Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : February 10, 2018

Market Action

Stocks globally were down sharply for the second week in a row, and stock market volatility has returned with large daily market swings; this week the CBOE Volatility Index (the VIX) reached its highest level since China’s currency crisis in 2015. The decline in stocks is driven by bond market weakness with bond yields rising in response to rising interest rates based on expectations for stronger economic growth, which has led to concerns about higher inflation and more short-term interest rate hikes. The decline and volatility in equity markets have been compounded by algorithmic trading (buying and selling directed by computer algorithms) and by margin calls. However, spreads and the Libor remained calm. Maybe the party that central banks initiated with ultra-low rates is coming to an end and disciplined investment strategies will be valued more.

In previous equity market sell-offs, Chinese state-backed funds have stepped in and bought shares to stem market declines – but there has been little evidence of state-led buying this time. Is China showing increased tolerance for loss in order to tame excessive risk-taking in its financial system?

IHS Markit’s main gauge of business activity across the Eurozone reached a near 12-year high in January, with the composite PMI rising to 58.8, from 58.1 the previous month. If the trend continues in February and March, the Eurozone would be headed for quarterly growth of 1%, far above the area’s long-run average.

German Chancellor Angela Merkel’s Christian Democratic Union and the Social Democratic Party (SPD) have formed a coalition agreement in which Merkel ceded control of the powerful finance ministry to her coalition partner, in addition to the foreign and labor ministries. The deal must be ratified by SPD members.

The trade deficit of the United States grew by 12% last year, to $566bn, the highest it has been since 2008. Although American exports increased to $2.3trn, imports increased to $2.9trn which helped push the trade deficit with China to a record $375bn.

After falling below $6000 in the first half of the week, Bitcoin extended its ascent above $8,000 on Thursday and continued climbing on Friday. The price behavior of other major cryptocurrencies broadly followed Bitcoin.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Market Turmoil, Portfolios and Commodities: Time to Diversify, Part I

John E. Charalambakis

Recommended Reads

‘World on the brink,’ warns Munich Security Report

Deutsche Welle

Hard Brexit would cost public finances £80bn, says secret analysis

Jessica Elgot, Heather Stewart, and Peter Walker

Why South Korea is growing wary of China

The Economist

Video of the Week

Winter Olympics kick off under political spotlight

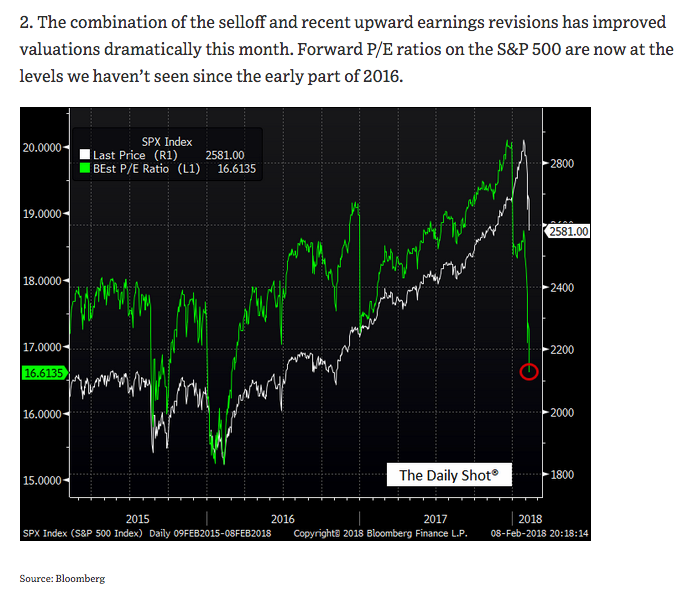

Image of the Week