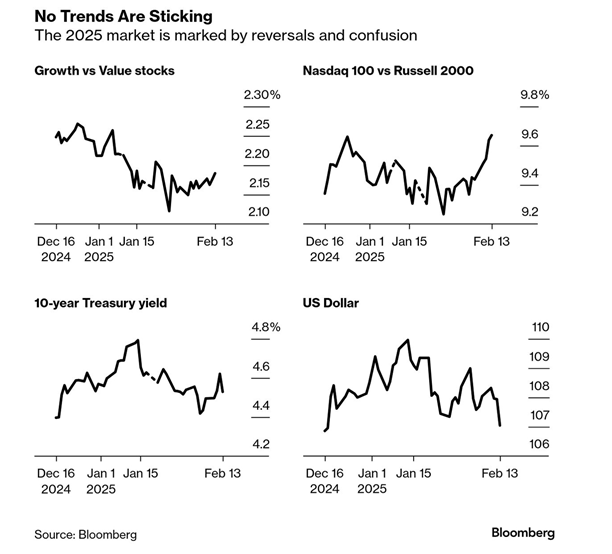

Image of the Week

Video of the Week

The Economic Argument for Ditching the Penny—and Why Some Want to Keep It