Regional Market Watch

Regional Market Watch

-

Author : The BlackSummit Team

Date : November 1, 2024

Welcome to our new bi-weekly newsletter which covers key developments in non-US markets. With this newsletter, we highlight corporate, debt, and monetary policy news in European, Asian, and Latin American markets. We end our newsletter with a spotlight on commodities.

Corporate and Business News

- TotalEnergies recently divested from its South African offshore blocks due to the difficulty in generating a return on gas at the sites.

- Italy’s biggest bank, Intesa Sanpaolo, improved next year’s profit forecast after reporting stronger-than-expected earnings for Q3, helped by a +10% y/y rise in net fees.

- Swiss National Bank (SNB) made a profit of $6.55 billion in Q3, helped by the increase in the value of gold, as its gold reserves stand at 1,040 tonnes.

- UBS Group posted a Q3 profit well above forecasts ($1.4B vs $740M expected), driven by higher revenue and cost reductions.

- German engineering orders fell again (-4% year over year) in September.

- German retail sales unexpectedly rose (+1.2% month over month vs +0.5% consensus) in September, extending an upward trend started in June, although growing at a slower pace.

- The Spanish economy grew at a faster-than-expected rate (+3.4 year over year vs +3.0% consensus) in Q3 to again outpace its European peers thanks to exports and a strong tourism season.

Debt and Monetary Policy News

- Eurozone inflation will durably reach the ECB’s 2% target in the course of 2025, according to ECB President Christine Lagarde.

- Banks regarded as Too Big To Fail (TBTF) are sufficiently capitalized, UBS Chairman said as his bank seeks to avoid regulations currently taking shape in Switzerland that could hurt business.

- SNB could further cut interest rates to maintain price stability. The SNB has been at the forefront of interest rate cuts this year, lowering borrowing costs three times in 2024 to 1%.

Asian Markets

Corporate and Business News

- China tells carmakers to pause investment in EU countries backing EV tariffs.

- China’s looming fiscal package aims to stabilize rather than boost growth.

- Xiaomi unveiled a luxury version of its SU7 electric sports car saying the $114k model would rank as the fastest four-door car in production in a direct challenge to the likes of Tesla and Porsche.

- Japan’s Panasonic said Q2 operating profit rose +42% year over year at its battery-making energy unit, as stronger sales of energy storage systems for data centers offset falling demand for automotive batteries.

- Toyota Motor and NTT plan to invest a total of $3.3 billion by 2030 into an infrastructure and software platform using AI to reduce traffic accidents.

- Japan’s factory output in September rose +1.4% month over month versus a median market forecast for a 1% rise.

- Maruti Suzuki India’s top carmaker by sales, reported its slowest quarterly revenue growth in nearly three years, hurt by low demand for small cars and bigger discounts, which weighed on margins.

- India’s infrastructure output grew 2% year over year in September, backed by strong cement and refined product output.

Debt and Monetary Policy News

- The Bank for International Settlements (BIS) said it would quit the cross-border payments platform Project mBridge, raising questions about how the scheme backed by China will evolve at a time of growing geopolitical scrutiny of global transfers.

- China is considering approving next week the issuance of over $1.4T in extra debt in the next few years to revive its fragile economy, a fiscal package that is expected to be further bolstered if Donald Trump wins the US election.

- The Bank of Japan (BoJ) maintained ultra-low interest rates but said risks around the US economy were somewhat subsiding, signaling that conditions are falling into place to raise interest rates again.

- India’s fiscal deficit for April-September was $56.50 billion or over 29% of the estimate for the fiscal year.

- India’s Central Bank is expected to cut its key policy rate in December by 25bps to 6.25% to bolster slowing economic growth, according to a slim majority of economists in a Reuters poll.

Latin American Markets

Corporate and Business News

- Colombian conglomerates Argos and SURA are reportedly exploring a possible ownership split.

- US exporters race to ship soybeans as looming election stokes tariff worries.

- Mining giant Grupo Mexico’s profit jump on copper prices and production.

- JM Smucker is expected to divest cookie brand Voortman in $305M deal.

- Brazil’s Carrefour sells off 15 Atacadao sites for $127 million.

- US charges Venezuelan TV news network owner in alleged $1.2 billion money laundering scheme.

- Mexico restaurant chain operator Alsea posts sharp drop in third-quarter profit.

- Brazil fines meat packers $64 million for buying cattle from deforested Amazon land.

- Brazil Institute sues social media giants for $525M over usage by minors.

- Mexico’s Pemex posts wider third-quarter loss, hit by weaker peso.

- Brazil crypto imports surge 60.7% through September, exceeding the 2023 total.

- Ecuador lawmakers approve a bill to boost private energy investment.

Debt and Monetary Policy News

- International Monetary Fund (IMF) raises Latin American growth forecast for 2024.

- World Bank will loan Argentina over $2B for social support.

- Bank of Canada slashes rates saying monetary policy has worked.

- World Bank and the International Development Bank (IDB) grant Argentina $8.8B in financing for economic development.

- Brazil’s inflation picks up in mid-October with higher electricity costs.

- TSX posts its longest daily losing streak since April.

- Argentina risk index breaks below 1,000-point barrier as markets cheer.

- Brazil’s Azul reaches a deal with bondholders for up to $500 million in fresh financing.

Commodities Spotlight

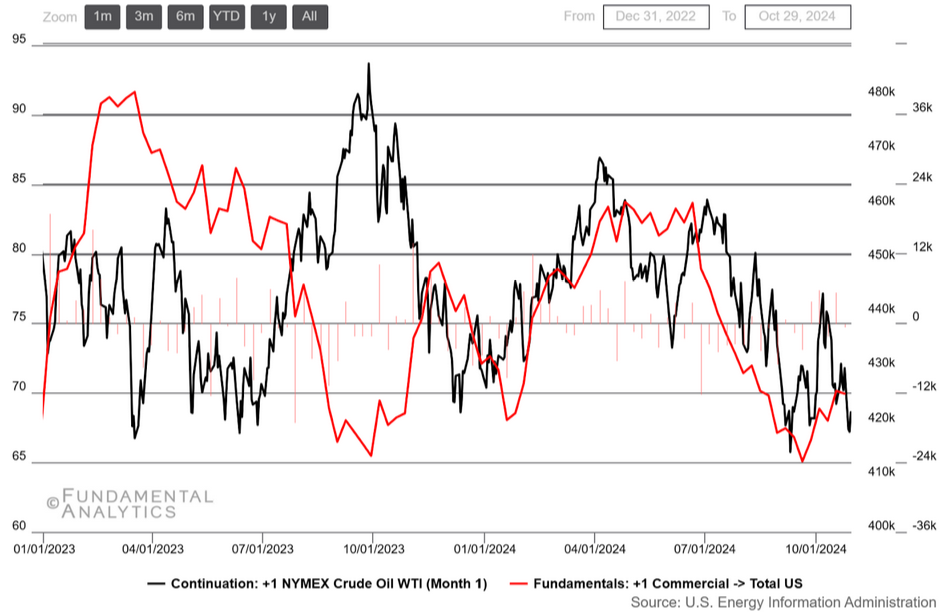

Source: Fundamental Analytics

WTI crude oil futures rose to around $69 per barrel on Thursday, extending an over 2% rebound from the previous session, supported by an unexpected drawdown in US stockpiles. EIA data showed that US crude inventories fell by 0.5 million barrels last week, defying market expectations of a 2.3 million barrel build. However, bearish pressure remains due to weak Chinese demand, while investors assess the supply outlook following reports that OPEC+ may delay the planned December increase in oil production by a month or more.