Mystery Over Troubled Waters: Contemplating the Market Outlook Within Oligarchic Trajectories in 2025 (and beyond)

Mystery Over Troubled Waters: Contemplating the Market Outlook Within Oligarchic Trajectories in 2025 (and beyond)

-

Author : John E. Charalambakis

Date : November 26, 2024

The US government recently won its case of alleged monopolization against Google. Probably the government’s argument can be better understood as a case of a monopoly within an oligopoly (given that only 3-4 search engines dominate web searches). Should we expect the government to pursue a case against the Magnificent Seven for oligopolizing the market’s returns in an over-concentrated – and some would say overpriced – market? Maybe, as we are approaching the second quarter of the 21st century, we should start our sentences with the word oligo (very few) whether that means oligo (small) returns (judging from the lowest equity premium since 2002), oligopoly, or oligarchy.

Effective oligarchies can be based on traditional aristocracy of birth and landholding, or on the prerogatives of a founding elite, but they can also be based on the power of wealth (plutocracy), on an intellectual elite (Plato’s Republic), on military power (junta), on theocracy, on tribal supremacy, on control of the media, on systemically organized corruption (postmodern Cosa Nostra), or on a mixture of any of the above.

What is the one element that marks the trajectory of oligo structures? Desire for control while consolidating power. From that perspective, the fact that central banks’ gold reserves hit over 13% a few days ago (the highest in three decades), while foreign ownership of US Treasuries fell to about 24% (the lowest in over two decades), represents another dimension of power consolidation within sectors and countries (let alone groups of countries), which seems to be entering us into a new era with geopolitical and policy implications at a time when the ratio of Emerging Markets equities relative to US equities is at a 25-year low (does that fact make them attractive especially when we consider the current policies’ trajectories?)

The consolidation in power can even be seen in the rising dollar, in the spread between the yields in corporate bonds and the yield in US Treasuries which is the lowest since the late 1990s, and also in the withdrawal of investors from China (for the first time in history, China is on track to witness an annual net withdrawal from foreign investors). The world is irrigated by flows of trade, capital, labor, and regulations. We may be on the verge of consolidation in all these flows which could mark the beginning of an anarchic disorderly order.

Burckhardt was a historian who taught us that social, political, and economic systems could disintegrate via cultural revolutions when the latter took the form of religious beliefs. To that we may add that when the irrigation of flows of trade, capital, labor, and regulations is radically affected at a time of major technological and economic evolution and/or devolution, what might seem like normal progression and outcome, may suddenly reverse itself (for example if the strong dollar which is enjoying a major upswing, suddenly loses traction and reverses its trajectory).

A reversal of such order can be seen in the prognosis for the market outlook by a well-known bear in Wall Street (Michael Wilson of Morgan Stanley, who uplifted his 2025 S&P 500 outlook from 5400 to 6500, and who sees animal spirits and deregulation uplifting equities throughout 2025). Certainly, prognoses for the US stock market outlook in 2025 have not been consolidated as they range from a drop of 20%+ to a gain of over 26%. Given that the US market seems to be the only game in town, prognoses on non-US markets outlook are limited (consolidation’s effects).

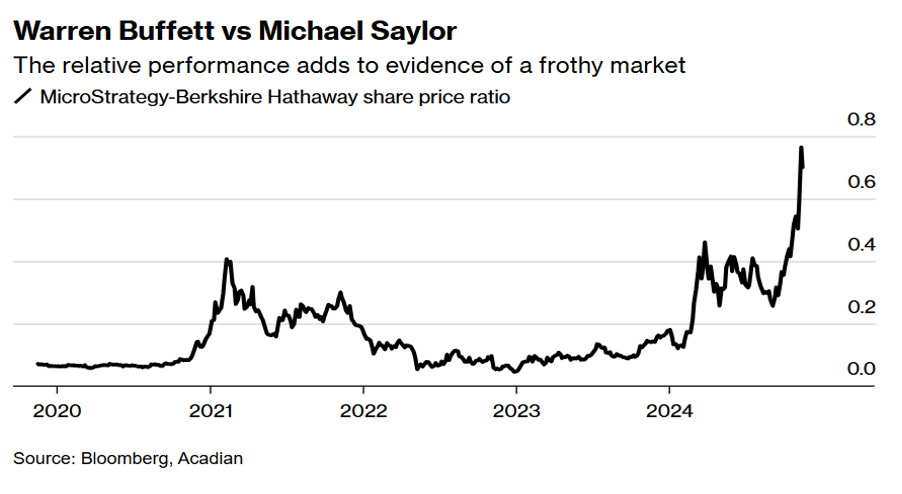

The flow of funds to gold ETFs, central banks’ purchases of gold, geopolitical instability, trade tensions, and the expectation of lower rates, give a push to analysts’ outlooks for precious metals, with some predicting gold will hit over $3K in 2025. If to that scenario we add a dollar reversal (possibly due to US fiscal position), then we should not be surprised if it goes even higher. A dollar reversal would also uplift the prospects of oil, whose trajectory could also be boosted by policies that penalize Iran’s oil flows. As for grains, if the flow of trade is affected by tariffs (especially against China), the implications for US soybeans, corn, wheat, and meat prices are not optimistic. How then could an anarchic disorderly order emerge? Let’s take a look at the ratio (developed by Owen Lamont of Acadian Asset Management) between Warren Buffett’s traditional marker (the price of Berkshire Hathway) that represents traditional value but boring stocks, and Michael Saylor’s MicroStrategy stock price which represents faith in the rising crypto/Bitcoin sector. The ratio is known as the Buffett-Saylor ratio.

In early 2024, every share of MicroStrategy represented 10% of Buffett’s Berkshire’s value. By mid-November, it represented 80%. Any reasonable person would say that this anarchic exponential increase for an asset without any intrinsic value could possibly lead the market astray, especially if profit expansion suffers and inflationary pressures revive (by late 2025) due to a new tariffs regime, supply constraints, labor pressures, and higher demand originating from fiscal policy, let alone speculative pre-emptive efforts.

Over the last 100 years, we have lived through two major economic policy reversal shocks (not including world-changing geopolitical shocks such as World Wars or revolutions). The first was the depression of the 1930s that brought to the surface government-instigated economic programs and solutions, and the second was the delinking of gold from the dollar in 1971. Are we on the verge of another tectonic change where oligo inflation might be more desirable than an anarchic disorderly order, especially at a time when AI starts writing its own code?