It is apparent that Morsi never made up his mind regarding the ultimate Machiavellian question of whether a leader needs to be feared or be loved. The solution imposed by the military creates significant dilemmas for the western nations while raises issues of legitimacy, the rule of law, and institutional order. The Arab spring is being converted into a winter with bloodshed and uncertainty reigning supreme. At the same time the desire for intervention in Syria in the form that is being planned, takes by the day more and more the characteristics of a half- pregnant woman which by definition is an absurd notion. Simultaneously, Jordan is threatened with instability at a time when we are trying to revive the talks between Israelis and Palestinians. What do these examples of instability remind me of? Fiat currencies seeking to portray an illusionary image of strength. What else do those two images (fiat currencies and fiat regimes) have in common? Fragility, gaps of legitimacy, and a foundation that cannot sustain the buildup of risks.

A few weeks ago, we commented on the collateral gap that permeates the banking sector, especially in the EU. Our own Treasury reported that the gap ranged between $6.5 and $11.4 trillion, depending on the prevailing risk, without even taking into account the funding gap that arises from derivatives. We choose to opine that we are entering into a period of risk segregation as the supply of monetary reserves desperately seeks to create demand for fiat money. The QEs have enforced the notion of an inverted credit pyramid, and unless demand for fiat money is created in order to balance the supply of reserves, the inverted credit pyramid is threatened with a fall that could be catastrophic. However, demand for fiat money presupposes faith in it, which has a pre-condition lost trust in the power of real money a.k.a. precious metals. Therefore, the short sales of gold become a self-fulfilling prophesy that enhances the illusion of strength in fiat currencies.

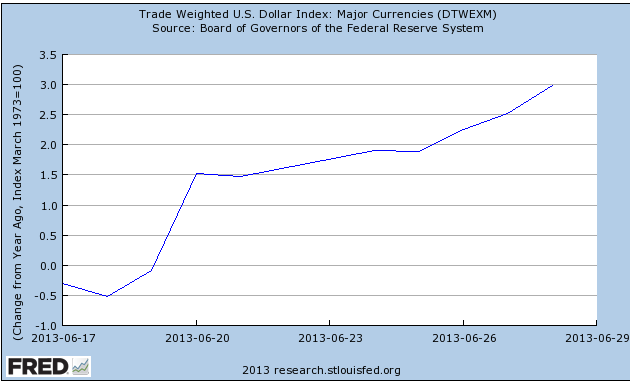

At the same time, the recent spike in oil prices serves well the need for dollars too. In addition, the turmoil in emerging markets creates the background for an outflow of funds (especially those denominated in local currencies) from those countries into developed ones, and thus enhancing the need for dollars. The graph below demonstrates the strength of the dollar in the last couple of weeks which is the mirror image of the demand for it.

The strengthening of the dollar is anticipated to continue and with it the marginal efficiency of investments a.k.a. rate of return will strengthen too, outpacing the rise in the cost of capital. This is the main reason which allows us to project that the equities markets will continue exhibiting strength in the foreseeable future.

This re-balancing act will allow the collateralization of assets which by definition implies demand for loans, and thus the renewed demand for credit will be met through the conversion of monetary reserves into bank loans, which in turn will allow the strengthening of the banks’ balance sheets, in a last-effort attempt to save the unredeemable.

It is our opinion that these efforts to rebuild the credit mechanisms and to jump-start the real economy can only produce illusions of growth and progress and can only last temporarily, since they do not address the causes of the problems and are reduced into mechanisms of segregating risks, making the next crisis not just more likely but also more dangerous.

Where the Middle East Meets the Gnomes of Fiat: The Segregation of Risks

Author : John E. Charalambakis

Date : July 5, 2013

It is apparent that Morsi never made up his mind regarding the ultimate Machiavellian question of whether a leader needs to be feared or be loved. The solution imposed by the military creates significant dilemmas for the western nations while raises issues of legitimacy, the rule of law, and institutional order. The Arab spring is being converted into a winter with bloodshed and uncertainty reigning supreme. At the same time the desire for intervention in Syria in the form that is being planned, takes by the day more and more the characteristics of a half- pregnant woman which by definition is an absurd notion. Simultaneously, Jordan is threatened with instability at a time when we are trying to revive the talks between Israelis and Palestinians. What do these examples of instability remind me of? Fiat currencies seeking to portray an illusionary image of strength. What else do those two images (fiat currencies and fiat regimes) have in common? Fragility, gaps of legitimacy, and a foundation that cannot sustain the buildup of risks.

A few weeks ago, we commented on the collateral gap that permeates the banking sector, especially in the EU. Our own Treasury reported that the gap ranged between $6.5 and $11.4 trillion, depending on the prevailing risk, without even taking into account the funding gap that arises from derivatives. We choose to opine that we are entering into a period of risk segregation as the supply of monetary reserves desperately seeks to create demand for fiat money. The QEs have enforced the notion of an inverted credit pyramid, and unless demand for fiat money is created in order to balance the supply of reserves, the inverted credit pyramid is threatened with a fall that could be catastrophic. However, demand for fiat money presupposes faith in it, which has a pre-condition lost trust in the power of real money a.k.a. precious metals. Therefore, the short sales of gold become a self-fulfilling prophesy that enhances the illusion of strength in fiat currencies.

At the same time, the recent spike in oil prices serves well the need for dollars too. In addition, the turmoil in emerging markets creates the background for an outflow of funds (especially those denominated in local currencies) from those countries into developed ones, and thus enhancing the need for dollars. The graph below demonstrates the strength of the dollar in the last couple of weeks which is the mirror image of the demand for it.

The strengthening of the dollar is anticipated to continue and with it the marginal efficiency of investments a.k.a. rate of return will strengthen too, outpacing the rise in the cost of capital. This is the main reason which allows us to project that the equities markets will continue exhibiting strength in the foreseeable future.

This re-balancing act will allow the collateralization of assets which by definition implies demand for loans, and thus the renewed demand for credit will be met through the conversion of monetary reserves into bank loans, which in turn will allow the strengthening of the banks’ balance sheets, in a last-effort attempt to save the unredeemable.

It is our opinion that these efforts to rebuild the credit mechanisms and to jump-start the real economy can only produce illusions of growth and progress and can only last temporarily, since they do not address the causes of the problems and are reduced into mechanisms of segregating risks, making the next crisis not just more likely but also more dangerous.