Weekly Market Update

Weekly Market Update

-

Author : Laura Hochstetler

Date : January 14, 2018

Market Action

The Euro rose to a three-year high versus the dollar on Friday after German party leaders reached a breakthrough in talks to form a “grand coalition” and minutes from the ECB’s mid-December meeting signaled the ECB could slow its stimulus program in early 2018 in response to upbeat macroeconomic data.

The German economy expanded at the fastest pace in six years in 2017, with GDP rising 2.2%, marking the eighth year in a row that the economy has grown.

Brent crude oil broke above $70/bbl this week for the first time since 2014, underpinned by the effectiveness of OPEC output cuts and geopolitical risk in producing countries like Iran. In the US, WTI crude rose as high as $64.77 as domestic stockpiles posted their eighth straight week of declines.

Retail sales in the US increased 0.4% in December and rose 5.5% in Q4 versus the previous year. Sales growth for the year was the strongest since 2014, according to the US Department of Commerce.

The National Federation of Independent Business reported this week that its confidence index, which measures the mood of US small business owners, reached a record high in 2017. Tax cuts and regulatory reform were cited as catalysts.

China posted a trade surplus with the United States last year that climbed 10% over the previous year to a record $275.8B, accounting for nearly two-thirds of China’s overall trade surplus of $422.5 billion. China also reported a sharp drop in business with North Korea in 2017 following new UN sanctions, stating that overall trade between the two nations fell 10.5% to about $5B, and the month of December showed trade dropping 50.6% compared to 2016.

Please click here for this week’s update on market returns.

This Week from BlackSummit

Foreseeable Economic Prospects and Equity Markets: Sizing up the New Year

John E. Charalambakis

Recommended Reads

China Sets New Records for Gobbling Up the World’s Commodities

Pratish Narayanan

Switzerland’s Central Bank Made $55 Billion Last Year—More Than Apple

Brian Blackstone

Ready or Not for the Next Recession?

Barry Eichengreen

Video of the Week

https://video.nationalgeographic.com/video/news/180109-algeria-sahara-rare-snow-vin-spd

Image of the Week

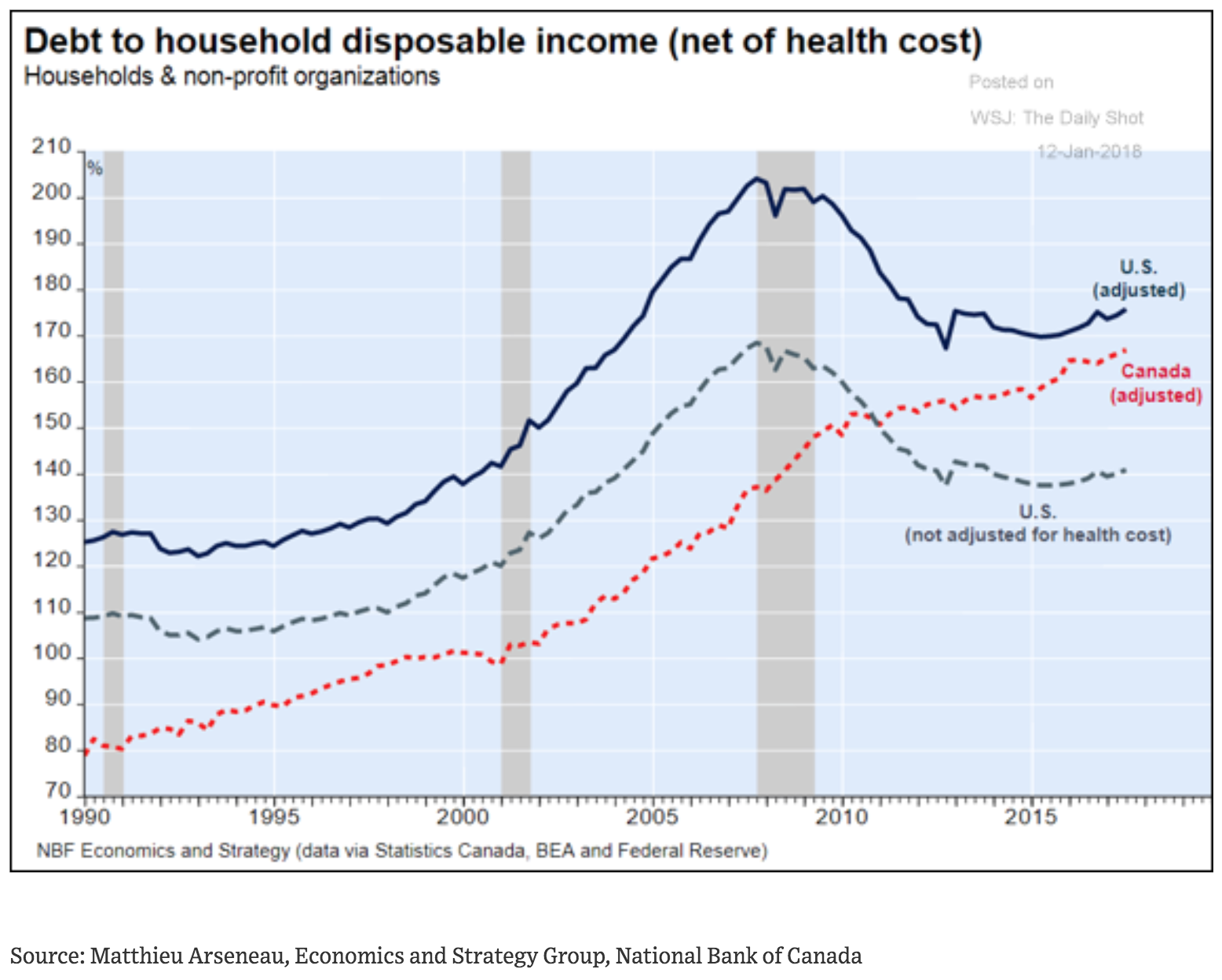

From the Economics and Strategy Group, National Bank of Canada: “Americans pay less tax than Canadians but today must devote about 20% of disposable income to health spending, a non-discretionary expense. In Canada, the share of income going to health care not covered by public insurance is about 4%. When we correct disposable income for this factor, household leverage in the U.S. turns out to be higher than in Canada, not lower.” Below is the comparison between the US and Canadian household leverage before and after the adjustment.