Carbon Market News Roundup

Carbon Market News Roundup

-

Author : The BlackSummit Team

Date : August 27, 2024

Welcome to our monthly newsletter, Carbon Market News Roundup, the goal of which is to introduce our audience to a new asset class market in the making: the carbon market. Our previous issues, along with the rest of our commentaries, may be read here.

In the last issue we explored how the voluntary carbon market (VCM) has recently evolved, highlighting the significance of carbon removal technologies, and we examined the impact of climate change on the transition to renewable energy. This issue, we explore the connection between the climate crisis and housing market concerns, the shifting energy mix that powers the US, and two new carbon market developments: biochar and carbon ‘insets’.

The Climate Crisis and the Housing Market

A $1 Trillion Time Bomb Is Ticking in the Housing Market

Mark Gongloff, Bloomberg

The Risky Business of Predicting Where Climate Disaster Will Hit

Eric Roston, Krishna Karra, Leslie Kaufman, & Sinduja Rangarajan, Bloomberg

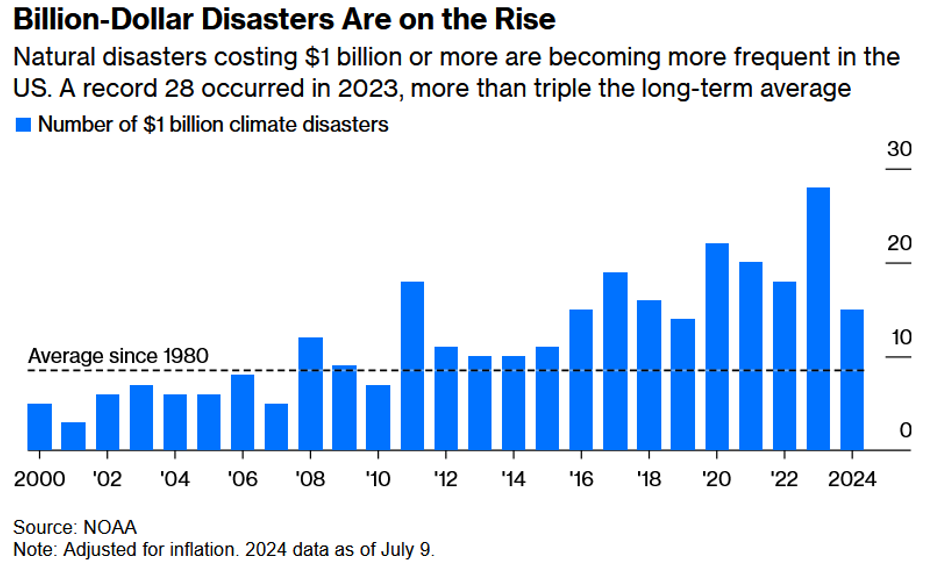

As climate change accelerates the frequency and severity of natural disasters like wildfires and floods, the US housing market faces a looming crisis. Despite the growing risks, millions of American homes remain underinsured, with a staggering shortfall of $28.7 billion annually in wildfire and flood coverage alone. Financial experts like David Burt, who foresaw the subprime mortgage crisis, now warn that nearly 19% of US homes, collectively worth $1.2 trillion, are at risk of severe devaluation due to climate-related damages. This potential financial devastation looms particularly large over vulnerable communities, where the impact of climate-fueled catastrophes could be most profound.

In response to the escalating risks, insurance premiums have risen, yet they still fail to fully capture the true danger posed by climate change. Regulatory constraints, such as California’s Proposition 103, have prevented premiums from reaching levels that would adequately cover these risks. This has led insurers to withdraw from high-risk states like California and Florida, leaving many homeowners reliant on state-backed insurance programs that are often costly and insufficient. The result is a deepening vulnerability, where the financial ruin of these properties seems almost inevitable.

The long-term solution lies in accurately pricing climate risk, which could deter development in high-risk areas and ensure that insurance premiums truly reflect the cost of protecting homes. However, implementing such measures could trigger a sudden and severe devaluation in the housing market, with Burt’s projected $1.2 trillion in losses potentially becoming a reality. As climate change increasingly threatens the housing market’s stability, the challenge will be finding a balance between economic resilience and the urgent need to mitigate climate risk.

Compounding this crisis is the growing industry of climate risk prediction, where advanced computing and satellite imagery have enabled the creation of sophisticated models that forecast specific events like floods or wildfires down to individual building lots. While these models are invaluable to government agencies, insurers, and real estate firms seeking to climate-proof their investments, they also present significant challenges. The predictions offered by different models can vary widely, leading to uncertainty and potential harm, especially when discrepancies arise in vulnerable communities. The lack of transparency and standardization in these models raises the stakes, as decisions influenced by these predictions could shape the futures of millions of lives and trillions of dollars. Until the industry adopts more rigorous and transparent practices, the risk of misguided decisions—and subsequent financial disaster—remains alarmingly high.

The Shifting US Energy Mix

Wind Beat Coal Two Months in a Row for US Electricity Generation

Minho Kim, The New York Times

How Does Your State Make Electricity?

Nadja Popovich, The New York Times

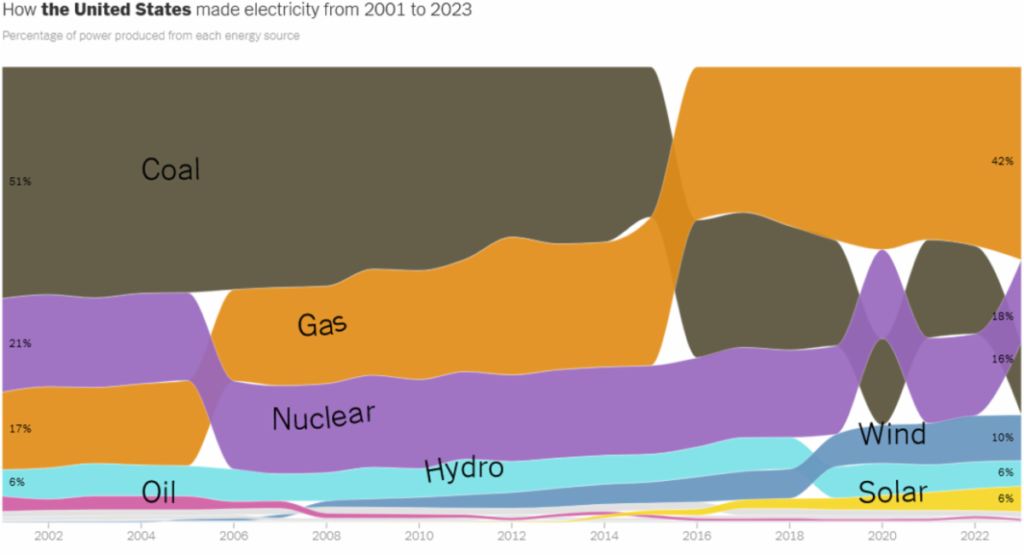

In March and April, wind turbines generated more electricity than coal-burning power plants in the US for the first time, marking a significant milestone in the energy transition. Advances in technology have reduced the costs of wind turbines, solar panels, and battery storage, making renewable energy cheaper than coal in many areas. The Inflation Reduction Act of 2022 and state regulations mandating a shift to clean energy have further boosted renewables.

These economic shifts, federal tax credits, and state mandates have driven rapid growth in renewable energy. Environmentalists have also targeted the economics of coal plants, leading to their closure in regions like New England. From 2000 to 2024, US coal capacity nearly halved, while wind capacity increased over 60 times and natural gas capacity nearly tripled.

As of April 2024, fossil fuels still generated the majority of US electricity, with natural gas at 39%, coal at 12%, and nuclear power at 18.5%. Wind and solar contributed 15% and 6%, respectively. Analysts predict wind energy will supply about 35% of electricity in the US and Canada by 2050. Wind power peaks in spring and dips in summer, while coal use rises in winter and summer due to higher power demand.

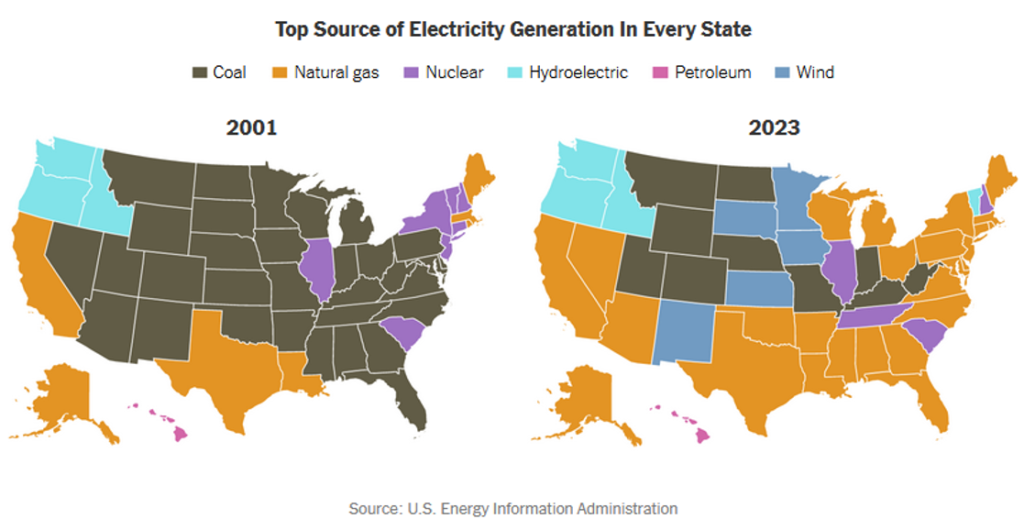

Natural gas overtook coal as the leading source of power in the US in 2016, with renewables like wind and solar rapidly becoming significant contributors. In Nevada, natural gas became the primary electricity source in 2005, and solar power has recently seen substantial growth. Iowa has seen wind power surpass coal since 2019, becoming the state’s largest power source. Even in coal-dominant Wyoming, alternative energy sources are making steady progress.

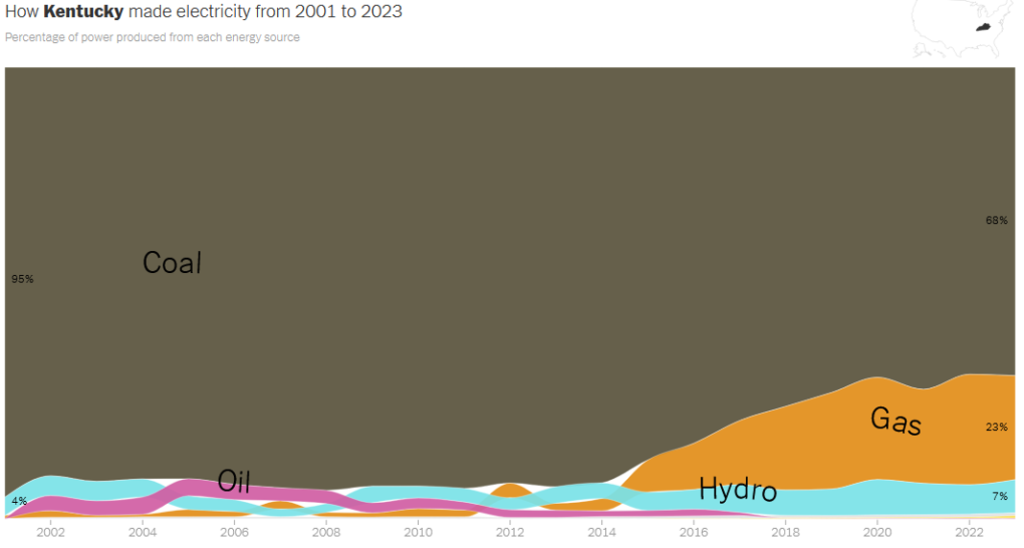

While fossil fuels still dominate US electricity generation, the transition from coal to natural gas and renewables has reduced carbon dioxide emissions and other pollutants. In Kentucky, coal remains the primary electricity source, but its share has decreased from over 90% in the 2000s to 68% last year, as older coal plants have been shut down or converted to natural gas.

Last year, coal was the top electricity fuel in 10 states, down from 32 states in 2001, with natural gas and wind power gaining prominence, especially in the Midwest.

Experts emphasize that more needs to be done to achieve zero emissions in the power sector, a goal set by President Biden. Melissa Lott from Columbia University notes that while switching from coal to gas reduces emissions, it doesn’t eliminate them. Rapid development of renewables and other technologies is essential to meet climate goals. The 2022 Inflation Reduction Act, aimed at boosting renewable energy and supporting technologies like nuclear energy and carbon capture, faces uncertainty in an election year, with potential repeals by Republicans. State-level actions also play a crucial role in the pace of new energy development.

New Carbon Market Developments

Ancient Amazon Charcoal Seen as Next Big Thing in Carbon Markets

Sheryl Tian Tong Lee, Peter Millard, & Heesu Lee, Bloomberg

Carbon ‘insets’ tackle emissions by unleashing the power of capitalism

Brooke Masters, Financial Times

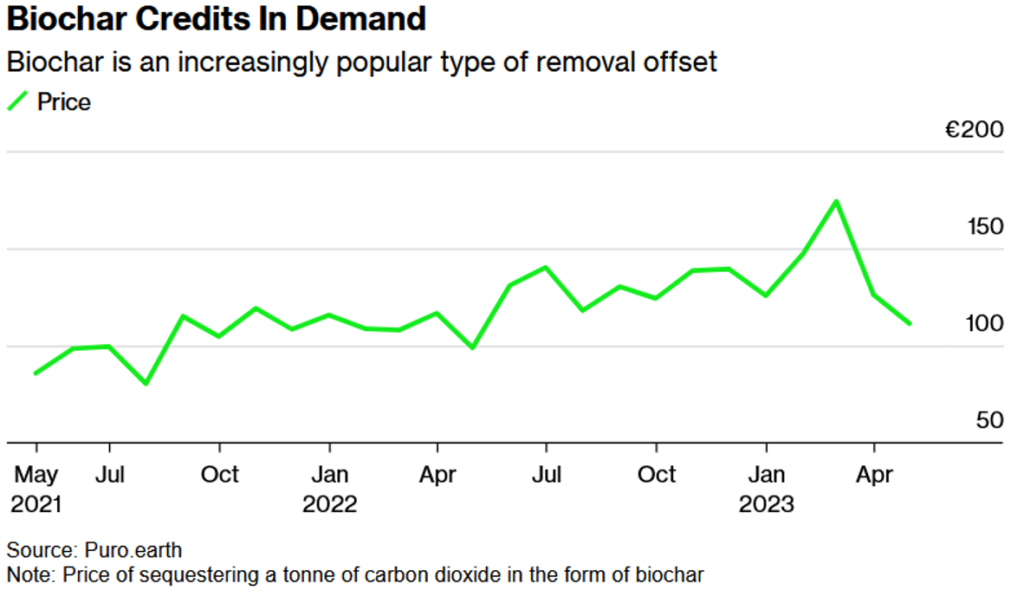

Biochar, a form of charcoal that has been used by Amazonian tribes for centuries, is now becoming a key component in the carbon reduction strategies of major corporations like Microsoft and JPMorgan Chase. Created through a process called pyrolysis, which heats agricultural waste in a low-oxygen environment, biochar can store carbon for hundreds of years while also improving soil quality. Companies are increasingly turning to biochar as a reliable and scalable carbon removal solution.

With the potential to sequester up to 2 billion tons of carbon dioxide annually by 2050, biochar is seen as a powerful tool in the global effort to meet net-zero emissions targets.

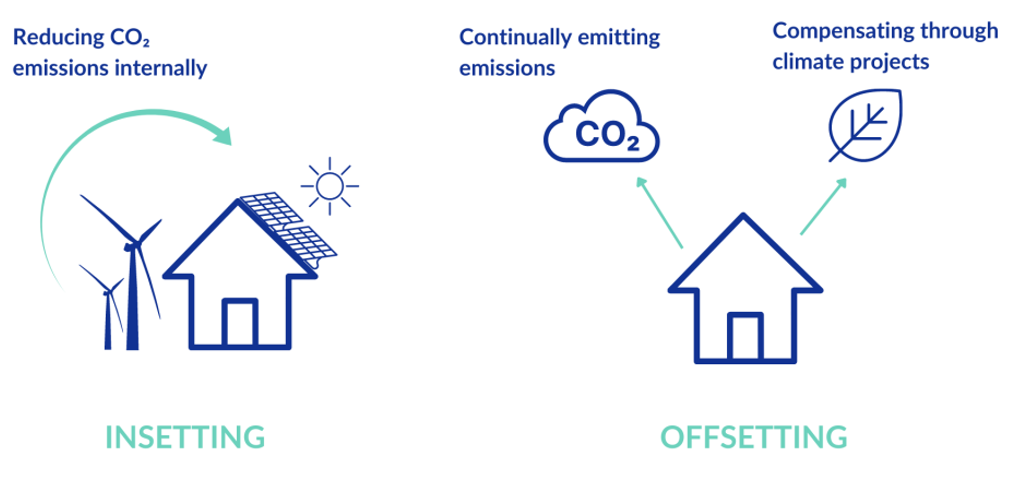

In addition to biochar, another innovative approach to carbon reduction is gaining traction: carbon ‘insets’. Unlike traditional carbon offsets, which involve projects unrelated to the buyer’s direct activities, carbon insets focus on reducing emissions within a company’s own supply chain.

Source: The Climate Choice

For example, World Energy is pioneering the use of sustainable aviation fuel (SAF) made from waste fats and oils, which reduces carbon emissions by up to 70%. Companies like JPMorgan and Netflix are committing to purchasing SAF certificates, which help fund the production of greener fuel while reducing their own carbon footprints. These insets offer a more traceable and reliable way to cut emissions and are being endorsed by organizations like the US Treasury Department as a preferable alternative to offsets.

The biochar market, though still relatively small, is growing rapidly as companies recognize its multiple benefits, including co-benefits for ecosystems, biodiversity, and soil health. Biochar credits have seen a surge in demand, with prices increasing by 29% last year, and experts predict the market will continue to expand as more US companies invest. Similarly, the adoption of carbon insets is on the rise, providing a more effective means for companies to achieve their decarbonization goals. Together, biochar and carbon insets represent a shift towards more sustainable and impactful carbon reduction strategies, offering scalable solutions that could play a significant role in the global effort to combat climate change.