What a week that was! It seemed that anywhere we turned our sights, signs of volatility were dancing over our heads. The objectives of this commentary are twofold: First, to discuss what happened in the economic, financial, and geopolitical spheres. Second, to assess what the possibilities might be following those developments and how investors may be able to optimize portfolio holdings and performance.

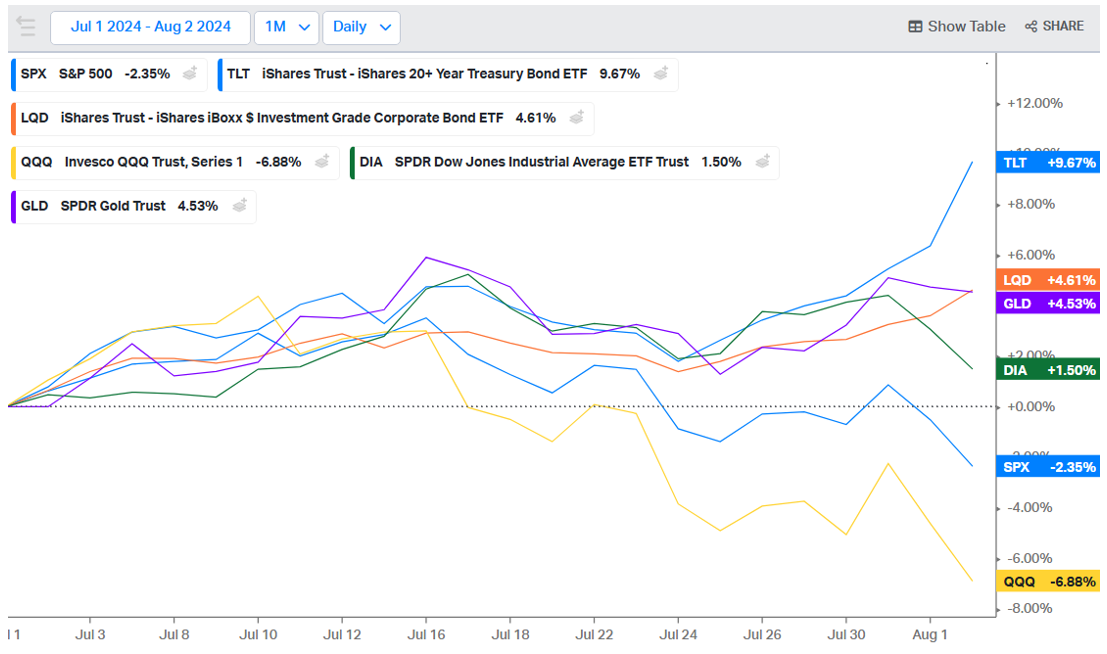

On June 25th we wrote to our clients: “In the last few weeks, we see clear signs of an economic slowdown in terms of sales, hirings, and slowing profit margins.” Unfortunately, that assessment became reality. The turmoil that hit the markets this past week can be seen in the graph that follows which reflects the performance of the Dow Jones (DIA/green line), S&P 500 (SPX/blue line), Nasdaq 100 (QQQ/yellow line), gold (GLD/purple line), corporate investment-grade bonds (LQD/orange line), and long-term US bonds (TLT/blue line) since July 1st:

Source: Koyfin

It is obvious that the riskier aspects of the market (Nasdaq and S&P 500) have been hit harder than the boring Dow Jones, especially since July 29th. At the same time, safe havens such as gold or long-term government bonds gained. The latter (ticker TLT) gained significantly while the market turmoil surfaced in the last few days, especially on the expectation that the Fed may cut rates by more than 25 bps in its September meeting.

Naturally, then, the question is what caused this market reversal? And why are investors fleeing stocks like Amazon which last Friday lost almost 9% of its value in just one day, or Intel which lost 26% of its value also on Friday?

We could say that the story unfolded in three phases: First, manufacturing reports early in the week of July 29th signified slowing economic activity, and more specifically indicated activity levels which are usually associated with recessionary signals. At the same time, reports on consumer confidence clearly demonstrated a downward trend. Then came some quarterly earnings which did not meet investors’ expectations (case in point Intel). And finally – to limit our discussion to the most important developments that led to the turmoil – Friday’s job creation and unemployment reports were underwhelming, showing a job creation trajectory associated with recession, while unemployment has jumped in consecutive months by more than 0.50% which is usually a recessionary signal.

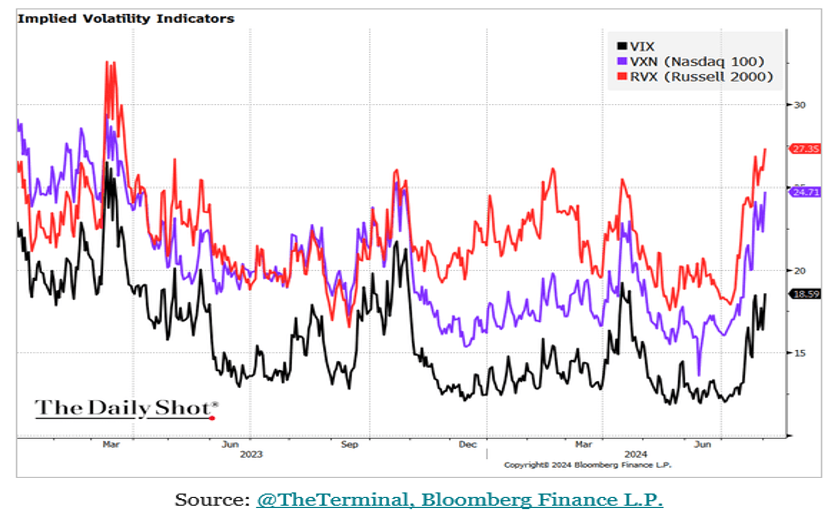

The markets opened this morning with a major bang, as the volatility index jumped another 56% on top of the 40% jump it experienced last Friday (see graphs below).

The US equity indexes started the day by dropping between 2.7-6.0%.

The reason behind such dramatic falls is fear. While economic news released last week – as discussed in this update – were not encouraging, they were certainly not dramatic enough to warrant such significant drops that drove the markets to correction territory.

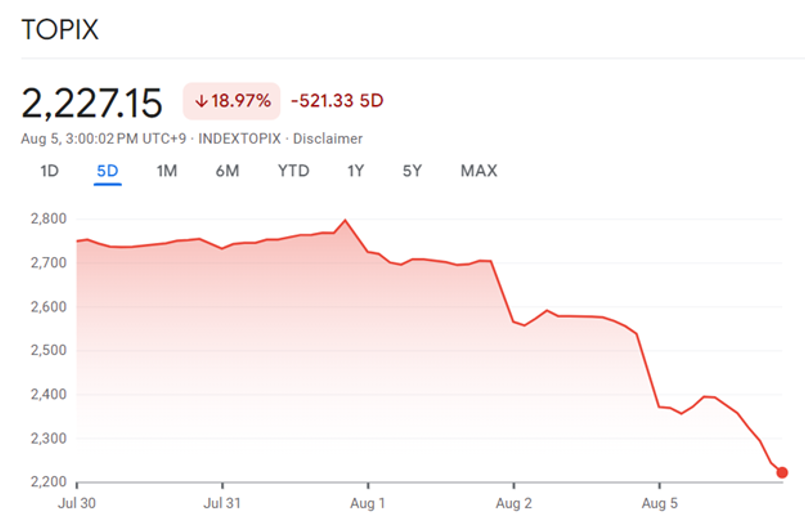

The silver lining in these developments is that conservative portfolios not only can withstand such turmoil, but those with a significant amount of cash can deploy the cash in order to acquire solid companies at much lower prices. It should also be noted that the downturn involves European and Japanese markets (to limit ourselves to developed markets), with the latter losing more than 19% in the last few days, as shown below. Those drops too could present some good buying opportunities.

However, the above does not actually represent the causes but merely the pretexts that triggered the market turmoil. Thus, we need to distinguish reality (causes) from noises and pretexts: The unemployment rate increased mainly because more people entered the labor market, so from that perspective the higher unemployment rate does not imply recessionary forces. However, while the slowdown in hiring is also reflective of some weather issues in July, most importantly in our opinion it represents slower spending and precautionary moves by businesses and consumers due to high interest rates, higher debt levels, and rising market, political, and geopolitical risks. Investors are repricing their risk appetite and prefer less risk, hence the preference for safer assets such as bonds and gold. At the same time, the fact that the market (mainly 10 stocks) has had very good gains so far this year, gives the sense of overvaluation and thus the need for correction especially for heavy-tech indexes such as the Nasdaq.

So, what do the above tell us about the future? Let’s start with economic expectations and then move to possible market and asset class trajectories: We don’t expect recession for the rest of the year. We believed that recession may hit us in the second half of this year, but we are of the opinion that this potential event has been postponed for now. We expect that the Fed will cut rates by at least 75 bps (0.75%) this year, and that by February of 2025, the rates will be lower by at least 100 bps (1%) if not more. This could uplift market expectations, lower the cost of financing, and may boost spending. However, we also believe that the inflation rate won’t drop to the desirable level of 2% and may bounce between 2.4-2.8% in the foreseeable future.

Now regarding the market trajectory, we expect some market turmoil until mid/late September, however, we also expect that the market will bounce back in the last quarter and especially in the last two months when the dust settles. Therefore, de-risking adjustments (or hedging using trailing stops) might be necessary for the immediate future.

Where do we see possible opportunities in this turmoil? We expect long-term government bonds to gain (they have already started gaining as discussed earlier), and we also believe that the energy sector (mainly the oil sector which trades at a P/E of less than 13 despite a record level of accumulated cash, improved efficiencies, rising demand for electricity due to industrial/EV/and data centers demand, and rising geopolitical risks) is undervalued. Some of those petrochemical companies also pay good dividends. Gold and silver should continue doing well, especially if geopolitical risks continue rising.

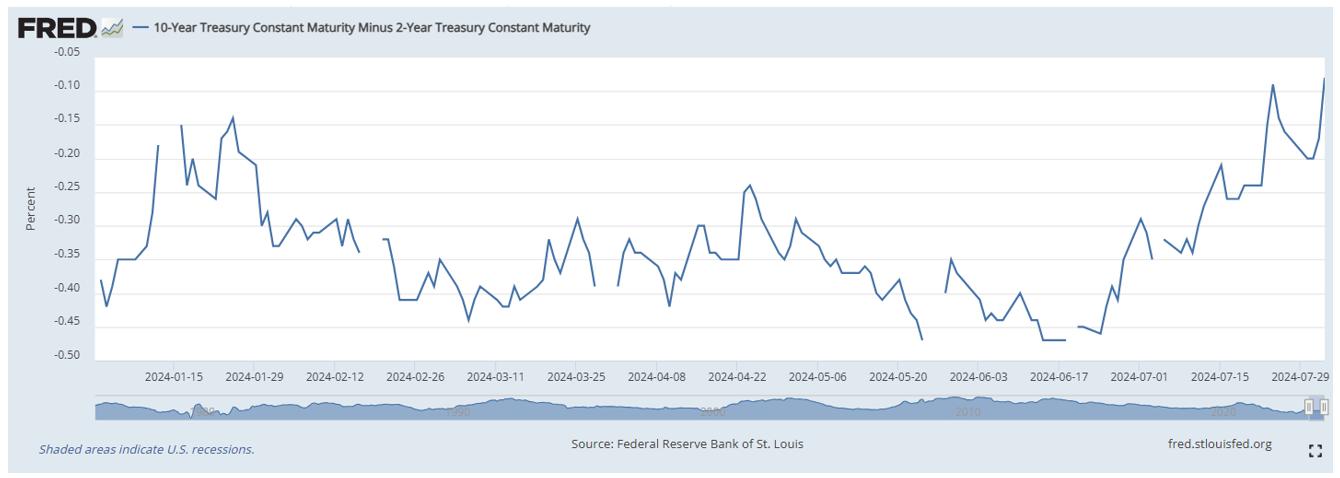

The steepening of the yield curve (the difference between 10- and 2-year Treasuries), as shown below, signifies that the inversion is over and the normalization of the curve may also imply a normalization of rates which should bring doses of stability and reason in the financial markets, contingent upon geopolitical developments.

Now, speaking of geopolitical developments, the signals point to a wider war in the Middle East. Within the same day, the assassination of Fuad Shukr (a senior commander of Hezbollah which is supported by Iran’ Shia regime in Beirut) and the strike inside Tehran that killed the political leader of Hamas Ismail Haniyeh took place. The latter act was particularly humiliating for Iran because it sent the signal that it could not protect its dignitary guests on the very day of the new President’s inauguration. These developments leave little room for doubt that a blended response (Iran, Hezbollah, Houthis) against Israel should be expected soon. And this time, we should not expect a restrained response (meaning we should expect targets to be both military and non-military using more powerful missiles).

Inside Iran, it seems that the new (moderate) President Pezeshkian will have to follow the supreme leader’s decision, and it is well-understood that Ali Khamenei’s hardline circle is preparing for a harsh hit, which suits well Benjamin Netanyahu and his determination of not reaching a truce – let alone a ceasefire – in the ongoing war. The US has no option but to look into this escalating risk using trifocals: Iran as part of an axis that seeks to change the world order; the economics of energy; and the security of the US and of Israel in the midst of a war that can explode, reminding us that the “Guns of August” are prepping up.