The Wooden Nickel

The Wooden Nickel

-

Author : The BlackSummit Team

Date : December 10, 2024

The Wooden Nickel is a collection of roughly a handful of recent topics that have caught our attention. Here you’ll find current, open-ended thoughts. We wish to use this piece as a way to think out loud in public rather than formal proclamations or projections.

1. Demography as Destiny

The demographic dividend is well-known as an economic force. At the macro level, it refers to a favorable ratio of a young, productive, working-age population relative to the elderly non-working population. A high ratio can be a boon for an economy, providing it with ample tax resources, ample savings, and a growing capital stock. While no guarantee of macroeconomic success, it has been an observed effect benefitting countries in the past such as Ireland (the Celtic Tiger) and South Korea.

Of course, Father Time is undefeated, as they say, and eventually the demographic tailwind peaks and turns into a tax. One needs to look no further than Japan and China for the difficulties and anchors that an aging population can inflict on an economy.

While we refer to this at the macro level, I wonder if we should consider that something similar occurs at the micro/corporate level as well, especially when compared with new technological paradigms. Each generation has its own habits, customs, and behavioral trends (sometimes overstated). Each generation’s quest to define its own norms provides both tailwinds and headwinds for individual firms to rise and fall. When paired with technological evolutions (and some revolutions), the forces can be powerful. The media and consumer goods landscape look nothing like they did prior to the rise of Millennials and Gen Z, who have essentially known the internet for their entire lives. The cable bundle has died while YouTube and Netflix have risen. Consumer goods brands like Gilette stagnated and brought us Harry’s and Dollar Shave Club. And before then, 60 Minutes couldn’t fathom Amazon overtaking Sears.

A recent article in the Journal naturally lends the question, is search and Google, next?

2. Pascal’s (Artificial) Wager

When I was first learning to play chess, my teacher told me to remember 3 things with every move

- Did my opponent’s move put any of my pieces in danger?

- If I execute this move am I putting it in danger? Do I have it protected?

- If I move this piece am I removing protection for another piece on the board?

Many years later, I would recommend adding a fourth rule to be applied over time: What tendencies does my opponent have? Where do they like to attack? What common setups do they use to corner my king?

2024 has been (once again) a year of AI enthusiasm in financial markets. When even a utility stock climbs the S&P 500’s leadership board on the prospect of selling power to data centers, you know you are not in a dismal market. With any euphoric narrative there is always a corner of the world and financial markets that greets it with skepticism; sometimes warranted and sometimes out of jealousy for missing out. The AI trade has been no different; some skeptics mention respectable questions while others just employ bitter cynicism and dubious “analysis.”

The most common questions that are usually mentioned in some form are: Is all this spending worth it? What is the plan to make a return off of these hundreds of billions of dollars in investment?

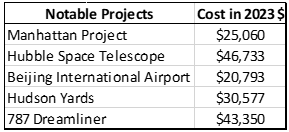

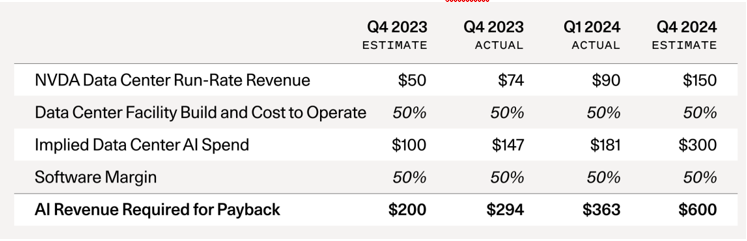

It is a perfectly reasonable question. Most people’s lives have not been transformed by AI yet, and the spending that has occurred in the last couple of years is one of the greatest capital projects in human history. Just consider that in its last 4 quarters, Microsoft has spent over $49 billion, much of it dedicated to AI investments. That is more than some of the most notable capital investments in history. It is no wonder then that Goldman’s head of equity research is raising alarms or that Sequoia calls the current investment phase a bubble, claiming that $600B of revenue is needed to justify current expenditures.

Figure 1: AI Investments Surpass Some of Humanity’s Biggest Projects

Figure 2: Sequoia’s Estimate of AI Revenue Needed to Justify CapEx

But where things get a bit misguided is when they insist that monetization must be around the corner or else the spending is in jeopardy; that the two are joined at the hip. In some ways, they are but not as much as most people believe. Yes, a recession would pare back spending. Yes, the complete evaporation in scaling laws would probably force a pare back in spending.

But this is where the proposed fourth rule from chess comes in: it is foolhardy to think the hyperscalers, model builders, and other infrastructure providers are operating under conventional decision-making parameters; their tendencies and motivations are not for returns. This is a calculation of life and death. It is, as one analyst put it, Pascal’s wager applied to computing: better to invest for AGI and find out it cannot be done than believe it cannot be done and turn out to be wrong. The former is wasteful, yes, but companies are spending out of excess cash (unlike the dot-com bubble). The latter is to invite your own condemnation.

3. How to Use Sell-Side Research

As a counter to the last rendition of the Wooden Nickel, below are some ways and uses we think that the endless amount of research out there can provide value:

1. Figuring out how ____ works

One of the better use cases for sell-side research and the equity analyst community is to first get the basics of a business or industry down. Knowing how the web of suppliers, customers, and various monetization means and levels across various parts of a value chain can be complicated depending on the business type. Sometimes, the base business itself can be overwhelming and a barrage of industry vernacular can drown out understanding. We’ve especially felt the latter when looking into the cybersecurity space. Sell-side research (especially initiation reports) can be extremely valuable for understanding what something is, what someone does, why it matters, and how it fits into the broader industry.

2. Diagnosing Sentiment

Alpha may come through many different means, but they all have commonalities: you need to have some level of variant perception. And at some point, you have to find out if your thesis is just one in a crowd or a lonely view. Sell-side research represents the output of someone who talks with a lot of other people: management teams, institutional investors, activist investors, consultants, third-party researchers, etc. It provides a wonderful opportunity to triangulate what the crowd is thinking and seeing, if there is a lever that most are missing, an excess in sentiment, and if everyone believes the same thing. “When everyone is thinking the same, then no one is thinking.”

3. The Three Types of Analysts

When first starting out in portfolio management, I had a mentor reach out to me and give the following bit of advice. There are three types of analysts he said:

The first is the one married to the spreadsheet. The one who literally cannot see the forest for the trees. If a concept can’t fit into Excel then they’re not interested. They lack strategic foresight and creativity. The second is the one with all fluff and sizzle, who likes to be on television and in the press as much as possible. Be careful with this one. They know enough to be dangerous but not enough to tell you something that you couldn’t get elsewhere. Their insights are either hollow or fragile. The final one, he said, thinks like an investor. They are not afraid to think independently, look out beyond a quarter or two, and can more ably balance the many tugs and pulls on them from a variety of directions.

“Don’t talk to anyone for a year. Not a phone call. Not a meeting. Just read. And find out which analysts are in the third category.” That was the final piece of advice he provided. It’s not because it will improve your stock selection abilities but rather because you’ll learn to think for yourself. We couldn’t agree more as we see more and more people rely on the sell-side as a crutch rather than a resource.

4. Recommended Reads and Listens