Welcome to our monthly newsletter, Carbon Market News Roundup, the goal of which is to introduce our audience to a new asset class market in the making: the carbon market. Our previous issues, along with the rest of our commentaries, may be read here.

In the last issue we explored the connection between the climate crisis and serious concerns regarding the housing market, the shifting energy mix that powers the US, and two new carbon market developments: biochar and carbon ‘insets’. In this issue, we explore effective climate policies and emission reduction, innovations and alternatives in energy and fuel, and a landmark investment in carbon capture technology.

Effective Climate Policies and Emission Reduction

Most Climate Policies Don’t Work. Here’s What Science Says Does Reduce Emissions.

Eric Niiler, The Wall Street Journal

Global carbon pricing needed to avert trade friction, says WTO chief

Andy Bounds, Financial Times

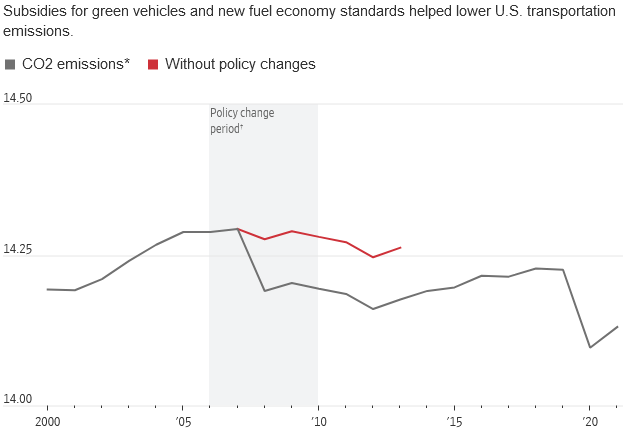

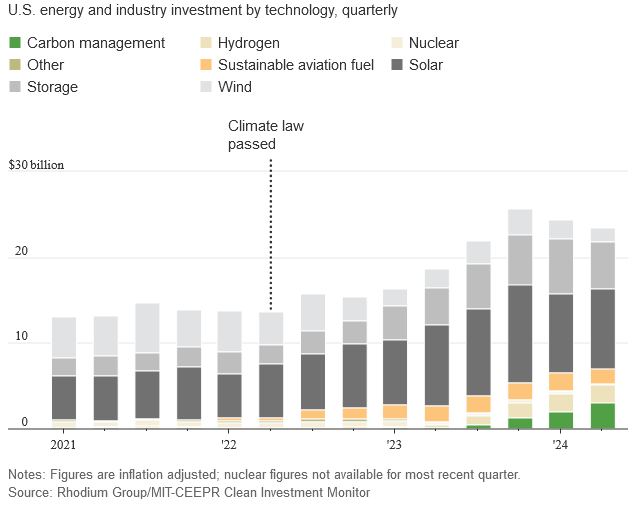

Recent studies and initiatives highlight the critical need for effective climate policies and global carbon pricing to address greenhouse gas emissions and prevent trade disputes. An evaluation of over 1,500 climate policies across 41 countries found that only 63 successfully reduced emissions. The study, published in Science, emphasized that subsidies and regulations alone are insufficient unless combined with price-based strategies like carbon pricing, energy taxes, or vehicle taxes. These findings underscore the importance of integrating financial incentives, regulations, and taxes to influence consumer and corporate behavior effectively.

Ngozi Okonjo-Iweala, head of the World Trade Organization (WTO), echoed the necessity of global carbon pricing to prevent trade disruptions over environmental measures. She highlighted the WTO’s collaboration with the IMF, OECD, and UN to develop an international carbon pricing system. This initiative responds to the EU’s carbon border adjustment mechanism, which requires exporters to pay a levy linked to the EU carbon price for certain carbon-intensive products. The measure aims to level the playing field between EU manufacturers and exporters from countries with lower or no carbon prices but is expected to face challenges from trading partners, including potential WTO cases from countries like India.

The findings suggest that a mix of climate policies is necessary to prevent severe climate impacts. However, the study’s limitation is its focus on short-term impacts, potentially overlooking long-term policy effects. Experts like Janna Hoppe from ETH Zurich stress that while the study provides a valuable roadmap, achieving climate neutrality within the next 30 years remains a significant challenge.

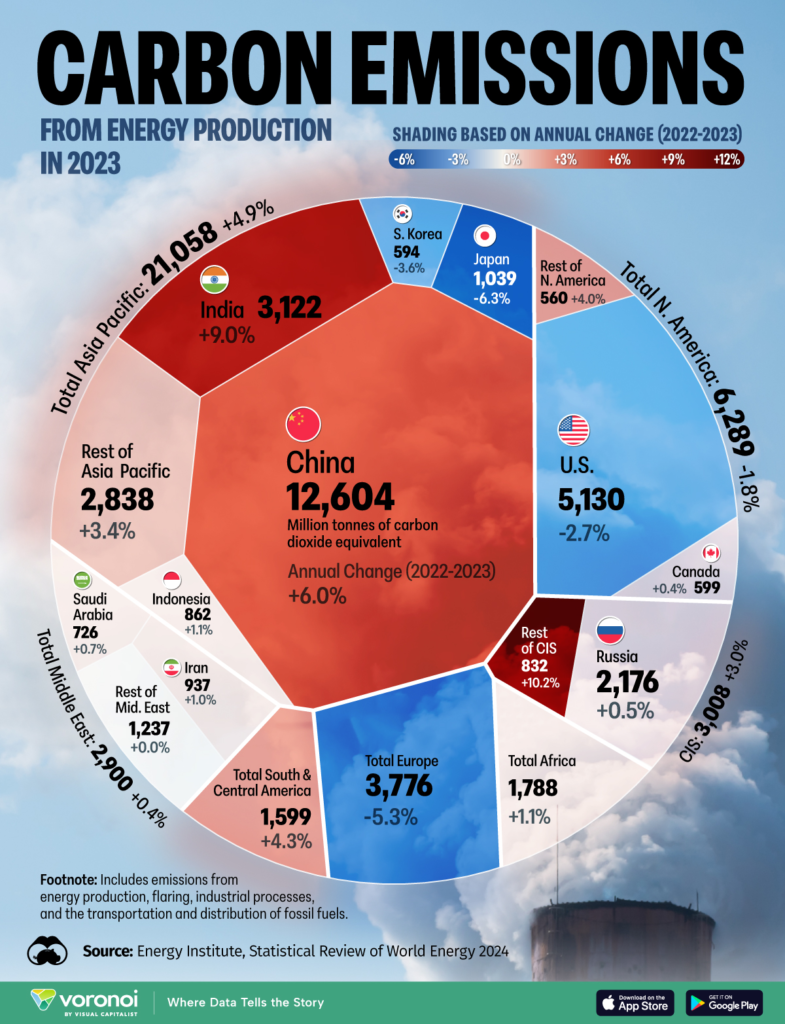

Developing countries have expressed concerns about the EU’s carbon border adjustment mechanism, viewing it as a protectionist measure. Okonjo-Iweala noted that these countries contribute minimally to global emissions, with Africa accounting for only 3% of current emissions. The EU has defended its approach, emphasizing efforts to assist countries like China in developing their own carbon markets. However, Okonjo-Iweala warned that the EU’s strategy could disrupt efficient trade routes and economic growth, advocating for a global framework to harmonize carbon pricing and reduce trade litigation.

Despite identifying successful policies, the study noted that current efforts are insufficient to meet the Paris Agreement targets, predicting that global emissions will exceed the target by 23 billion metric tons of CO2 by 2030. Okonjo-Iweala also highlighted the potential for trade to contribute to reducing carbon emissions, reversing the perception of trade as part of the problem. She encouraged countries to prioritize green purchasing and discussed ongoing WTO talks on a global environmental goods agreement to eliminate tariffs on items like solar panels. Additionally, she called for redirecting environmentally harmful subsidies towards sustainable industries.

In summary, both the study and Okonjo-Iweala’s comments underscore the urgent need for comprehensive and coordinated climate policies. Integrating financial incentives, regulations, and taxes, along with a global carbon pricing framework, is essential to effectively reduce emissions and prevent trade disputes. While significant challenges remain, these efforts provide a roadmap for achieving climate goals and leveraging trade as a positive force in the fight against climate change.

Innovations and Alternatives in Energy and Fuel

Eric Priante Martin, TradeWinds

How much do biofuels need to cost to compete with traditional fuels?

Hecla Emissions Management

Startups Are Devising New Ways to Expand the Lithium Supply Chain

Michelle Ma, Bloomberg

As the world transitions towards electrification, the demand for lithium, a key component in batteries for electric vehicles and cell phones, is set to skyrocket. This surge in demand has spurred a wave of innovation, with startups developing new methods to produce lithium and tap into previously untapped sources. Despite facing economic challenges and a current market slump, these companies are pushing forward with technologies like Direct Lithium Extraction (DLE). DLE, which recovers lithium from brine using techniques such as lithium-attracting beads and selective membranes, is now maturing to potentially compete with traditional extraction methods.

In the maritime industry, LNG (liquefied natural gas) is regaining its dominance as the preferred alternative fuel for new vessels, with a particular focus on its greener variant, liquefied biomethane (bio-LNG). Bio-LNG can be a carbon-negative fuel when considering its full lifecycle emissions. The upcoming FuelEU Maritime law in the European Union, which enforces stricter carbon-intensity limits on ships, allows shipowners to pool their vessels to meet these targets. This regulatory framework is driving the adoption of bio-LNG, as it offers significant emissions reductions and compliance benefits.

The shift back to LNG from methanol is driven by LNG’s wider availability and improved pricing. Despite environmental concerns about LNG’s methane emissions, shipowners are betting on its regulatory compliance. Companies like Uniper and United European Car Carriers are already investing in bio-LNG, and Hapag-Lloyd is planning to procure significant quantities to fuel its natural gas-powered ships. This shift highlights the industry’s commitment to meeting regulatory requirements and reducing greenhouse gas emissions.

Biofuels, including bio-LNG, need to be cost-effective to compete with traditional fuels. For low-sulfur fuel oil (LSFO), the combined cost of FuelEU and the EU Emissions Trading System (ETS) on an intra-EU voyage is approximately $736 per metric ton (mt). In comparison, B30 biofuel costs around $705 per mt in Rotterdam. Realizing the value of biofuels involves complex compliance and pooling arrangements, but it ultimately drives demand and supports the broader adoption of greener fuels.

The lithium market is also experiencing significant changes. While traditional extraction methods from brine and rocks have dominated, new DLE startups claim to have overcome previous technological challenges. These startups offer methods that use less water and fewer resources and can work with lower-quality brines. Companies like Lilac Solutions Inc. are making significant strides, raising over $300 million to commercialize their DLE technology and planning to build North America’s largest DLE production facility. However, economic hurdles remain, as lithium prices have dropped significantly since their peak.

In both the maritime and lithium industries, innovation and regulation are driving the adoption of greener technologies. While challenges remain, the commitment to reducing emissions and meeting regulatory requirements is clear. As these industries continue to evolve, the successful implementation of new technologies and regulatory frameworks will be crucial in achieving long-term sustainability goals.

Bank of America Bets on Carbon Capture With Big Tax-Credit Deal

Amrith Ramkumar & Ed Ballard, The Wall Street Journal

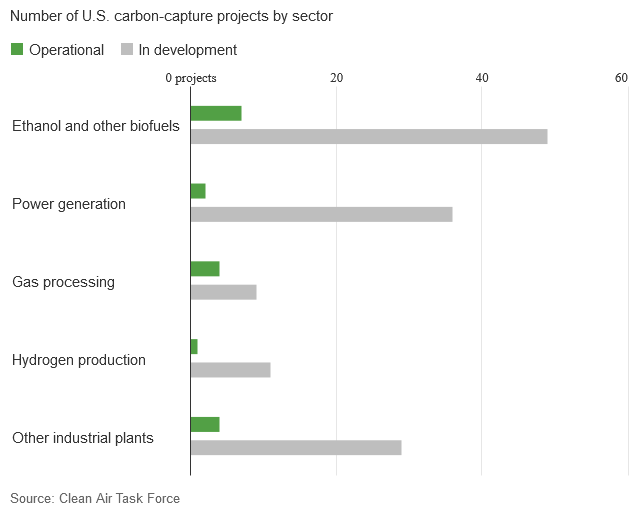

Bank of America has made a significant $205 million investment in carbon capture technology by purchasing tax credits from Harvestone Low Carbon Partners, an ethanol producer in North Dakota. This deal is notable as it is the first of its kind since the 2022 climate law increased the tax credits for capturing and storing carbon underground. Carbon capture technology, despite its historically poor track record, is gaining renewed interest from companies like Exxon Mobil due to these enhanced tax incentives.

Noah Zerance from Bank of America emphasized the need to address current emitters to help them decarbonize, highlighting the importance of this technology alongside renewable energy efforts.

Harvestone’s plant in North Dakota, which began capturing carbon last October, is capable of capturing over 200,000 metric tons of CO2 annually, equivalent to the emissions of about 42,000 gas-powered cars. This project is one of the few operational carbon capture initiatives in the U.S. and demonstrates the potential for such technology to significantly reduce emissions from industries that cannot easily transition to renewable energy. The success of this project is seen as a positive indicator for the industry and the nation’s ability to undertake similar initiatives.

The deal also underscores the strategic bets investors are making on the durability of the Biden administration’s climate policies, even amid potential political shifts. Carbon capture has bipartisan support, particularly in Republican states, and many tax credits are expected to survive even if there are changes in the executive branch. However, challenges remain, such as the lengthy permitting process for sequestering carbon underground and local opposition to carbon transport pipelines. Harvestone’s ability to secure permits quickly in North Dakota, due to the state’s unique EPA permissions, and its plans for additional projects, highlight the evolving landscape of carbon capture technology and its growing financial viability.