In 1904 Sir Halford Mackinder published his famous paper The Geographical Pivot of History. The paper served as the cornerstone for the study of geopolitics in the 20th century. Sir Mackinder claimed in that paper that the age of sea power (initiated by Alfred Mahan’s book The Influence of Sea Power upon History) had passed, and that a new age of land power had arrived. In his view the epicenter of the new epoch was supposed to be Eurasia. The “Heartland” of the new era was that pivot area, and actually he claimed that Europe, Asia, and Africa were three continents in one, which he called “the World Island”. “Whoever rules the World Island commands the World” he declared. Mackinder failed to see the importance of the United States and the Americas in general. In his view the Americas were “merely satellites of the old continent”. The US succeeded in turning that prediction on its head, and the crown of that reversal is the domination of the USD as the international reserve currency of the world. That exorbitant privilege has been questioned, and efforts have been made as recently as 2009 by other powers to replace the dollar with something else.

The essence of this commentary can be summarized in the following sentence: the unwinding of the Fed’s QE programs may be initiating a period of turbulence in world currencies, strengthening the USD temporarily, until the fragile fiat system experiences a major earthquake that will change the global monetary landscape for the next several decades.

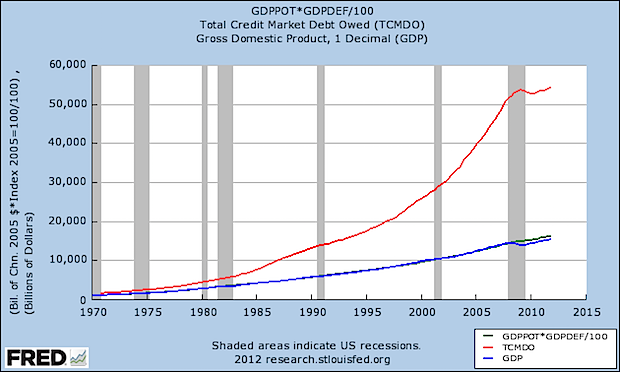

Throughout history, money is supposed to reflect high commodity value. When the latter disappears, money can keep circulating for a period due to customs and the demand for the medium of exchange. However, the continuous circulation of fiat money requires an instrument-vehicle, which modern finance found it in credit. The leveraging of the economy using fiat money can for a period of time experience increasing returns in the form of GDP growth rates. However, the time has come for diminishing returns to credit increases, which simply means that more and more credit is needed in order to generate an increase of 1% in GDP.

The graph below shows us the declining returns the economy is enjoying as it expands its debt. In this case debt becomes a prison and its exponential growth diminishes growth and employment prospects as it burdens households and businesses. The ratio of total credit market debt (TCMD) to GDP has risen from 1.6 in 1971, to 2.8 in 2000, and to 3.7 in 2012.

As the economy started expanding credit in order to exit the most recent recession, interest rates dropped to almost zero levels with the ten-year Treasury rate reaching record low yields. As the US is preparing to partially exit from the environment of record low rates, the currencies around the world have started experiencing tremors, especially those affiliated with countries that have high current account deficits.

The following graph shows the depreciation of the Brazilian currency against the US dollar. As the graph shows the Brazilian currency has lost almost 18% of its value relative to the USD, since mid May of this year.

The next graph below shows that the depreciation of the Indian Rupee against the dollar touches the neighborhood of almost 25% since May. It should be noted that other countries such as Turkey, Indonesia, Malaysia, etc., have also experienced declining currencies.

As the currencies of developing and emerging markets decline against the USD – and given sclerotic and inelastic regulatory frameworks as well as import substitution inflexibility – their current accounts may worsen, which will be a further stimulus for capital flight. Moreover, as imports costs rise, further inflationary pressures are ignited, all of which will force their central banks to raise interest rates, which in turn will slow down their growth rates. Therefore, emerging markets have entered into a period of turbulence, while the US is positioning to become the harbor of funds that repatriate back to the US.

We should also point out that as those currencies lose ground, public finances will deteriorate too, while corporations whose debt is denominated in USD will suffer declines in their bottom line.

And while the picture in the developing and emerging world seems to be following a downward trajectory, recent EU signs of life injected optimism in the land of troubled banks and non-existing productivity growth. In that waste land, the dysfunctional currency a.k.a. the Euro is artificially held above $1.32 level through central banks’ swaps and other face-lifting measures that postpone the inevitable. We should not be surprised if after the September 22nd German elections, a form of Abenomics is implemented in the EU, which of course will depreciate the Euro relative to the US.

All in all, the significance of the undercurrent seems to be that we are headed for the last tango of the global fiat currency system which tango may last another two-three years. Just remember that it is best to be performed in Argentina.

World Island Meets World Currencies: Planting the Seeds of Turbulence

Author : John E. Charalambakis

Date : August 31, 2013

In 1904 Sir Halford Mackinder published his famous paper The Geographical Pivot of History. The paper served as the cornerstone for the study of geopolitics in the 20th century. Sir Mackinder claimed in that paper that the age of sea power (initiated by Alfred Mahan’s book The Influence of Sea Power upon History) had passed, and that a new age of land power had arrived. In his view the epicenter of the new epoch was supposed to be Eurasia. The “Heartland” of the new era was that pivot area, and actually he claimed that Europe, Asia, and Africa were three continents in one, which he called “the World Island”. “Whoever rules the World Island commands the World” he declared. Mackinder failed to see the importance of the United States and the Americas in general. In his view the Americas were “merely satellites of the old continent”. The US succeeded in turning that prediction on its head, and the crown of that reversal is the domination of the USD as the international reserve currency of the world. That exorbitant privilege has been questioned, and efforts have been made as recently as 2009 by other powers to replace the dollar with something else.

The essence of this commentary can be summarized in the following sentence: the unwinding of the Fed’s QE programs may be initiating a period of turbulence in world currencies, strengthening the USD temporarily, until the fragile fiat system experiences a major earthquake that will change the global monetary landscape for the next several decades.

Throughout history, money is supposed to reflect high commodity value. When the latter disappears, money can keep circulating for a period due to customs and the demand for the medium of exchange. However, the continuous circulation of fiat money requires an instrument-vehicle, which modern finance found it in credit. The leveraging of the economy using fiat money can for a period of time experience increasing returns in the form of GDP growth rates. However, the time has come for diminishing returns to credit increases, which simply means that more and more credit is needed in order to generate an increase of 1% in GDP.

The graph below shows us the declining returns the economy is enjoying as it expands its debt. In this case debt becomes a prison and its exponential growth diminishes growth and employment prospects as it burdens households and businesses. The ratio of total credit market debt (TCMD) to GDP has risen from 1.6 in 1971, to 2.8 in 2000, and to 3.7 in 2012.

As the economy started expanding credit in order to exit the most recent recession, interest rates dropped to almost zero levels with the ten-year Treasury rate reaching record low yields. As the US is preparing to partially exit from the environment of record low rates, the currencies around the world have started experiencing tremors, especially those affiliated with countries that have high current account deficits.

The following graph shows the depreciation of the Brazilian currency against the US dollar. As the graph shows the Brazilian currency has lost almost 18% of its value relative to the USD, since mid May of this year.

The next graph below shows that the depreciation of the Indian Rupee against the dollar touches the neighborhood of almost 25% since May. It should be noted that other countries such as Turkey, Indonesia, Malaysia, etc., have also experienced declining currencies.

As the currencies of developing and emerging markets decline against the USD – and given sclerotic and inelastic regulatory frameworks as well as import substitution inflexibility – their current accounts may worsen, which will be a further stimulus for capital flight. Moreover, as imports costs rise, further inflationary pressures are ignited, all of which will force their central banks to raise interest rates, which in turn will slow down their growth rates. Therefore, emerging markets have entered into a period of turbulence, while the US is positioning to become the harbor of funds that repatriate back to the US.

We should also point out that as those currencies lose ground, public finances will deteriorate too, while corporations whose debt is denominated in USD will suffer declines in their bottom line.

And while the picture in the developing and emerging world seems to be following a downward trajectory, recent EU signs of life injected optimism in the land of troubled banks and non-existing productivity growth. In that waste land, the dysfunctional currency a.k.a. the Euro is artificially held above $1.32 level through central banks’ swaps and other face-lifting measures that postpone the inevitable. We should not be surprised if after the September 22nd German elections, a form of Abenomics is implemented in the EU, which of course will depreciate the Euro relative to the US.

All in all, the significance of the undercurrent seems to be that we are headed for the last tango of the global fiat currency system which tango may last another two-three years. Just remember that it is best to be performed in Argentina.