Markets could implode from within creating black holes where everything goes in and nothing comes out, destroying in the process paper wealth but also real economies. The essence of Gamma Ray Bursts (GRBs) is that explosions could take place when a star collapses and forms a black hole. Huge releases of intense radiation occur during such a supernova event. An illustration is shown below.

What has been happening in the markets since August 2007 is that market fusion can no longer generate real assets needed to backup credit creation, and hence the stars (real estate, CLOs, CDOs, CDSs, and other exotic instruments a.k.a. tools of mass deception) can no longer resist the forces of gravity. Hence, the markets collapse. The explosions have the potential of destroying life, and in market jargon the actions of Wall Street will hit Main Street. We have written before that the shaky position of EU banks regarding the refinancing of unsecured debt they have issued (debt that exceeds four trillion dollars and needs refinancing in the next three years) creates risks even for central banks.

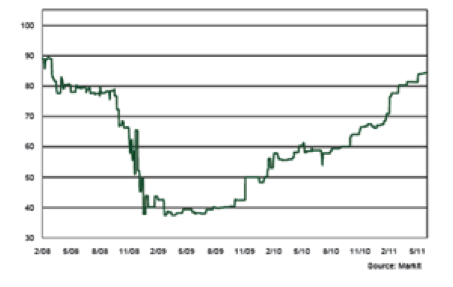

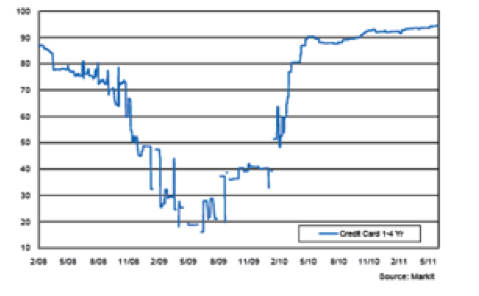

We will use this commentary as our prelude to our September newsletter, but we should state at this point that when we see BBB rated EU paper hitting again the pre-2007 highs (see figures below), we know that market fusion cannot identify real assets needed, and hence the stars are destined to collapse creating black holes and a GRB phenomenon that could crash market and real life.

Pan-European 3-5 Yr BBB CMBS Prices

Pan-European 1-4 Yr BBB ABS Prices

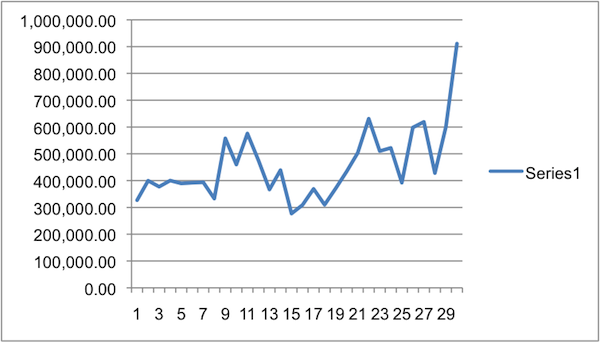

The figures above reported by Markit as well as the one that follows reported by SIFMA, show that the markets may be anticipating that fall and hence the insurance (CDSs) bought on transfer risk is reaching all-time highs, as the following figure shows.

CDSs over the last 30 Weeks on Market Risk Transfer Activity

We are of the opinion that bank reserves should stop inflating paper assets and rather be released from the banking system allowing reasonable inflationary expectations (contributing to debt’s partial liquidation) to be formed while reversing the trend of the money multiplier (discussed a few times over the course of the last year). In the meantime we are watching what the GRB’s effect is on some of our positions discussed in our June 12th and 17th commentaries, as well as our recent position on white precious metals, all shown below.

We only hope that the GRBs will be a wakeup call.