Welcome to our new bi-weekly newsletter which covers key developments in non-US markets. With this newsletter, we highlight corporate, debt, and monetary policy news in European, Asian, and Latin American markets. We end our newsletter with a spotlight on commodities.

European Markets

Corporate and Business News

- German industry retreats further as government collapse deepens crisis. Output dropped 2.5% on month in September, nearly offsetting the 2.6% rise in August.

- German investor morale falls, with investors’ assessment of the current economic situation deteriorating to its worst level since the midst of the COVID-19 pandemic in May 2020.

- Denmark launched a landmark framework for using AI under EU rules, winning backing from the country’s biggest banks and Microsoft.

- Shell won its appeal against a landmark Dutch climate ruling that in 2021 demanded the oil giant drastically reduce its carbon emissions.

- The CEOs of Europe’s three biggest computer chip makers – Infineon, STMicroelectronics, and NXP – said that demands by the US, Chinese, and European governments that each region has its own semiconductor production are creating more obstacles to business.

- The United Kingdom’s economic growth slowed down sharply in Q3. The Office for National Statistics said growth during the July to September period was just 0.1%, coming in much lower than the 0.5% recorded in Q2 and below market expectations for 0.2%.

Debt and Monetary Policy News

- The Bank of England (BOE) lowered interest rates by a quarter point. The BOE reduced its key rate to 4.75% from 5%, while in light of Donald Trump’s election victory the previous week, Governor Andrew Bailey highlighted risks to the outlook for global trade.

- Following the release of the UK’s weak economic data, The pound headed for its biggest weekly loss since January on Friday. The currency is also under pressure from a surging dollar.

- Europe must not be “Unprepared” for a trade war, ECB’s Rehn Say. Rehn said a soft landing for the eurozone economy was still a plausible scenario, but that the outlook is clouded by growing geopolitical uncertainty.

Asian Markets

Corporate and Business News

- China’s producer price index fell 2.9% in October, for a 25th straight month of decline, more than the 2.6% decline analysts expected. China’s GDP deflator has now been in negative territory for six consecutive quarters.

- Surging defense stocks are Asia’s Trump trade. Global rearmament has created an unlikely new winner—South Korea. The country’s defense contractors stand out for similar reasons that Asian manufacturers have in other manufacturing sectors: They deliver on time at competitive prices.

- Tencent will invest $500 million by 2030 in cloud infrastructure in Indonesia. Indonesian technology company GoTo unveiled the new agreements with Tencent and Alibaba at the Indonesia-China Business Forum in Beijing.

- Slowing urban spending in India over the past 3-4 months has not only hurt the earnings of the largest consumer goods firms, but it has also raised questions about the structural nature of India’s long-term economic success.

Debt and Monetary Policy News

- Japan’s Finance Minister issued fresh warnings after the yen’s tumble as the dollar strengthened. According to market participants, the Bank of Japan Governor hinted that an intervention is around the corner.

- India may relax spending limits to meet 2025’s Capex target. Federal government spending slowed during April-June due to the national elections, with total expenditure in six months through September at about 44% of the full-year target.

- Taiwan’s central bank sees peril in Trump tariffs. The US last year ran a $48 billion trade deficit in goods with Taiwan. The central bank said that the aggressive tariff policy Trump promised on the campaign trail would be the most impactful trade policy of the incoming administration if implemented.

Latin American Markets

Corporate and Business News

- Brazil’s Itau Unibanco bumps up credit outlook after Q3 profit climbs 18%. The bank posted a net recurring profit of 10.68 billion reais ($1.84 billion) for the quarter ended in September, surpassing analysts’ estimates.

- Brazil’s Nubank beats estimates on Q3 adjusted profit, reporting an impressive 18% increase in its third-quarter adjusted net profit, reaching $592 million.

- Brazil’s BTG Pactual reports a surge in quarterly profit. The bank posted a record net profit of R$6.5 billion and revenues of R$13.9 billion for the third quarter of 2024.

- Chile’s Codelco seeks permit for $650 million Andina water project. The project will require up to 1,650 workers and is estimated to take 36 months to complete.

- Barrick Gold missed profit estimates on higher costs, leading to a decision to lower its Nevada production.

Debt and Monetary Policy News

- Argentine consumers feel squeezed even as inflation dips below 200%. Analysts in Argentina now project year-end inflation at 120%, a decrease of 3.6 percentage points from their previous forecast.

- Brazil’s Central Bank has issued a warning that it may extend its rate-hike cycle if inflation expectations continue to worsen. During its recent policy meeting, the bank raised its benchmark interest rate by 50 basis points to 11.25%.

- Brazil’s Lula has urged Congress to cut spending to help “beat” financial markets. Lula emphasized the need for fiscal responsibility across all branches of government to address the pressures on Brazil’s economy, including a weakening currency and rising interest rate futures.

- Brazil’s currency weakens amid government delays in announcing new fiscal measures the real, has weakened significantly amid delays in the government’s announcement of new fiscal measures. The real fell about 1% against the U.S. dollar, extending its decline for the year to over 16%.

Commodities Spotlight

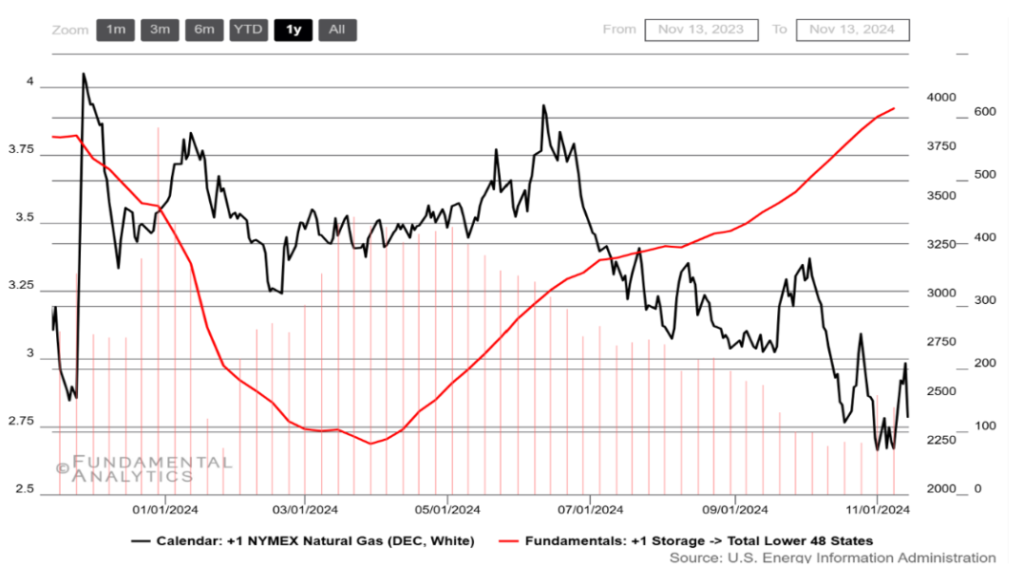

US Natural Gas Futures Fall as Storage Builds

Source: Fundamental Analytics

US natural gas futures fell toward $2.8/MMBtu after the EIA’s storage build report showed supply remains robust. Meanwhile US utilities added 42 bcf of natural gas into storage last week, slightly below the expected 43 bcf build, gas in storage is now 6.1% above the seasonal norm. This marks the fourth consecutive week of above-average storage builds, a trend not observed since October 2022.

Source: Fundamental Analytics

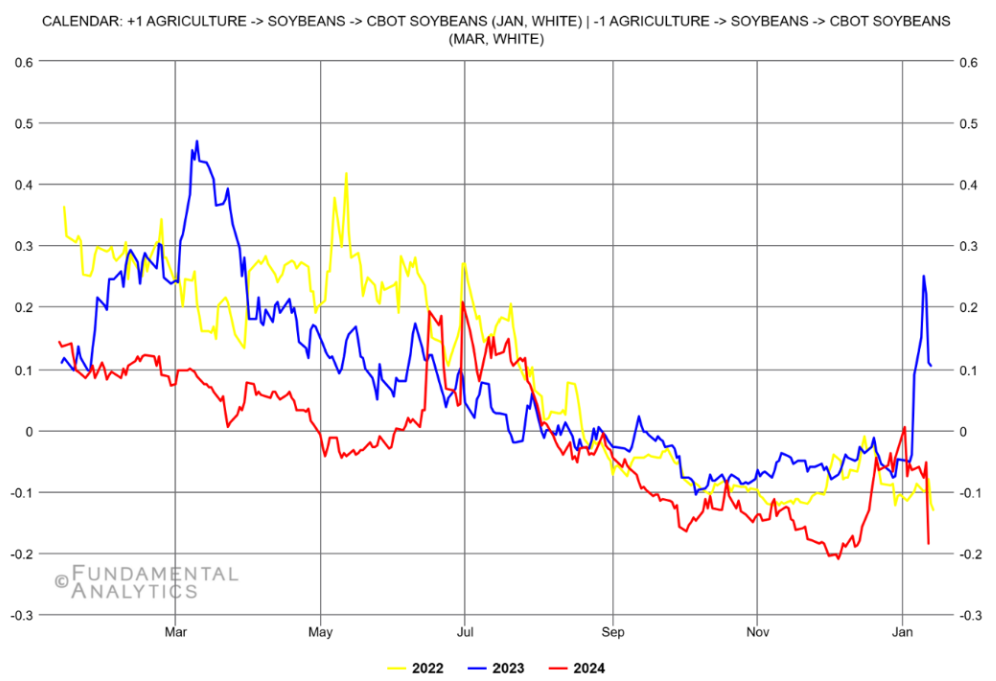

Soybeans futures fell below $10 per bushel from a one-month high of $10.30 on expectations of lower demand amid an unfavorable environment for the biofuel industry under a Trump administration. Additionally, China, the world’s top soybean importer, is expected to cut its imports by 9.5% for the marketing year ending September 2025, lowering demand from 109.4 million metric tons to 98.8 million tons.