Collective hallucinations are dangerous. Undershooting carries risks, but overshooting could have much more serious consequences. Ignoring history is detrimental. Hubris backfires and lack of foresight demonstrates foolishness. My fear is that in this meta-modernity era where truth is manufactured rather than been discovered, solipsism has becoming a dominant force.

Worldviews determine policies and the latter geoeconomic and geopolitical matters. It seems that solipsism will be the worldview that will be shaping policy in the foreseeable future. If knowledge outside of ourselves is questionable and if the source of truth is just ourselves, then reality is just us and if it is just about ourselves then illusions become delusionary forces that blind us as to the real uncertainties while mislead us as to extent of risks we are taking by not containing historical realities that seek to challenge the international monetary system and the role that the US dollar has been playing in it.

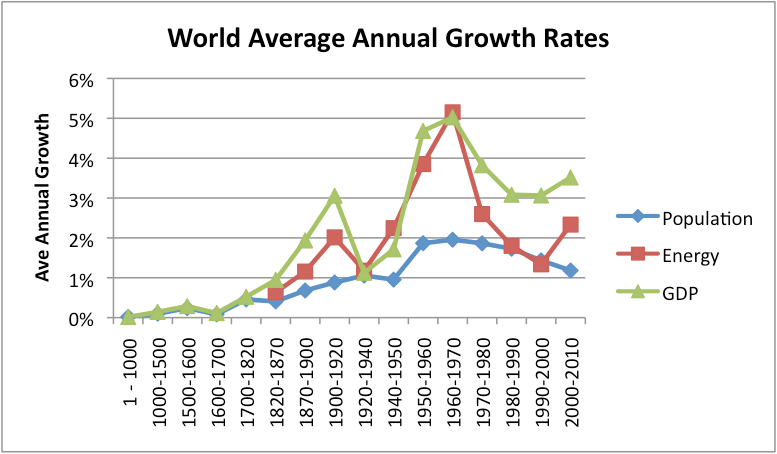

The truth of the matter is that as long as the US dollar was the unquestionable reserve currency of the international financial system, the world experienced unprecedented stability and prosperity (mid 1940s-1971 and 1980-early 2000s) as shown below.

The Trans Pacific Partnership (TPP) that we recently cancelled (and which both candidates for the US Presidency opposed) was a vehicle and a venue to contain future challenges to the role that the US dollar plays as the dominant reserve currency around the world, and especially in Asia and the rising powers there. My fear is that the cancellation of the TPP opens the door for a Chissiaran [Chi(na)(Ru)ssia(I)ran] alliance and the latter spells trouble for global financial stability. This kind of subjective idealism represented by metaphysical solipsism as a worldview has been tried before and it led to historic geopolitical and geoeconomic catastrophes.

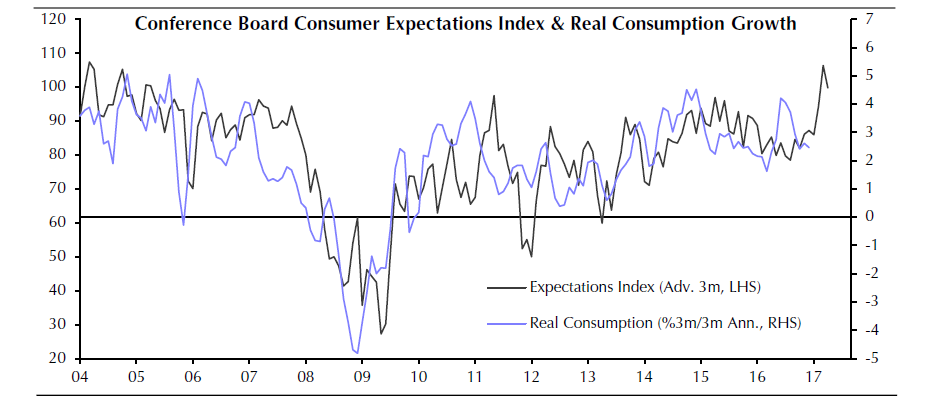

All this to say that while we should not avoid taking advantage of a rising market, we should also at the same time prepare like the ants do for a possible forthcoming winter (down the road) which might be pretty rough. The financial stress index is below the threshold level, and consumer confidence is pretty healthy as shown below, which leads to healthy consumption growth rate, healthy earnings, and a healthy growth rate.

Assuming that solipsism-related policy will eclipse, then the world could enjoy some good and prosperous years where living standards will be uplifted and problematic areas will be shaped through restructuring so they will also become more promising. If however, the experiment of subjective impressions elevate solipsism’s delusions into a syndrome, then my humble suggestion is to start constructing the refuge a portfolio that has intrinsic value.

Worldviews, Solipsism, and Chissiaran: A Random Walk Down the Boulevard of Invincibility

Author : John E. Charalambakis

Date : February 1, 2017

Collective hallucinations are dangerous. Undershooting carries risks, but overshooting could have much more serious consequences. Ignoring history is detrimental. Hubris backfires and lack of foresight demonstrates foolishness. My fear is that in this meta-modernity era where truth is manufactured rather than been discovered, solipsism has becoming a dominant force.

Worldviews determine policies and the latter geoeconomic and geopolitical matters. It seems that solipsism will be the worldview that will be shaping policy in the foreseeable future. If knowledge outside of ourselves is questionable and if the source of truth is just ourselves, then reality is just us and if it is just about ourselves then illusions become delusionary forces that blind us as to the real uncertainties while mislead us as to extent of risks we are taking by not containing historical realities that seek to challenge the international monetary system and the role that the US dollar has been playing in it.

The truth of the matter is that as long as the US dollar was the unquestionable reserve currency of the international financial system, the world experienced unprecedented stability and prosperity (mid 1940s-1971 and 1980-early 2000s) as shown below.

The Trans Pacific Partnership (TPP) that we recently cancelled (and which both candidates for the US Presidency opposed) was a vehicle and a venue to contain future challenges to the role that the US dollar plays as the dominant reserve currency around the world, and especially in Asia and the rising powers there. My fear is that the cancellation of the TPP opens the door for a Chissiaran [Chi(na)(Ru)ssia(I)ran] alliance and the latter spells trouble for global financial stability. This kind of subjective idealism represented by metaphysical solipsism as a worldview has been tried before and it led to historic geopolitical and geoeconomic catastrophes.

All this to say that while we should not avoid taking advantage of a rising market, we should also at the same time prepare like the ants do for a possible forthcoming winter (down the road) which might be pretty rough. The financial stress index is below the threshold level, and consumer confidence is pretty healthy as shown below, which leads to healthy consumption growth rate, healthy earnings, and a healthy growth rate.

Assuming that solipsism-related policy will eclipse, then the world could enjoy some good and prosperous years where living standards will be uplifted and problematic areas will be shaped through restructuring so they will also become more promising. If however, the experiment of subjective impressions elevate solipsism’s delusions into a syndrome, then my humble suggestion is to start constructing the refuge a portfolio that has intrinsic value.