Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : January 21, 2018

by Andy Quirk

Market Action

The U.S. Federal Government officially shut down in the early hours of Saturday as Democrats blocked a stopgap spending measure, allowing government funding to expire. The funding dispute is largely over funding for the Deferred Action on Childhood Arrivals (DACA) legislation. The shutdown comes exactly a year and a day since the beginning of the Trump Presidency. Though a shutdown will concern investors, it has historically not impacted markets negatively and is unlikely to impact the markets in a significant way.

The yield on the U.S. 10-year reached its highest peak on Friday morning since 2014, rising to 2.642 percent. J.P. Morgan predicts the yield to move higher throughout 2018, but not to exceed 3 percent. The move comes as the Federal Reserve raises interest rates and moves away from quantitative easing.

Greece’s sovereign credit rating raised one level by the S&P Global Ratings from B- to B on Friday. Though this rating remains five levels below investment grade, it represents an improvement in growth and fiscal outlooks. EU finance ministers meet on Monday to assess Greece’s compliance with current bailout terms, and could sign off on additional loan disbursements of 6.7 billion euros.

French President Emanuel Macron and British Prime Minister Theresa May met this week to discuss Anglo-French security and Brexit. The French President has rejected any deal that allows Britain access to the Single market without ceding to EU financial contributions and accepting EU jurisdiction and regulation. It is unlikely that Britain will achieve any deal on the single market without making concessions on EU regulation and funding.

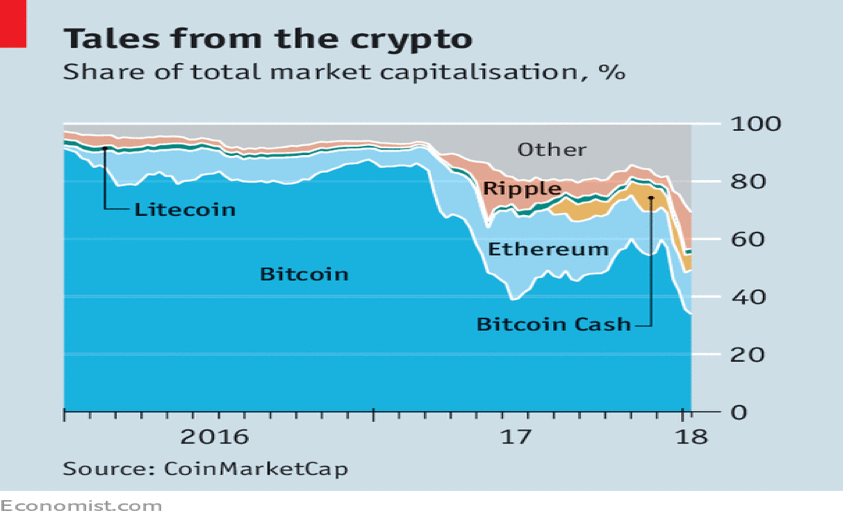

The price of Bitcoin fell to a low of $9,200 this week, though it has recovered slightly, up to $11,611 as of Friday morning. Debates continue over whether this represents the beginning of the end for Bitcoin or merely represents a seasonal event. What is clear is the amount of energy bitcoin mining requires: as of Tuesday, electricity consumption from Bitcoin roughly equaled the energy used by all of New Zealand. It’s unlikely that mining bitcoin will slow down anytime soon given that it generates around $12bn. per year in revenue.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Sector Focus: Shipping

Ken Rietz and Dave Coulliette

Recommended Reads

As Trump heads to Davos, survey points to rising risk of war

Noah Barkin

Why the oil price is so high

The Economist

It’s Not Just Trump: Six Charts That Will Define Davos

Andre Tartar, Jeff Green, Haylen Warren, and Samuel Dodge

Beyond the Bitcoin Bubble

Steven Johnson

Video of the Week

Image of the Week

Bitcoin might be dropping, but cryptocurrencies are here to stay.